Tomorrow morning at 8:30 AM EDT, the Bureau of Labor Statistics (BLS) will be releasing its November Consumer Price Index (CPI) data. While this is not the Federal Reserve’s preferred inflation statistic – that’s the PCE Deflator[i] released alongside GDP data – CPI is the most widely reported measure and thus the one most referenced by the public. Think of it like the Dow Jones of inflation, the most embraced measure of a key statistic, except that in this case the metric is actually a useful measure anyway. Ahead of a set of numbers that could influence monetary policy ahead of next week’s Fed meeting, major equity ETF options are surprisingly sanguine.

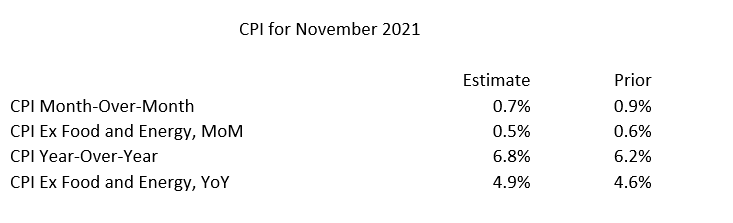

Here are the current consensus economist estimates from Bloomberg, along with the prior month figures:

We see that the monthly statistics are expected to decline while the annual statistics are expected to rise. This is more of a statistical quirk than anything else. The raw number is also likely to rise faster than the “core” ex-food and energy statistic. Economists prefer to focus on the core because it excludes more volatile, commodity market-related food and energy prices. (Consumers tend to dislike this number because few people neither eat nor drive.)

The key to understanding markets’ likely reaction is realizing that markets are already pricing in a fair amount of inflation, so the question will be is it under control or not. Fed Chair Powell recently dismissed the use of the term “transitory”, meaning that the Federal Reserve is more likely to view inflationary pressure as endemic to the current economic picture than something that is likely to fade naturally. That would imply that the Fed is more likely to take measures to quash inflationary expectations, including faster tapering of bond purchases and interest rate hikes. All of those are reductions in the pace of monetary stimulus to which investors have become accustomed.

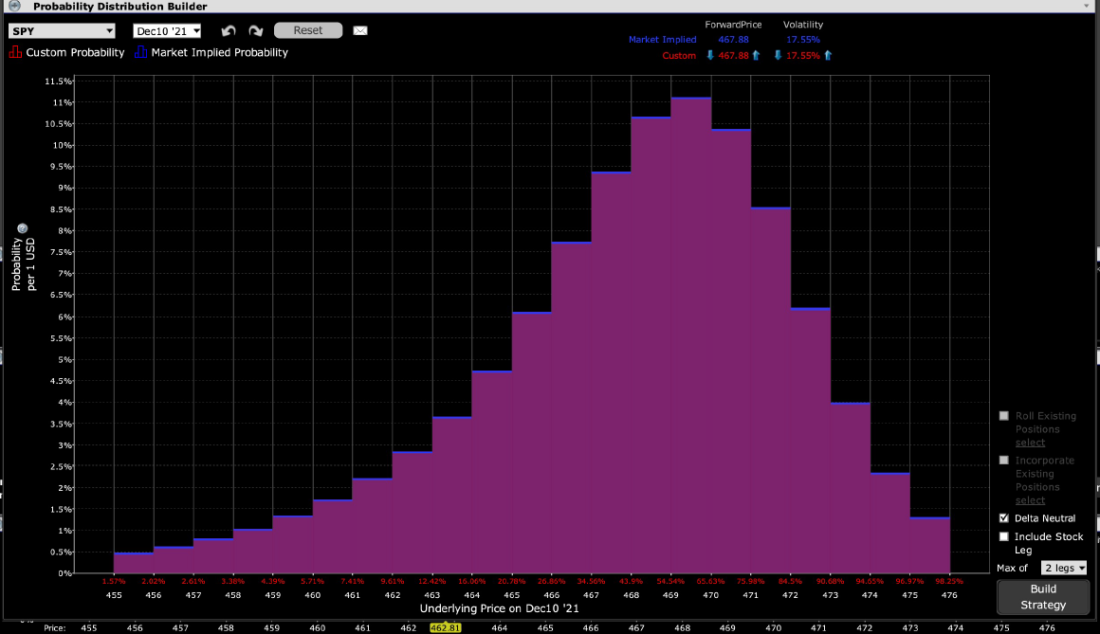

Markets didn’t like being told about this prospect, and gyrated accordingly, though equity indices have since largely recovered. If equity investors are nervous, that should be reflected in options volatility. The evidence shows that markets are pricing in a higher likelihood for a rise tomorrow than a fall, as evidenced by the IB Probability Lab’s distribution for weekly options that expire tomorrow:

