This year has been a year of firsts on Wall Street, and the options market is the latest to register an unprecedented surge in popularity.

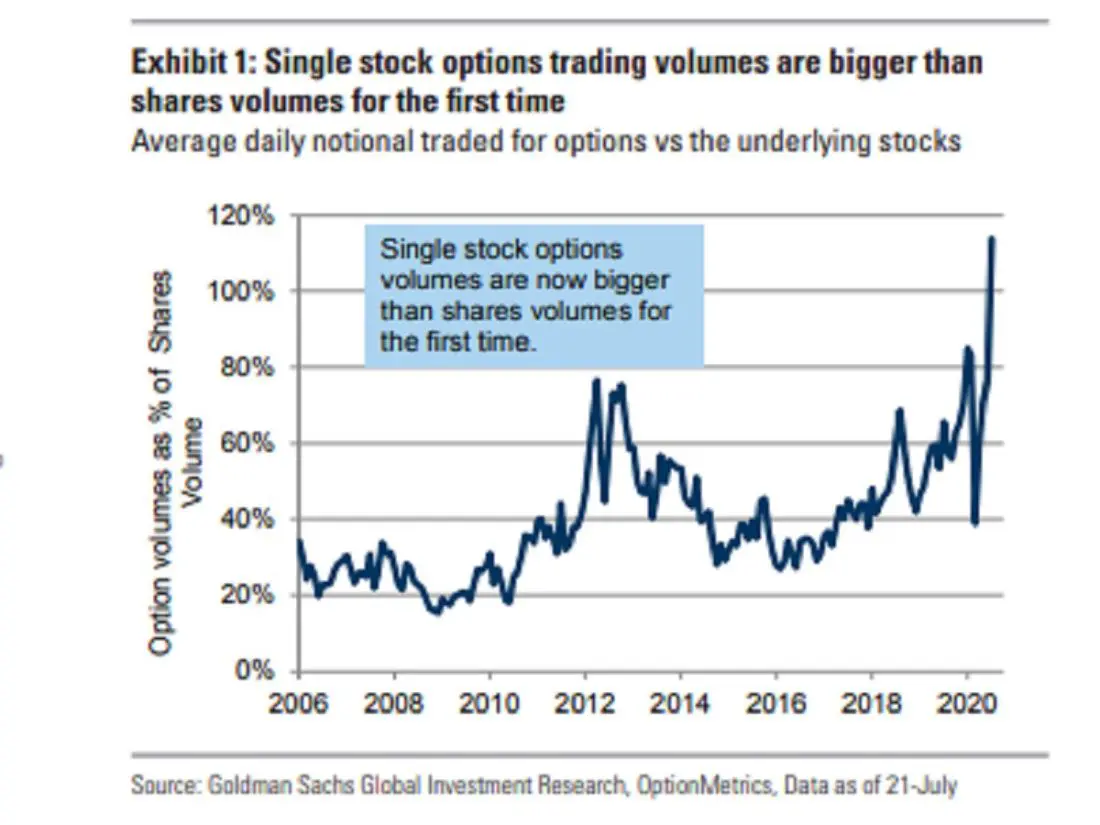

Goldman Sachs has reported that single stock options trading volume has surpassed the daily trading volume of the underlying stocks for the first time in history.

Option Trading Spike:

The graph below shows just how much option volume has skyrocketed relative to stock trading volume in 2020, and some market experts are concerned about how a flood of younger, inexperienced and risk-hungry traders may be impacting the market.

With many Americans stuck at home for extended periods of time due to lockdowns, major sports and other events canceled and casinos closed, the number of retail stock traders has skyrocketed in 2020. Popular trading app Robinhood reported 3 million new accounts in the first quarter alone. Robinhood users reportedly have an average age of 31, and the company has said half of its users have never invested before.

Some of the most popular stocks on the Robinhood app are names like American Airlines Group Inc AAL, Tesla Inc TSLA and Carnival Corp CCL, extremely volatile and high-risk stocks that each have less than 30% “Buy” ratings among Wall Street analysts.

But some young traders appear to be taking the risk to the next level by venturing into the complicated world of leveraged option trading. Twenty-year-old Alex Kearns made headlines when he took his own life after racking up what he believed to be $750,000 in losses in his Robinhood account from option trading.

In his suicide note, Kearns told his family he had “no clue what I was doing now in hindsight.”

Option Market Gamblers:

As of late June, a record 28 million option contracts have been traded daily in 2020, up 45% from a year ago, according to Options Clearing Corp. Among the 50 most-traded stocks, Goldman Sachs research found the percentage of option contract trades that represent extremely small orders of only a single contract has risen from 10% last year to 14% in 2020.

For market gamblers, the appeal of option contracts is obvious. Option buyers can essentially bet on 100 shares of stock for a small fraction of the cost of those underlying shares. A relatively small move in the underlying stock can produce huge swings in the value of its option contracts due to this leverage.

Combine this massive potential option leverage with the fact that studies have consistently shown upwards of 90% of new day traders lose money in the market, and it’s understandable why Wall Street veterans are getting nervous about the spike in options trading activity this year.

Benzinga’s Take:

New investors should understand the difference between investing to make money in the long-term and day trading stocks and options contracts to gamble. Studies have repeatedly shown that long-term, diversified investing for time horizons of 10 years or longer is almost always a profitable endeavor, whereas day trading is a losing strategy for at least 90% of new traders.

—

Originally Posted on July 28, 2020 – Option Trading Volume Higher Than Underlying Stock Volume For First Time Ever

Disclosure: Benzinga

© 2022 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Benzinga and is being posted with its permission. The views expressed in this material are solely those of the author and/or Benzinga and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Options Trading

Options involve risk and are not suitable for all investors. Multiple leg strategies, including spreads, will incur multiple commission charges. For more information read the "Characteristics and Risks of Standardized Options" also known as the options disclosure document (ODD) or visit ibkr.com/occ