The sharp sell-off in government bond yields in the last few weeks is testing the patience of central banks and bond markets are reacting to the hawkish messages. Portfolio Manager Andrew Mulliner explains.

Key Takeaways

- Following the rally over the summer, where 10‑year U.S. Treasury yields fell to around 1.2%, the risks were, in our view, skewed toward yields moving higher through the end of the year. Hawkish messages from the September round of central bank meetings increased the pace of that move.

- In the U.S., tapering of asset purchases could begin this year and end mid-2022, but it does not signal the start of hiking. The challenge for the Bank of England, which sees conditions building for tightening monetary policy, is that it may have to tighten policy into a stagflationary environment.

- The calculus of risk for central banks is finely balanced. While we expect many of the factors driving higher inflation presently to abate over time, some challenges have lasted longer than initially anticipated and high prices are likely to continue into the winter period.

The last few weeks have seen a sharp sell-off in sovereign bond yields globally, with central banks’ ability to be “patient” tested by higher inflation. After the rally seen in July, where the U.S. 10-year yield fell to around 1.2%, we considered that government yields in core markets were at the bottom end of their fair value range, with risks skewed towards higher yields as we moved into the end of the year. The speed of the move has been faster than expected with the September round of central bank meetings. With bond yields rising across sovereign yield curves and breaking out of their previous ranges at certain maturities in the U.S. (two and five years) and in the UK (two, five and 10 years), the move has accelerated.

The Fed’s September Meeting Takes a More Hawkish Tone

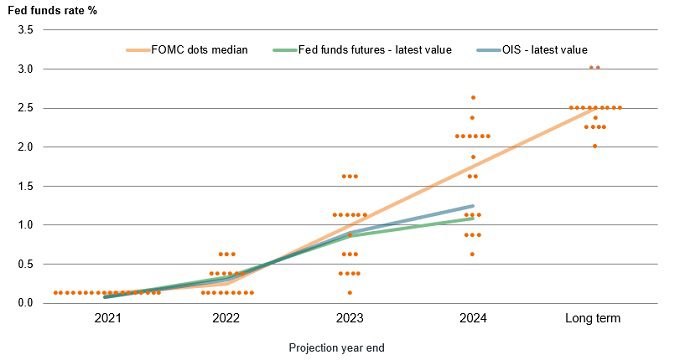

The September meeting of the U.S. Federal Reserve (Fed) brought a new set of economic outlooks, which revised inflation expectations upwards for this year and next, and a more hawkish tilt to the dot plot. Half of the Federal Open Market Committee (FOMC)’s voting members now expect a single rate hike by the end of next year and the fed funds target rate may climb back to 1.0% by the end of 2023 (see figure 1).

Figure 1: The Fed’s Latest Dot Plot and Implications for Fed Funds Rate

Source: Bloomberg, Janus Henderson Investors, as at 1 October 2021.

Chairman Powell also expressed some confidence that the tapering of U.S. Treasury and mortgage‑backed securities (MBS) purchases could be completed by the middle of next year. However, he made clear that “the timing and pace of the coming reduction in asset purchases will not be intended to carry a direct signal regarding the timing of interest rate lift-off”. So, there will be some clear air between the end of tapering and the first rate hike, but it is clear that the balance of risks have shifted and there is considerable uncertainty how long transitory inflation factors will last.

The Next day, Bank of England Adds to the Hawkish Message

The Bank of England (BoE)’s meeting the day after the Fed’s added to the hawkish message. UK government bond yields had been rising since August, but the front end of the yield curve in particular moved to price in a more aggressive hiking cycle. The central bank said the case to tighten UK monetary policy is building: there was increasing evidence from global and domestic cost and price indicators that inflationary pressures were likely to persist; realized inflation may breach 4% in the near term and, with the existing policy stance, inflation was likely to remain above the 2% target in the medium term. As a result, the market is now* pricing the bank rate (BoE’s base rate) to reach 0.5% by mid-2022, with one further hike to 0.75% by mid-2023 before levelling out, with the next hike to 1.0% priced by the end of the decade.

The BoE’s commentary on sequencing between quantitative easing (QE) and rate hikes was strengthened, when it stated that rates will be the main policy tool and can start to rise even before the end of the QE program. By de‑linking QE and the bank rate, there is more onus on using the bank rate to manage the cycle and will result in a smaller balance sheet (of asset purchases) over the long term. It also confirmed that in the first instance it would allow maturing gilts to run off rather than engage in actively selling holdings, which would only take place after a 1.0% bank rate is reached.

Despite the higher rate expectations, sterling has struggled to rally as the UK economy finds itself potentially in a stagflationary1 environment. The BoE has to begin to tighten policy into weaker growth and a supply side inflation shock, exemplified by the dramatic moves higher in inflation break-evens this week (now through 4% on the 10-year retail price index swaps – figure 2).

Figure 2: Dramatic Moves Higher in Inflation Expectations in the UK

Source: Bloomberg, Janus Henderson Investors, as at 6 October 2021.

Note: 10-year GBP Inflation Swap RPI Zero Coupon – the swap, based on the retail price index (RPI) in the UK, is commonly used by investment professionals for hedging purposes and is reflective of (or a measure of) the breakeven rate of inflation (i.e., market expectations for inflation).

The Calculus of Risks for Central Banks Is Finely Balanced

Similar to the central banks, we expect that many of the factors driving higher inflation presently will abate through time, we are mindful that supply chain challenges in particular have lasted longer than we had initially anticipated. With high prices expected to continue into the winter period, and into 2022, this leaves the calculus of risks for central banks finely balanced. On one hand, high prices will likely act as a drag on economic growth and should therefore abate as either demands drops to equalize with constrained supply or supply eventually picks up. On the other hand, extended periods of higher prices pose a risk to the unanchoring of inflation expectations, which may result in a more persistent inflationary environment.

Central bankers are generally cautious creatures, but clearly the current environment has tilted their attitudes in a more hawkish direction and bond markets are in the midst of repricing to reflect this shift.

1 1 October 2012.

2 Stagflation: a relatively rare situation where rising inflation coincides with anemic economic growth.

—

Originally Posted on October 7, 2021 – Yields Move Higher – September Spike or Sustained Trend?

Disclosure: Janus Henderson

The opinions and views expressed are as of the date published and are subject to change without notice. They are for information purposes only and should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation to buy, sell or hold any security, investment strategy or market sector. No forecasts can be guaranteed. Opinions and examples are meant as an illustration of broader themes and are not an indication of trading intent. It is not intended to indicate or imply that any illustration/example mentioned is now or was ever held in any portfolio. Janus Henderson Group plc through its subsidiaries may manage investment products with a financial interest in securities mentioned herein and any comments should not be construed as a reflection on the past or future profitability. There is no guarantee that the information supplied is accurate, complete, or timely, nor are there any warranties with regards to the results obtained from its use. Past performance is no guarantee of future results. Investing involves risk, including the possible loss of principal and fluctuation of value.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Janus Henderson and is being posted with its permission. The views expressed in this material are solely those of the author and/or Janus Henderson and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Forex

There is a substantial risk of loss in foreign exchange trading. The settlement date of foreign exchange trades can vary due to time zone differences and bank holidays. When trading across foreign exchange markets, this may necessitate borrowing funds to settle foreign exchange trades. The interest rate on borrowed funds must be considered when computing the cost of trades across multiple markets.