NVDA Large Call Spread: Insights and Analysis

NVDA‘s option trading has taken the lead, surpassing giants like TSLA and SPY, to become the most actively traded options by dollar value, reaching an impressive $2.7 billion. Our curiosity piqued, we turned to MarketChameleon’s advanced tool that specializes in parsing the trade tape and identifying multi-leg strategies.

Among the insights garnered, one particular call spread emerged as notably popular: the 22-Mar-24 885 : 890 call spread, expiring in just one day.

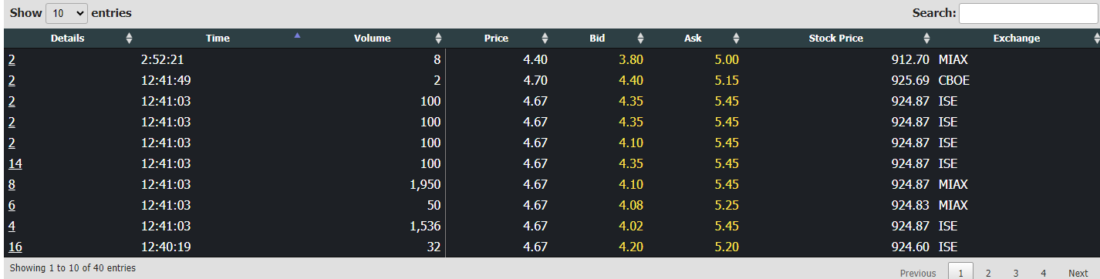

NVDA Multi-Leg Option Trade Analyzer

The Trade Breakdown

Source: MarketChameleon

This call spread was executed 40 times between 9:30 am and 2:52 pm. The Volume Weighted Average Price (VWAP) for this $5 spread stood at $4.44, indicating a robust interest level. What made this trading activity remarkable was its nature—not a singular large transaction, but a cumulative series of trades throughout the day.

This distribution suggests a growing volume, particularly towards the latter half of the trading period.

Exchange Dynamics and Price Variations

The spread’s journey across multiple exchanges, trading at various prices, highlighted potential liquidity challenges. Traders possibly navigated through multiple dealers across different exchanges, bidding up the price as NVDA’s stock value climbed, illustrating the strategic maneuvering required to fill these orders over time.

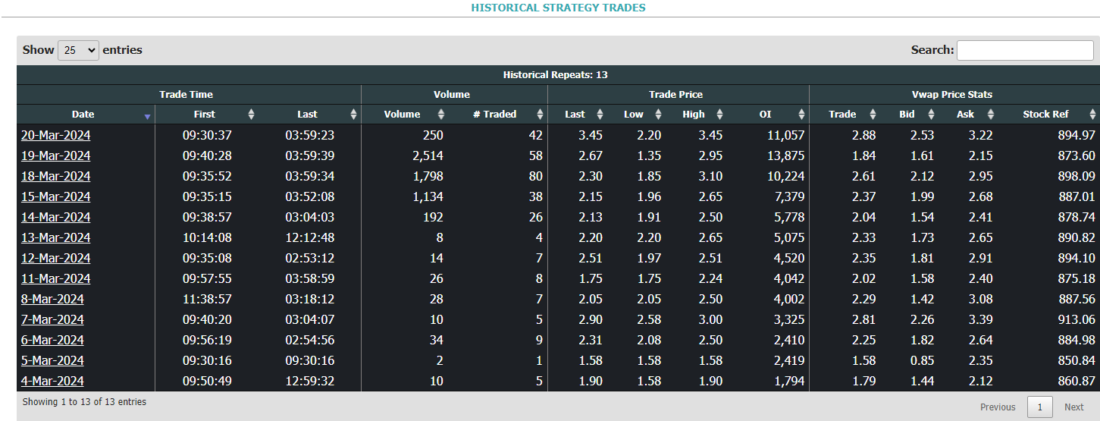

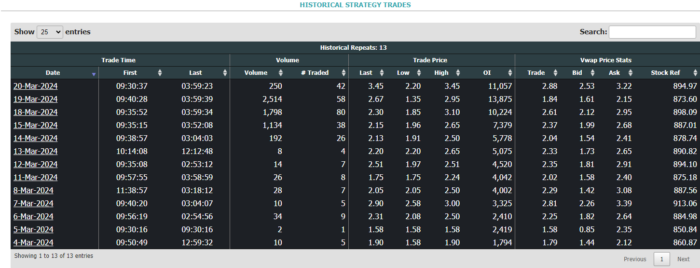

Historical Context

Source: MarketChameleon

MarketChameleon’s analysis revealed that this specific call spread has been a recurring trade in the market, trading nearly every day since March 4. Starting at $1.90 and ascending to $3.45 by March 20, this strategy showcased significant gains. The volume notably intensified on March 15, trading at a VWAP of $2.15, setting the stage for the recent surge in activity.

Looking Ahead

For the buyers of this spread to reap maximum rewards, NVDA’s closing above $890 on March 22 is crucial. Given the stock’s current position at $913 and with one day remaining, prospects seem promising for this limited risk strategy to yield significant returns amidst the stock rally.

Conclusion

Marketchameon‘s multi-leg trade analyzer helped highlight the 22-Mar-24 885 : 890 NVDA call spread, that might otherwise have remained obscured by the day’s extensive trading activity. This tool efficiently helped us monitor the spreads growth in both volume and price as the expiration approached.

This reveals insights into strategic opportunities that marry risk management with potential returns, highlighting the analytical depth required to uncover potentially hidden yet rewarding trading prospects.

—

Originally Posted March 21, 2024 – NVDA’s Most Traded Call Spread

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.

Leave a Reply

Disclosure: Market Chameleon

The information provided on MarketChameleon is for educational and informational purposes only. It should not be considered as financial or investment advice. Trading and investing in financial markets involve risks, and individuals should carefully consider their own financial situation and consult with a professional advisor before making any investment decisions. MarketChameleon does not guarantee the accuracy, completeness, or reliability of the information provided, and users acknowledge that any reliance on such information is at their own risk. MarketChameleon is not responsible for any losses or damages resulting from the use of the platform or the information provided therein. The 7-day free trial is offered for evaluation purposes only, and users are under no obligation to continue using the service after the trial period.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Market Chameleon and is being posted with its permission. The views expressed in this material are solely those of the author and/or Market Chameleon and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Options Trading

Options involve risk and are not suitable for all investors. Multiple leg strategies, including spreads, will incur multiple commission charges. For more information read the "Characteristics and Risks of Standardized Options" also known as the options disclosure document (ODD) or visit ibkr.com/occ

Disclosure: Options (with multiple legs)

Options involve risk and are not suitable for all investors. For information on the uses and risks of options, you can obtain a copy of the Options Clearing Corporation risk disclosure document titled Characteristics and Risks of Standardized Options by clicking the link below. Multiple leg strategies, including spreads, will incur multiple transaction costs. "Characteristics and Risks of Standardized Options"

not sure this is so “limited risk” strategy. Of course risk is capped at the cost of spread but it is rather a high probability/low income/high risk spectrum given the buyer loses everything NVDA goes from 913 to 885. It is 3% but with this stock we have seen more.