Over one quarter of the market capitalization of the NASDAQ 100 Index (NDX) reports after the close today. In this era of megacap tech concentration, it means that two of the behemoths are responsible for all that market weight – Microsoft (MSFT) and Alphabet (GOOG, GOOGL). Those two stocks – three share classes – also represent about 10% of the market cap of the S&P 500 Index (SPX) as well. It doesn’t get any bigger than this – until Thursday afternoon, when Apple (AAPL) and Amazon (AMZN) report.

During the FAANG stock heyday, I sometimes felt a bit sorry for MSFT. It had to be a bit of a blow to get omitted from the cool kids’ acronym. But MSFT and its shareholders have done just fine for themselves, certainly relative to the “F” and “N” of the famous acronym (Facebook and Netflix). It is now the second largest company in the US, with only AAPL – a company it bailed out 1997[i] – surpassing it.

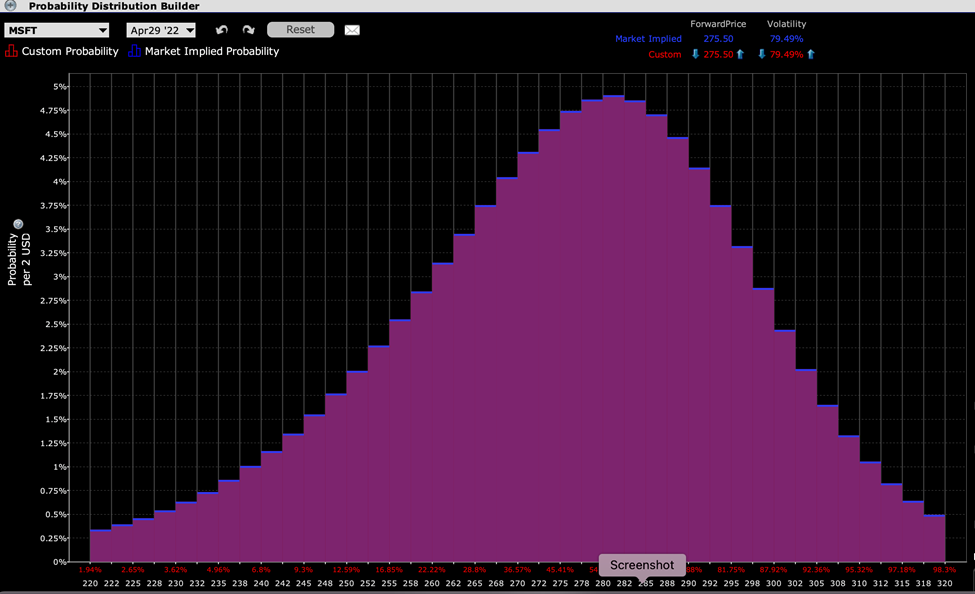

Can we blame MSFT investors for being a bit sanguine ahead of the company’s earnings, then? According the IBKR Probability Lab, the market places its highest probability on a 2-3% rise to the 280-282 range for options expiring this Friday:

Probability Distribution for MSFT Options Expiring April 29th, 2022

Source: Interactive Brokers

We can’t really blame traders for being bullish about MSFT’s prospects. According to Bloomberg data, the company hasn’t missed its quarterly estimate since April 2016 – a six-year streak of earnings beats! That hasn’t always translated into rising prices on the subsequent day, with the stock falling after 4 out of its last 8 reports – though it rose about 3% and 4% after each of its past two releases. Traders appear to be using the past as prologue by pricing in the highest probability for a similar move tomorrow.

