Starting anything new is difficult. That’s the truth, and more often than not, articles addressing “How to Start (________) “ like a diet, running, investing or a new language will oversimplify the process.

Humans are creatures of habit. In general, those habits serve us well. We are the products of evolutionary biology. However, establishing a strong foundation for a novel endeavor is far less natural.

The other issue is that many of the “experts” that write about the basics of using options have managed options risk for so long that they struggle to communicate in terms that resonate with a novice. Far too frequently, they are afflicted with The Curse of Knowledge.

So here are a couple of things to keep in mind before you start trading options.

Trust You

From my standpoint, when discussing financial matters, there is no “right way” because our circumstances are entirely unique. Despite the varied backgrounds, there are “better ways” to begin incorporating options in your portfolio.

First and foremost, use only discretionary capital. That axiom applies across financial disciplines. You must have your basic needs met before allocating funds to investments of any sort.

Then manage your expectations and establish a plan.

Many people want to skip this step, but it’s critical. Starting anything new involves a process of learning, feedback, and refinement. It’s also important to set realistic targets. Absent this, the approach is likely to fail.

Think about “New Year’s Resolutions.” According to research, about 80% of people “lose their resolve” with resolutions by mid-February. In general, we “fail” because there is inevitable friction, and we set the target too high.

It’s a Marathon, Not a Sprint

Using a personal example, I’ve been an active runner for years. I’ve finished several half-marathons, and when I’m in shape (read: sticking to my plan and incrementally improving), I can run a long way at an 8-minute-per-mile pace. Not too bad for a guy in his mid-40s.

Lately, it’s been more difficult for me to run regularly. I live just outside Chicago, and it’s cold (I don’t like running on a treadmill). Plus, I have a very active 8-year-old son. Yesterday was warm, and I had some free time, so I went on a short run. I didn’t target any pace. I got in about 2 miles and called it quits.

Many people in my situation will try to get right back to running a 10k (~6 miles). They will run too far or too hard in the beginning and may strain muscles.

In my estimation, financial well-being is akin to physical well-being. The process is very similar. You need to establish a base and try to improve incrementally. Sometimes you must go back to the basics. Putting one foot in front of the other, if you’ll pardon the pun.