IB Probability Lab for SPY December 10 options

Source: Interactive Brokers

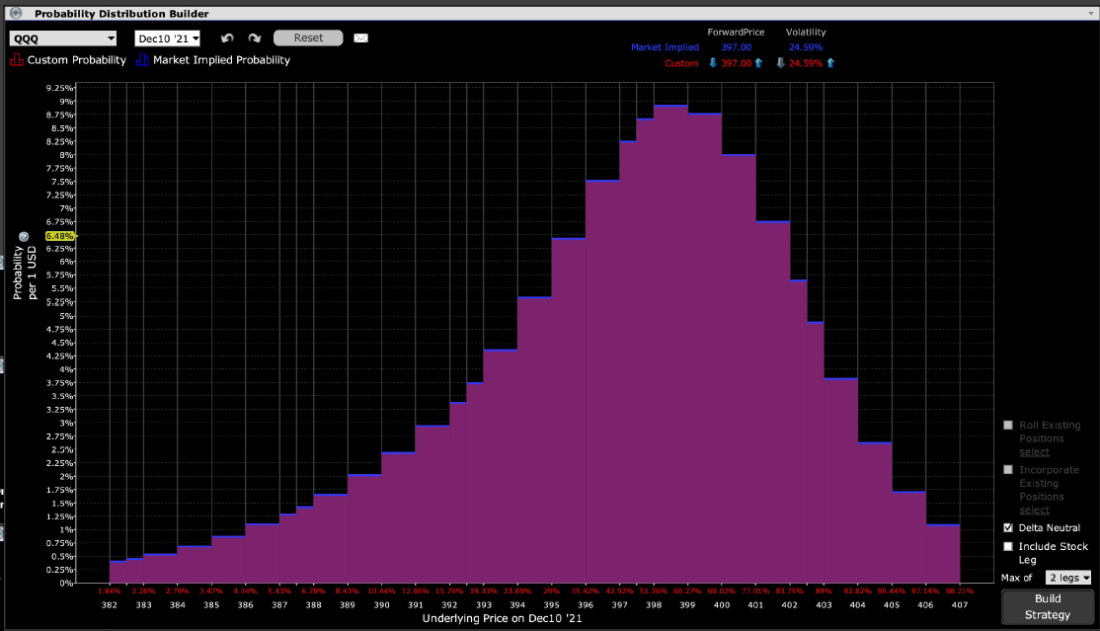

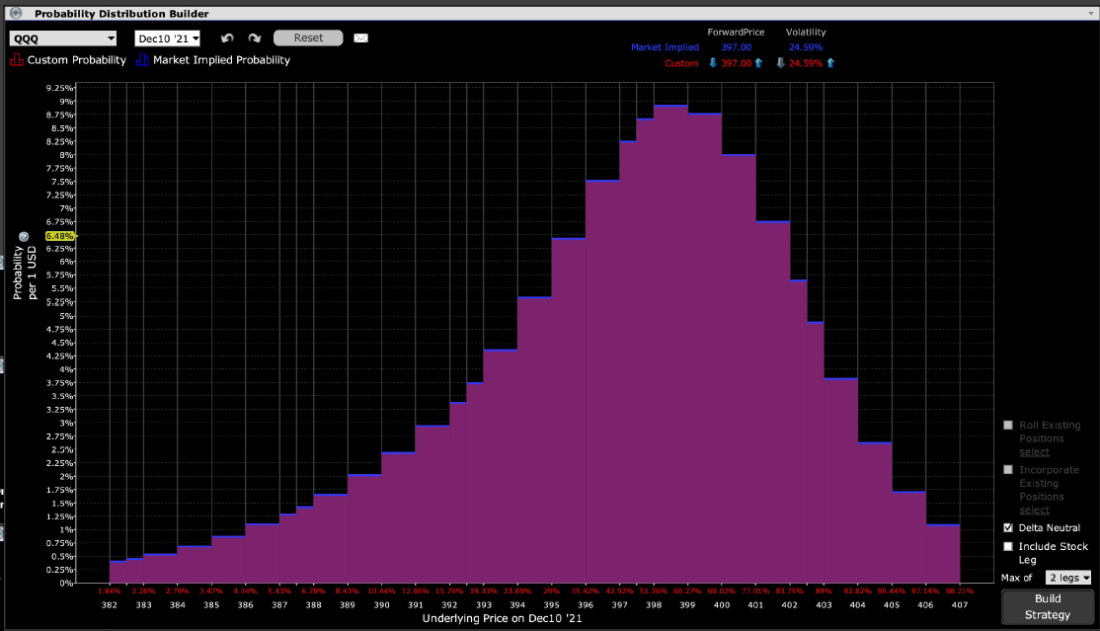

IB Probability Lab for QQQ December 10 options

Source: Interactive Brokers

We see that for both SPY, which is linked to the S&P 500 Index, and QQQ, which is linked to the NASDAQ 100 Index, options are pricing in slight rises as the most likely outcomes for tomorrow. QQQ has its peak at 399, which would largely recover today’s dip, while SPY has a more aggressive peak at 470. Remember that the weekly options that expire tomorrow afternoon are a relatively pure play on the CPI numbers since they only encompass trading that will occur this afternoon and tomorrow.

Nervous traders would be more aggressive at bidding up below market options, forcing those to have a higher probability than slightly above market options. That is not what we see in these charts. The cumulative probability of below market options is slightly lower for both key ETFs than it is for above market options.

This is a time when I tend to employ some contrarian thinking. Ahead of a major economic or earnings release it is important to know where the risk for an outlier number might be. Options in SPY and QQQ seem to be comfortable with the consensus estimates for CPI and showing us that a small rally is most likely if the statistics match expectations. It therefore tells us that the market is less prepared for an adverse result. Traders should decide for themselves whether they are comfortable with the consensus view and likely outcome, or whether some additional risk aversion is warranted.

—

[i] PCE -> Personal Consumption Expenditures

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.

Disclosure: Options Trading

Options involve risk and are not suitable for all investors. Multiple leg strategies, including spreads, will incur multiple commission charges. For more information read the "Characteristics and Risks of Standardized Options" also known as the options disclosure document (ODD) or visit ibkr.com/occ

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.