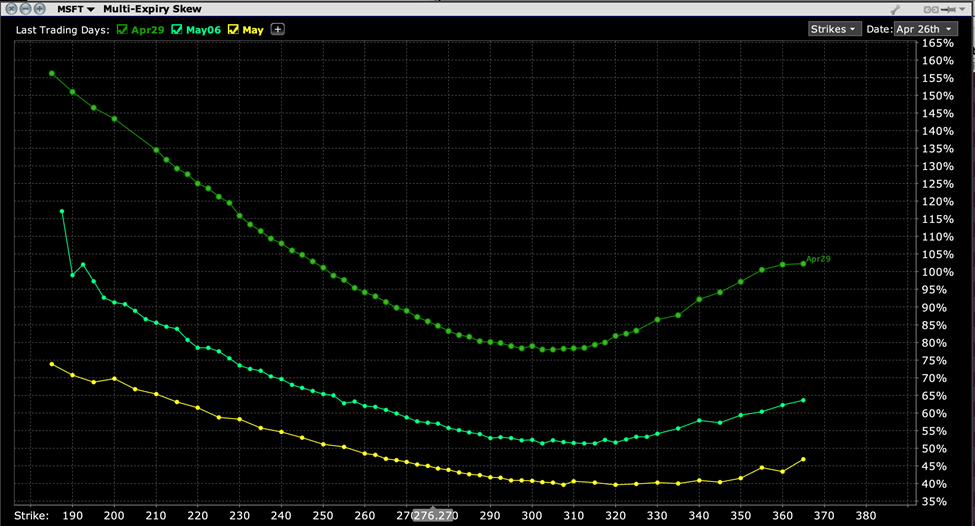

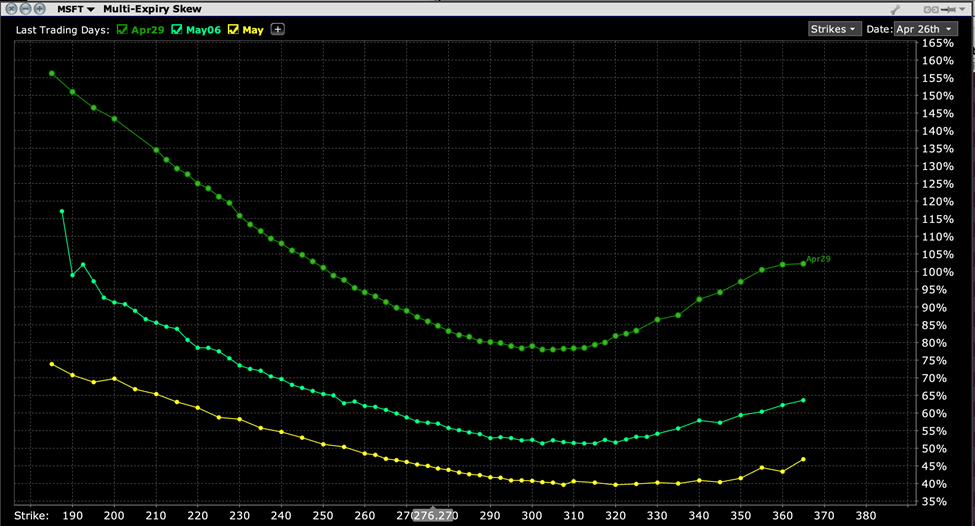

Yet from another viewpoint, traders are more nervous than usual about MSFT’s prospects. While the skew curve for this week’s expiry is more symmetrical than for the following week and next monthly expiration, the at money options are implying over a 5% post-earnings move. This compares with an average post-earnings move of about 3.5%. Considering the general nervousness pervading the market over the past few days, a bit more risk aversion seems warranted.

Multi-Expiry Skew for MSFT Options – April 29th (top), May 6th (mid), May 20th (bottom) Expirations