Ignore Noise

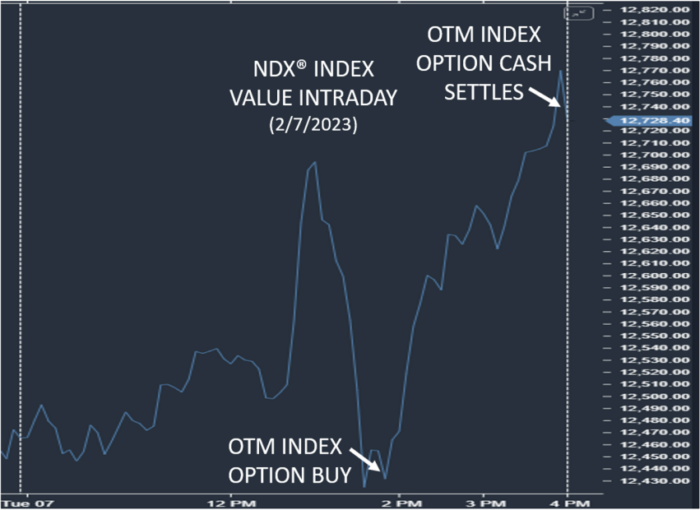

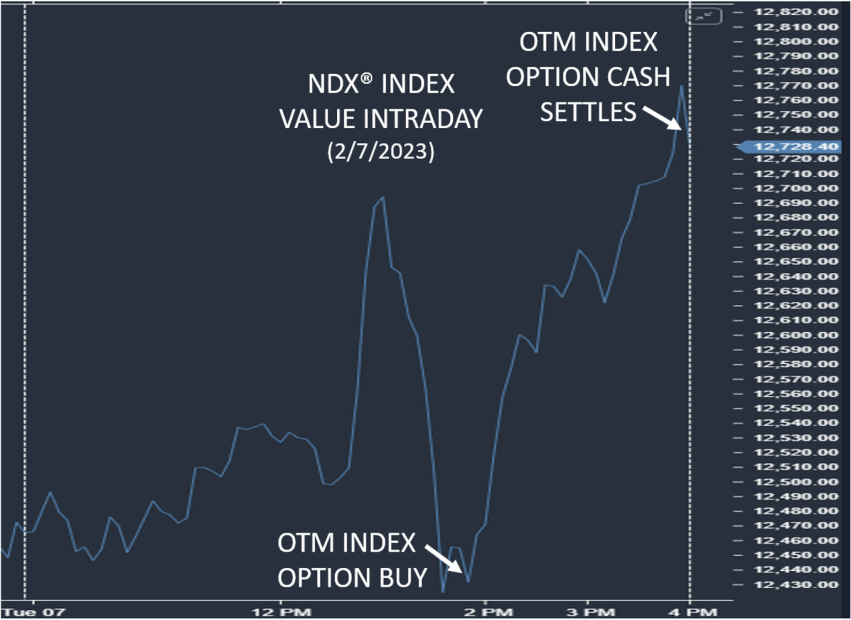

Bringing it back to options, perhaps you’ve seen someone on social media touting their success trading derivatives. For example, there was coverage of a sizeable index options trade ahead of the Consumer Price Index (CPI) data. This situation involved an index option that expired the same day (0 DTE). The call option was out-of-the-money (OTM) in the early afternoon and traded for $0.35. By the end of the day, that option was worth ~$25.00 because the Nasdaq-100 Index (NDX) and S&P 500 Index (SPX) rallied hard into the close.

Source: LIVEVOL PRO

These narratives feed our FOMO (loss aversion) heuristic. There’s a natural desire to take the “easy route.” We tell ourselves, “Somebody risked $35/option, and a few hours later, each option was worth $2500. I can do that!”

The reality is that you’re not going to do that. Just like you wouldn’t finish a marathon in under 3 hours without any training. You won’t hit a home run at Wrigley Field (spring training starts this week) without years of practice. You won’t lose 15 pounds without first losing ½ a pound.

Improving requires small steps, and you cannot fast forward to the good parts.

Fail to Improve

In my estimation, we improve by making mistakes and learning from them. When I speak to groups about my professional experience and the options business, I’ll point out that “we are all clerks” at some point.

I started learning about options in late 1999. My first job after graduation was as a clerk for an independent market maker on a trading floor. In that role, I was able to learn the language of options. I was able to ask questions and learn a little bit more every day. I was able to establish a foundation upon which to build. Eventually, I was entrusted with firm capital and given the opportunity to manage options risk on my own.

In my opinion, we are all “clerks” in one way or another. Apprentice may be a more appropriate term. Here is the part where I believe social media can be helpful. Today you’re able to tap into a global community of practitioners. Individuals that are willing to share their learnings can accelerate your own education. Curating a thoughtful group of social media accounts with an options focus can be very helpful.

There is No Substitute

In order to get started trading options, you have to trade an option. Period.

If you have investable capital, you need to make sure you have options approval from your brokerage firm. There are usually levels that distinguish the strategies you’re able to employ. The lowest level will allow the account holder to buy options.

Try it. Buy a call. Buy a put.

Establish a plan for how you will manage your exposure and stick to it.

If you buy a call option for $1.00, are you comfortable losing $100? Will you allow that call to expire worthless if the reference asset (stock, ETF or index) doesn’t move beyond your strike price at expiration?

If two weeks pass and the options decay to $0.50, will you plan on selling the call to close?

What about if things go well?

Entering a trade is relatively easy. The exit can be more difficult. This goes back to the planning element. If you paid $100 for an option and plan to sell it if it’s worth $250 – follow your plan.

Without a plan, we tend to bargain with ourselves when things go well. You might think, “wow, I’m so smart. This option is up 150%. What if it’s worth $500 next week?”

I can tell you from experience that turning a winner into a loser STINKS!

Using options requires discipline. That’s why this article starts with a hard truth: starting anything new is difficult. Going back to my floor experience, I remember so many people saying, “nobody goes broke taking profits.” While it’s not quite that simple, it’s close to the truth.

There will be positions that work well. There will be others that don’t. You must be able to manage both emotionally.

Markets are volatile. Whether you realize it or not, volatility is why we invest. Changes drive value whether you’re talking about an index, a specific company (earnings, etc.) or options (time value). Absent change, there is no incentive to invest.

Understand that you will lose money at some point.

It’s about learning from every trade. I believe you learn more from losing positions than winners.

Risk First, Not Reward

There’s a reason that financial marketing and presentations include disclaimers. Humans tend to be forward-looking and often optimistic. It’s part of what moved us to the top of the food chain. However, that tendency can be problematic.

There’s a cost associated with everything: monetary costs, opportunity costs, emotional costs.

Thinking about the risk inherent in any given options position as opposed to the potential reward is recommended.

Ask yourself:

- Am I comfortable risking $X on this position?

- What percentage of my account value is at risk?

- What’s the motivation to assume this risk?

- What’s my plan if things go well?

- What’s my plan if the market doesn’t do what I expect?

Always think about risk first!

For What It’s Worth

In my estimation, paper trading is far less beneficial than most believe.

