Options traders were quite bullish about Tesla (TSLA) heading into last night’s earnings. I noted here on Monday and here last Thursday that implied volatilities for above-market options were higher than those for their below-market counterparts. That meant that traders were expressing optimism about a rally after a well-received earnings report. Their enthusiasm was well placed, with TSLA opening about 3% higher after some stronger gains in the post- and pre-market.

But options math is inescapable. Those bullish call buyers found themselves with substantial losses despite the stock’s rise. They got it right, but ended up wrong.

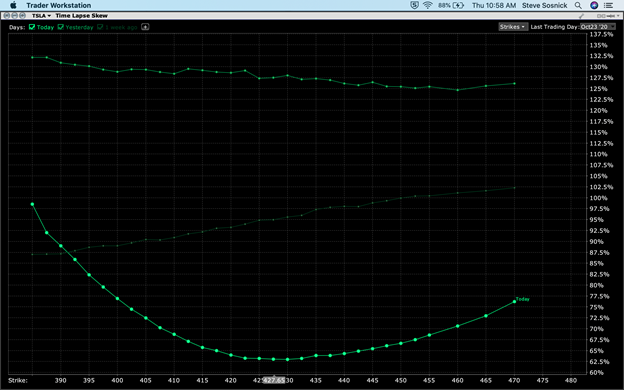

Consider the following graph. It shows the skews for TSLA options expiring this Friday at different times. I created the graph using the “Time Lapse Skew” function on my TWS. The top line is from yesterday’s close, the middle is from a week ago, and the bottom line is from this morning.

Source: Trader Workstation

We can see that a week ago, when I wrote this, the skew curve was essentially an upward sloping line. Traders were willing to pay higher prices (in volatility terms) to speculate on a bounce than they were to hedge against a loss. That is highly unusual, which is why I brought it to readers’ attention. Ahead of earnings, most stocks have skew curves that look similar to the bottom. That bottom displays a mix of risk aversion along with some speculation. By yesterday the level of overall volatility had increased, and the slope of the skew had inverted. That meant that some risk aversion had belatedly crept into the skew on a relative basis, but the implied volatility for all options had increased markedly. It is not unusual to see implied volatilities peak immediately before an earnings release. The market punishes latecomers, so those who demand protection or want to speculate at the last minute often need to pay up to do that.

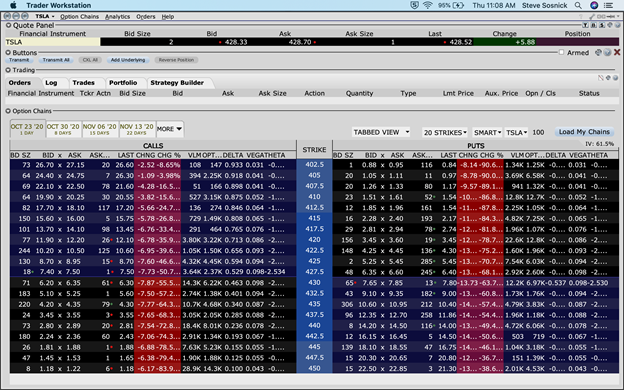

Bear in mind the space between the top and bottom lines in the graph above when you look at the table below. That displays the TWS Options Trader page for the 20 strikes closest to the money with the nearest expiration for TSLA.

Source: Trader Workstation

Note the bright red CHNG and CHG % columns. The losses for both puts and calls are substantial. The substantial change in volatility (Vega) combined with the high level of decay (Theta) that we see for short-term, high-price options account for the bulk of the declines. To be fair, this is much more about the relative lack of movement in TSLA shares than it is about the directional nature of the trading. Yet that is another important facet about understanding options pricing ahead of earnings.

We see from the top graph that the implied volatility for TSLA at-money options was about 127% yesterday. Using the rule of 16, we realize that converts to about an 8% daily volatility. According to Bloomberg data, the average post-earnings price change for TSLA was about 9%. Based upon that history, the pricing was not particularly unreasonable. Yes, it was slightly below the historical average, but not appreciably so. But if the market is pricing in an 8% move and the stock moves 1-2%, long holders of both puts and calls will likely find themselves underwater.

Experienced options understand that profitable trading around earnings is often less about getting direction right than it is about pricing in the proper overall move. I don’t want to oversimplify, but it is reasonable to expect that professionals were more likely to be selling risky options ahead of earnings than buying them. Those who routinely sell options understand that there is often more to be consistently gained by selling high priced options as long as they are strict about managing risk exposures.

Putting it back in to Greek letter terms, speculators tend to focus on delta: the change in an options price for a given change in the price of the underlaying. That is particularly true for inexperienced traders. Speculators learned an important lesson today – that the other Greeks like Vega and Theta, can influence prices just as much, if not more.

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.

Disclosure: Options Trading

Options involve risk and are not suitable for all investors. Multiple leg strategies, including spreads, will incur multiple commission charges. For more information read the "Characteristics and Risks of Standardized Options" also known as the options disclosure document (ODD) or visit ibkr.com/occ