Source: Interactive Brokers

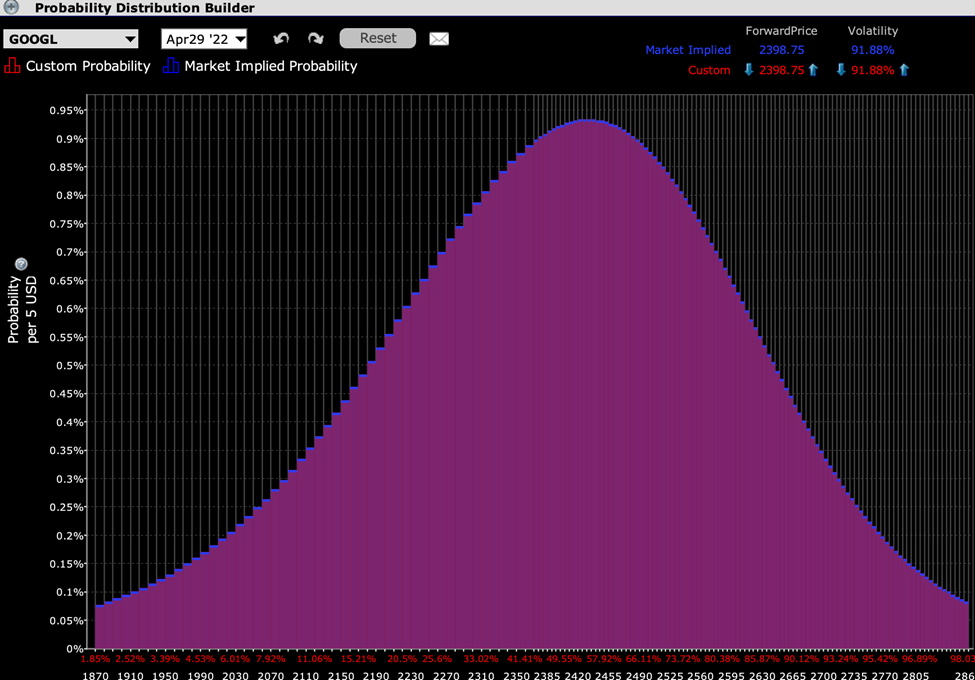

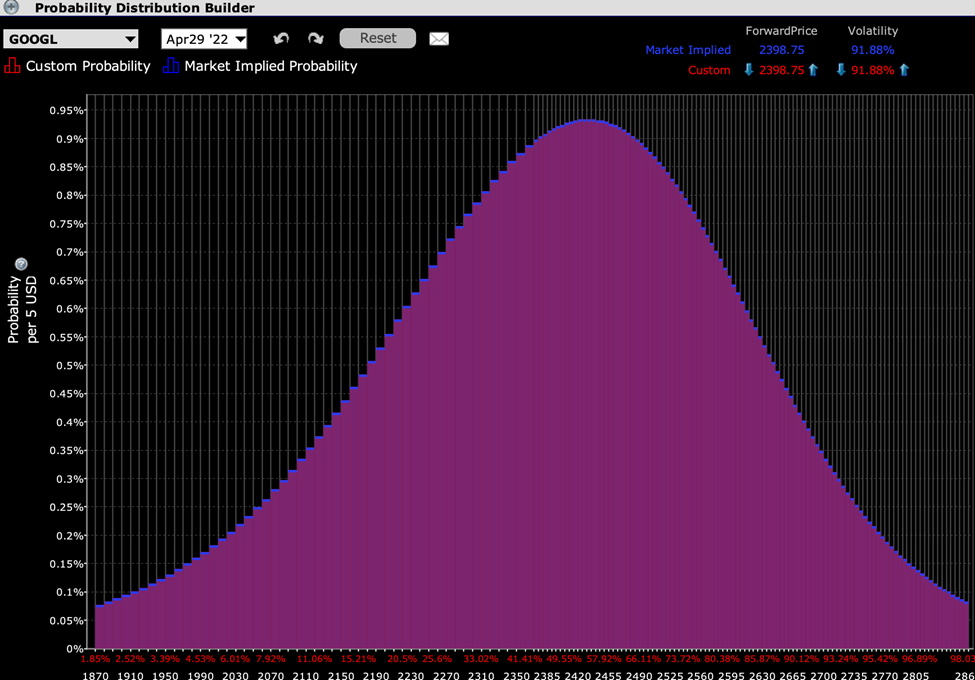

The scenario for GOOGL appears similar to that of MSFT.[ii] The Probability Lab shows a peak about 2-3% above the current market price:

Probability Distribution for GOOGL Options Expiring April 29th, 2022

Source: Interactive Brokers

As with MSFT, it is reasonable for traders who utilize historical precedent to anticipate a positive post-earnings result. GOOGL has rallied after beating earnings for each of the past six quarters. The only time it failed to rally in the past two years was in July 2020, which was also the only time it missed its estimate during that period.