I believe there is a powerful emotional component to investing and trading. It’s most powerful in the beginning, and I believe it wanes in time.

Using a paper trading account to learn about options may have utility, but it’s simply not the same.

Prior to working on a trading floor, I was a caddy. I started working at a golf course when I was 13 and continued to do so through college. As a result, I sometimes think in golf terms.

I draw a comparison to golfers hitting long, straight shots when they’re getting loose at the range (practice area). Then they will step up to the 1st tee, they are surrounded by the other golfers, caddies, a tree-lined fairway and possibly bunkers off to the sides. Now it’s real!

The optics are night and day. It just doesn’t feel the same. The risk profile is unique.

That same golfer who was striking ball after ball down the middle only minutes earlier tends to tense up and change their approach when it’s “real.”

Similarly, I’ve heard countless examples of people who used a $100k paper trading account and “turned it into $X,XXX,XXX” in short order. This person is almost certainly overconfident. That can have profoundly negative implications.

As a generic example, let’s imagine this same hypothetical person intends to open and fund an options-focused account with $10,000.

There’s already a huge difference in the types of strategies/options that could be employed.

Example: Buying a call spread for $700.

- In a $100k account, that works out to position risk of less than 1% of the account on the trade.

- In a $10k account, that same position would put 7% of the account at risk in one trade.

More importantly, there is no real risk with a paper trading account. Markets are driven by risk. Very real risk. When that’s removed from the equation, so too is the “reality” of the situation. It’s not a good barometer for how we might behave.

(From my perspective, buying a very short-dated option(s) would make it difficult to learn about puts and calls because options with different tenors behave differently. Using calls or puts with at least a month until expiration offers a greater opportunity to learn the basics of options.)

In Short

So, how do you get started trading options?

The same way you get started with anything else: You try it (just a little bit).

This is like me with sushi. I had to take very little bits to get comfortable with the idea of raw fish for dinner.

You could try trading one call or one put option for example.

Understand that your mindset and goals matter a great deal. Protecting and growing capital in the markets is hard work. Recognize that, like anything else that’s difficult, it requires discipline. Have a plan and stick to your plan. Make realistic, measurable goals. Learn from your mistakes.

Avail yourself of the tremendous resources available for free on your brokerage platform.

Work to become a little bit better all the time. Our efforts to improve tend to compound like money in savings (in a high-interest-rate environment). Establish a process and constantly refine it. Don’t judge yourself based on outside influences.

Financial well-being is incredibly personal. It doesn’t matter what your friends, or family or social media is doing. What matters is figuring out what’s best for YOU.

You’re not going to be perfect, but you can make a lot of progress when you set your mind to it.

—

Originally Posted February 15, 2023 – How to Get Started Trading Options

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Disclosure: Nasdaq

Index

Nasdaq® is a registered trademark of Nasdaq, Inc. The information contained above is provided for informational and educational purposes only, and nothing contained herein should be construed as investment advice, either on behalf of a particular security or an overall investment strategy. Neither Nasdaq, Inc. nor any of its affiliates makes any recommendation to buy or sell any security or any representation about the financial condition of any company. Statements regarding Nasdaq-listed companies or Nasdaq proprietary indexes are not guarantees of future performance. Actual results may differ materially from those expressed or implied. Past performance is not indicative of future results. Investors should undertake their own due diligence and carefully evaluate companies before investing. ADVICE FROM A SECURITIES PROFESSIONAL IS STRONGLY ADVISED.

© 2023. Nasdaq, Inc. All Rights Reserved.

Options

For the sake of simplicity, the examples included do not take into consideration commissions and other transaction fees, tax considerations, or margin requirements, which are factors that may significantly affect the economic consequences of a given strategy. An investor should review transaction costs, margin requirements and tax considerations with a broker and tax advisor before entering into any options strategy.

Options involve risk and are not suitable for everyone. Prior to buying or selling an option, a person must receive a copy of Characteristics and Risks of Standardized Options. Copies may be obtained from your broker, one of the exchanges or The Options Clearing Corporation, One North Wacker Drive, Suite 500, Chicago, IL 60606 or call 1-888-OPTIONS or visit www.888options.com.

Any strategies discussed, including examples using actual securities and price data, are strictly for illustrative and education purposes and are not to be construed as an endorsement, recommendation or solicitation to buy or sell securities.

© 2023. Nasdaq, Inc. All Rights Reserved.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Nasdaq and is being posted with its permission. The views expressed in this material are solely those of the author and/or Nasdaq and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Options Trading

Options involve risk and are not suitable for all investors. Multiple leg strategies, including spreads, will incur multiple commission charges. For more information read the "Characteristics and Risks of Standardized Options" also known as the options disclosure document (ODD) or visit ibkr.com/occ