Stocks – NONE

Macro – SPY, VIX, DXY

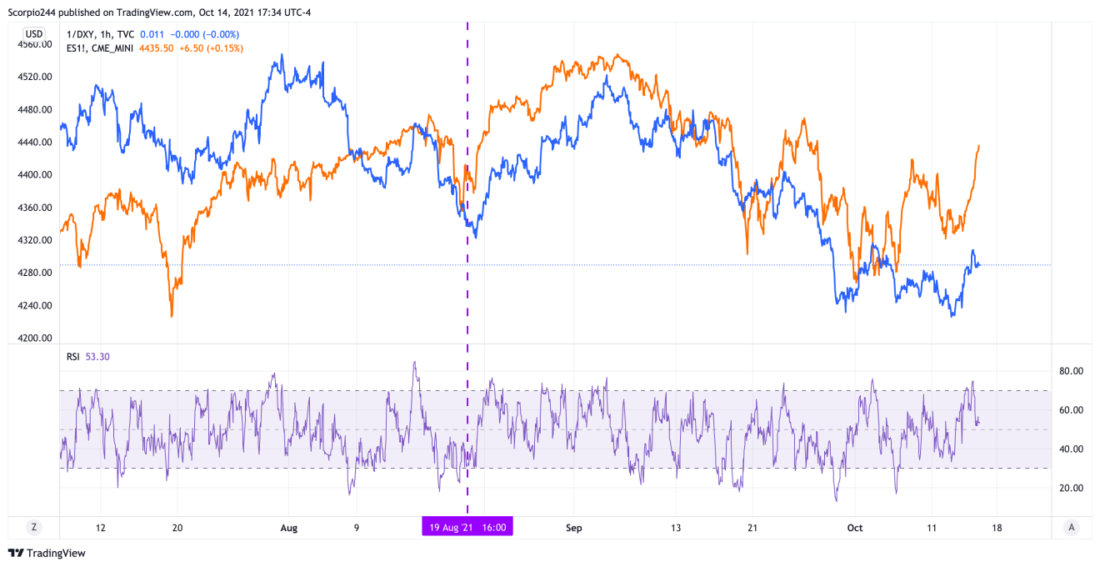

So the market decided today to pull itself together and stage a massive short-covering rally into options expiration tomorrow. This rally would have been more appropriate yesterday given how much the Dollar index pulled back, but instead, they decided to rally it today.

The VIX moved lower, closing at 16.85. The last time the VIX closed below 17 was back on September 2, at 16.40. Interestingly, and more to my point I was trying to make yesterday, in my The Dip Is Dead story, and here on this blog, September 2 also happened to be the day the S&P 500 topped out at 4537. So here we are now at the same spot, essentially, on the VIX, but the S&P 500 is about 100 points lower.

Maybe this isn’t an easy concept to understand, but if the VIX doesn’t start going lower, the S&P 500 will have a tough time rising back to its previous highs. Now could the VIX go to 15 or 13? Sure, it could, but given the unresolved Evergrande situation and increasing uncertainty in earnings estimates, now may not be an ideal time for the VIX to go to 13. Not to mention the VIX index has been steadily trending higher since June.

S&P 500 (SPY)

The S&P 500 rose today by around 1.7%, allowing it to finally refill the gap from September 27 while also again climbing to the 50-day moving average. Meanwhile, today’s move looked almost identical most of the day to the action on October 7, but by the days closed, it looked more like the move on September 23. Both of those days had big moves higher, with massive gaps up, and both moves ended the same with the market refilling the gap at lower prices days later.

Technically speaking, the gap at 4,440 is filled, and it should result in a continuation of the overall trend, which is lower. Additionally, there is now a gap that needs to be filled at 4,360. So since tomorrow is options expiration, and there will be a ton of gamma expiring for the indexes on the opening, there could be a very big gamma hangover. Not to mention if you think the market has been volatile now, just wait.

The other part of the equation is that the S&P 500 has been tracking the dollar very closely, which was crushed yesterday. Today the dollar was flat but managed to finish well off of its lows, just below 94. Since Jackson Hole, the dollar and the S&P 500 have been tight, so again, watch the dollar index; if it starts rising again, the rally in stocks will stall out.

–

Originally Posted on October 14, 2021 – Stocks Rally On October 14 Ahead of Option Expiration, For Now At Least

Disclosure: Mott Capital Management

Mott Capital Management is the portfolio manager for one portfolio offered by Interactive Advisors. Interactive Advisors clients do not invest directly with the Portfolio Managers like Mott Capital Management, and the Managers do not have discretionary trading authority over Interactive Advisors client accounts. The Portfolio Managers on the Interactive Advisors platform simply license their trade data to Interactive Advisors, which then allows its clients to have the same strategy and trading decisions mirrored in their accounts if the Portfolio is in line with their risk score. Portfolio Managers like Mott Capital Management implement their trading philosophy and strategy without knowing the identity of Interactive Advisors’ clients or taking into account these clients’ individualized circumstances.

Mott Capital Management has entered into a Portfolio Manager License Agreement with Interactive Advisors pursuant to which it provides trading data IA uses to offer a portfolio to its investment advisory clients. Mott Capital Management is not affiliated with any entities in the Interactive Brokers Group.

Interactive Advisors is an affiliate of Interactive Brokers LLC.

Pursuant to the Investment Management Agreement between Interactive Advisors and its clients, all brokerage transactions occur through Interactive Brokers LLC, an affiliate of Interactive Advisors. The use of an affiliate for brokerage services represents a potential conflict of interest as Interactive Brokers LLC is paid a commission on trades executed on behalf of Interactive Advisors. Interactive Brokers LLC does not consider this conflict material as it does not sell, solicit, recommend, trade against or otherwise attempt to induce Interactive Advisors to place any orders in any products. Interactive Advisors does not offer services through any other broker-dealer. All trading by Interactive Advisors is self-directed. Interactive Advisors clients acknowledge this potential conflict of interest and authorize Interactive Advisors to execute transactions through Interactive Brokers LLC when they open an Interactive Advisors account. Clients should consider the commissions and other expenses, execution, clearance, and settlement capabilities of Interactive Brokers LLC as a factor in their decision to invest in an Interactive Advisors Portfolio. Interactive Advisors believes it satisfies its best execution obligation by trading its clients’ trades through Interactive Brokers LLC. While there can be no assurance that it will in fact achieve best execution, Interactive Advisors does periodically monitor the execution quality of transactions to ensure that clients receive the best overall trade execution pursuant to regulatory requirements.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Mott Capital Management and is being posted with its permission. The views expressed in this material are solely those of the author and/or Mott Capital Management and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Options Trading

Options involve risk and are not suitable for all investors. Multiple leg strategies, including spreads, will incur multiple commission charges. For more information read the "Characteristics and Risks of Standardized Options" also known as the options disclosure document (ODD) or visit ibkr.com/occ