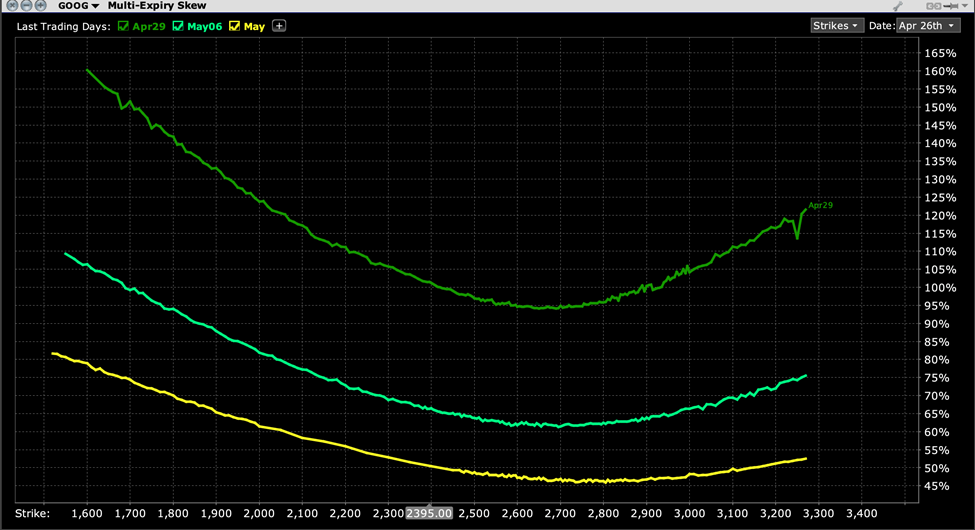

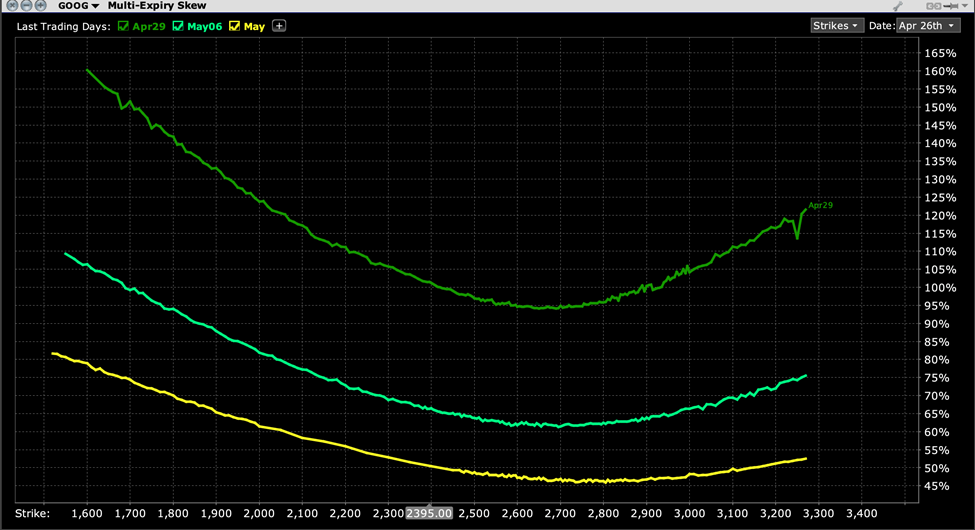

Alphabet is famously parsimonious with mid-quarter guidance, so it is not shocking that its average post-earnings move has been about 5%. With less ongoing guidance, analysts are more apt to be surprised by the company’s results – even if most of those surprises have been positive. As with MSFT, we are seeing a bit more risk aversion reflected in GOOGL’s at money implied volatility than history might indicate, with those straddles implying a move of over 6% at current levels:

Multi-Expiry Skew for GOOGL Options – April 29th (top), May 6th (mid), May 20th (bottom) Expirations

Source: Interactive Brokers

Bottom line: despite the general tone of risk aversion and nervousness in the overall market, two of its largest components are displaying modestly bullish sentiment ahead of their earnings reports after the close today. It is a sensible expectation from a historical viewpoint since both companies have tended to react well in recent quarters. It may also be a sensible contrarian view after several days of declining prices. Yet the higher than normal at-money implied volatilities in both companies show that traders are not ruling out the potential for further malaise.

—

[i] Bailout? Well, kind of. AAPL was floundering in 1997 when Steve Jobs returned, and MSFT was threatened by anti-trust lawsuits. MSFT invested $150 million in AAPL, which turned out to be a huge win-win.

[ii] We will use GOOGL as our proxy for Alphabet stock. The analysis and results are nearly identical whether we choose GOOG or GOOGL.

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.

Disclosure: Options Trading

Options involve risk and are not suitable for all investors. Multiple leg strategies, including spreads, will incur multiple commission charges. For more information read the "Characteristics and Risks of Standardized Options" also known as the options disclosure document (ODD) or visit ibkr.com/occ