The market adage, “Make the trend your friend”, is often quoted and implemented in tactical or dynamic investment portfolios. The ability to correctly identify a trend, particularly early, provides the potential for gains as long as the trend remains intact. Portfolio managers all have their preferred trends they like to track or follow. Some are price-based such as moving averages while others utilize a combination of volume, volatility or other risk factors.

There are also closely followed trends for the overall economy; from unemployment to GDP or consumer confidence, trends help investors gauge what the future may hold. The challenge for investors today is knowing which trends to follow as almost never before have I seen so many apparently conflicting trend occurring at the same time.

Author and statistician Nassim Taleb made the study of Black Swan events popular almost 20 years ago. Black Swan’s are events that theoretically are so rare that they are effectively never expected to occur. However, because there are essentially an infinite number of events that could be labeled as Black Swan’s, it seems every couple of years something happens in the economy or markets that has never occurred before.

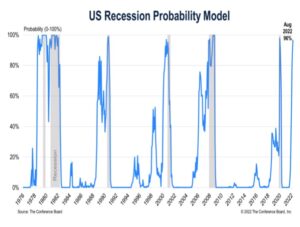

Following that logic, it is therefore predictable that we will experience something in 2023 that has never happened before regarding a potential recession. Never before in U.S. economic history have we had so many data points that suggest a recession is looming. Confidence, Sentiment, PMI Manufacturing, and Treasury Spreads are all at levels where every prior occasion the economy went into recession. Contrast that with current employment data that shows the unemployment rate below 4%. Never in U.S. economic history has there been a recession when unemployment was below 4%. Something will have to give.

Trends today appear to be unreliable as reversals occur on practically a weekly basis. U.S. growth stocks have been trending lower for some time, but small cap value has been trending higher since October 2022. Investors are stuck between long-term data that shows the stock market drop on average about 40%, peak to trough, when the U.S. enters a recession. We are only about half-way to that magnitude of correction from the December 2021 market high. There are equally signs of ‘green shoots’ suggesting a bottoming may have occurred and economic data will accelerate in a positive direction. If this turns out to be accurate and not head fakes, investors will not want to miss out on what could be strong and rapid rally in equities back to prior highs. We know that one group of data and trend lines are lying, but we don’t know which one.

The mixed messages coming from the Fed are certainly not helping matters. Many market participants and analysts expected the Fed to sound a relatively dovish posture following the February rate hike as it was presumed the Fed had gotten close to their terminal rate in the fight against inflation. Instead, Powell remained rather hawkish and suggested the Fed was more than willing raise rates higher than economists were forecasting. If true, the risk of recession greatly increases as higher rates and tighter financial conditions likely leads to a broad economic contraction. Conversely, if the Fed pivots and communicates a 2.5 percent or even 3 percent core inflation rate is acceptable, the Fed may be very close to ending rate hikes and the potential for a ‘soft landing’ (i.e., no recession) would greatly improves.

The only market adage more quoted than ‘make the trend your friend’ is probably ‘don’t fight the Fed’. We predict that we are back to a time where the equity market direction is likely to be highly correlated with Fed policy. Two more quarter-point rate hikes and most economists believe a recession may be averted. However, when the minutes of the last Fed meeting were released, it was clear some of the Governors with a vote believed the Fed should hike 50 basis points which explained Powell’s more hawkish tone.

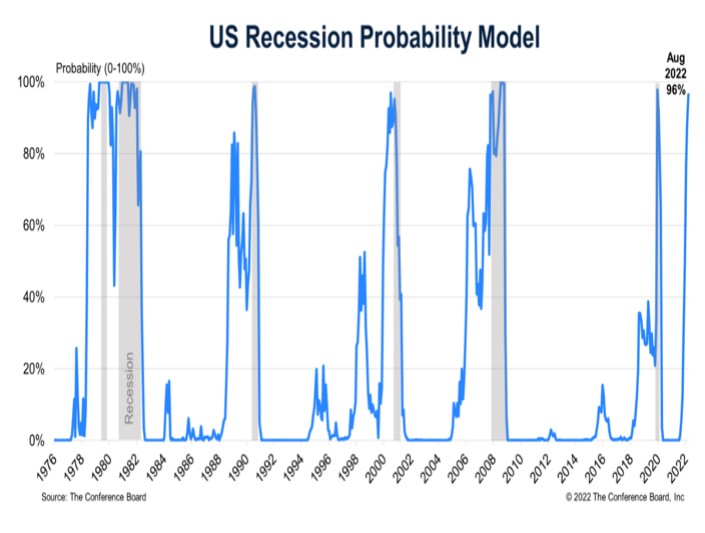

Courtesy of the Atlanta Fed, the data from GDPNow has been one of the more accurate forecasting tools for economists and portfolio managers on forward GDP prints. This chart just confirms the market confusion hovering between slight contraction and slight growth in the overall economy.

—

Originally Published March 2023 – Which Trend is your Friend?

Disclosure: Peak Capital Management

Peak Capital Management, LLC, is a fee-based SEC Registered Investment Advisory firm with its principal place of business in Colorado providing investment management services. A copy of our current written disclosure statement discussing our advisory services and fees is available for your review upon request. Advisory services are only offered to clients or prospective clients where our firm and its representatives are properly licensed or exempt from licensure. No advice may be rendered by Peak Capital Management, LLC unless a client service agreement is in place. Nothing herein should be construed as a solicitation to purchase or sell securities or an attempt to render personalized investment advice. To receive a GIPS compliance presentation and/or our firm’s list of composite descriptions, please email your request to info@pcmstrategies.com. Peak Capital Management claims compliance with the Global Investment Standards (GIPS). GIPS is a registered trademark of CFA Institute. CFA Institute does not endorse or promote this organization, nor does it warrant the accuracy or quality of the content contained herein.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Peak Capital Management and is being posted with its permission. The views expressed in this material are solely those of the author and/or Peak Capital Management and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.