Facebook (FB) is certainly in the news today. I awoke to alerts on my phone about the “Facebook Papers”, the leaked trove of company data with a salacious series of revelations. Some are certainly shocking, showing that the company is slow to act upon or publicly disclose[i] problems within their system, but the stock’s lackluster performance today implies that investors either already suspected these issues or don’t view them as relevant to current and future earnings.

While the societal implications of FB’s negligence, willful ignorance, or worse, are manifold and meaningful, it is the latter topic – earnings — that should concern options traders, at least for today. As we have done before, we will attempt to glean clues about what sort of reaction the options market expects from FB after it releases 3Q earnings this afternoon.

According to Bloomberg data, the analyst consensus for FB earnings is $3.66. It is likely that investors expect the company to beat that consensus, since it has done so every quarter since 1Q of 2013.[ii] Interestingly, though FB’s earnings consistently beat expectations, the stock’s post-earnings response has been rather mixed. The average move has been 6.47%, and in no particular direction. The price of the shares fell on the day following 5 of the past 10 earnings reports.

The simplest way to measure the options market’s anticipation for a post-earnings move is to calculate the price of the at-money straddle with the shortest expiry. As I write this, FB is trading right around $325 and the combined prices of the calls and puts expiring this Friday are $20.60. That happens to be just about 6.3%. Unfortunately, while that is a quick and dirty methodology, popularized by floor traders who didn’t have access to many analytical tools, it lacks subtlety. It tells us nothing about the implied volatilities across a range of strikes, which tells us much about whether traders are bullish or bearish.

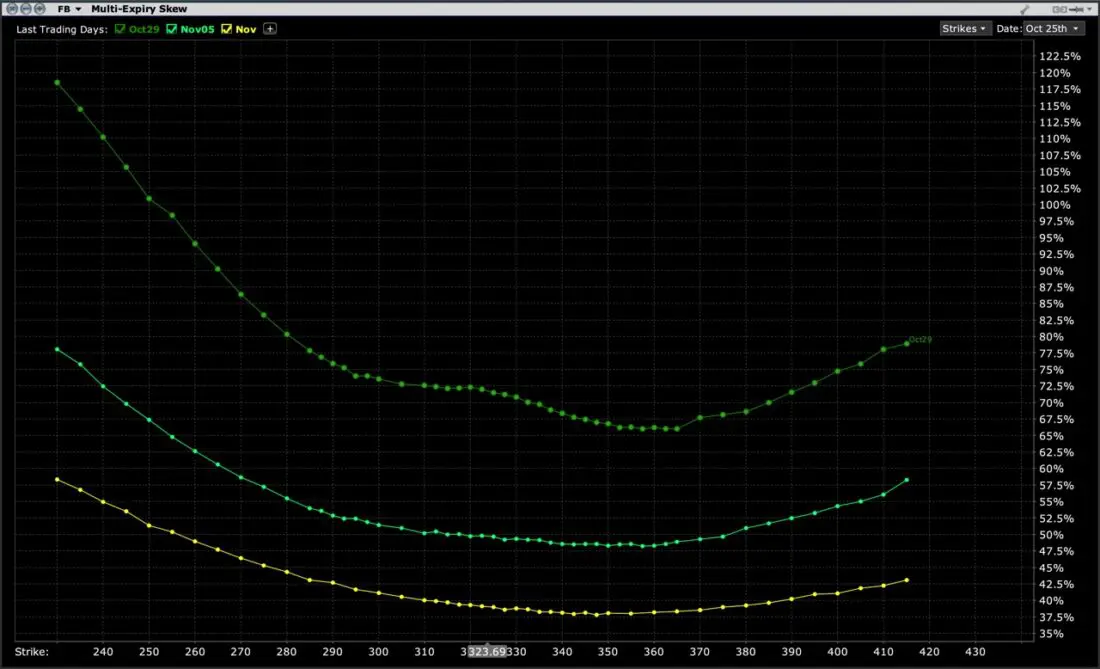

Graphing the option skew of a stock ahead of earnings gives us much more clarity. The graph below shows the implied volatilities of the range of strikes with expirations in each of the following 3 weeks[iii]:

Multi-Expiry Skew for FB With Sequential Three-Week Expirations

Source: Interactive Brokers

We see of course that the options that expire this week have the highest implied volatilities across the board. That is to be expected when earnings are imminent. We also see a typically steep, asymmetric skew. Remember that higher demand causes higher implied volatilities. Investors and speculators alike are more likely to buy puts to hedge their downside risk, with upside calls usually remaining as the province of bullish speculators. In this case, the elevated implied volatilities of options in the 300-325 range relative to those in the 330-360 range show that traders believe there is a higher likelihood for a modest downdraft than for a post-earnings rally.

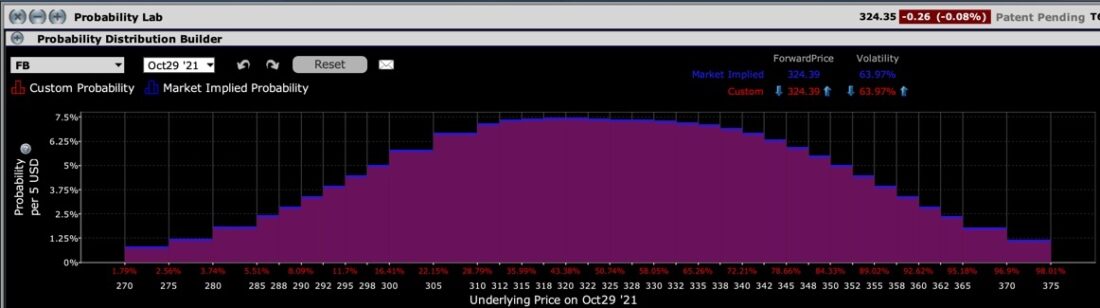

The Probability Lab function of the TWS[iv] allows us to gauge the options market’s expectations for post-earnings moves with a high degree of precision.

IBKR Probability Lab for FB Options Expiring October 29, 2021

Source: Interactive Brokers

As normal, we see that the market places the highest probability upon the range of outcomes around the current stock price. The plateau extends about +/- 6% in either direction from the current $325 level, which is consistent with prior post-earnings moves. The key is that the implied probability of an upside move of greater than 6% is far lower than that of a similar drop. Traders who are interested in hedging or speculating can then input their own probability assessments and let the system offer trades that meet those criteria.

The bottom line is this: despite the heavy flow of fundamental news about FB and its practices is having little impact upon the options market for the stock ahead of earnings. We see the usual amount of risk aversion with implied volatilities that anticipate a relatively normal post-earnings response. The most notable feature is the relative lack of speculative behavior in calls that anticipate an upward move of about 10%. Bullish traders might find that to be a buying opportunity, while bearish traders might find them an inexpensive way to hedge at-money calls.

—

[i] An example: one news report says that the company kept investors in the dark about how Facebook’s user base was skewing older. Did people not realize this? I attended a high school class reunion last weekend (go T-Birds) that was largely planned and followed up on Facebook. I can’t imagine that my and my classmates’ kids would plan something similar on that platform.

[ii] We can debate another time the extent to which the analyst community is systematically incorrect versus whether the company systematically underplays its prospects.

[iii] On your TWS, Analytical Tools -> Options Analysis -> Multi-Expiry Skew, then set the desired expirations and strikes

[iv] On your TWS, Analytical Tools -> Options Analysis -> Probability Lab

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.

Disclosure: Options Trading

Options involve risk and are not suitable for all investors. Multiple leg strategies, including spreads, will incur multiple commission charges. For more information read the "Characteristics and Risks of Standardized Options" also known as the options disclosure document (ODD) or visit ibkr.com/occ