This afternoon brings the final slug of mega-cap tech earnings when Apple (AAPL) and Amazon (AMZN) report after the close. Together they represent about 10% of the S&P Index (SPX) and just under 20% of the NASDAQ 100 Index (NDX). We had a similarly significant afternoon on Tuesday, when Microsoft (MSFT) and Alphabet (GOOG, GOOGL) reported solid results after the close. Both stocks rose smartly, +4.21% and 4.95% respectively, allowing NDX to rise 0.25% on a day when SPX fell -0.51%. It appears that stock traders are expecting similarly positive results from AAPL and AMZN, as they rise 2.5% and 1.3% in anticipation.

Those rises may also be somewhat attributable to today’s GDP report. Stock traders appeared to view today’s report as a generally positive “Goldilocks” report. That is unsurprising, because equities appear to be in an “all news is good news” mode. Yet the full report shows a 12.2% annualized gain in intellectual property products. That could play an important role in explaining both the solid results from MSFT and GOOG, and today’s outperformance in AAPL and AMZN.

Ahead of Facebook’s (FB) earnings on Monday, we looked at options skew and the options market’s implied probabilities. The options market got it generally right, with an anticipation of a move of about 5% with a bias to the downside. FB fell -3.92% on Tuesday. That is why we see value in utilizing this methodology for AAPL and AMZN.

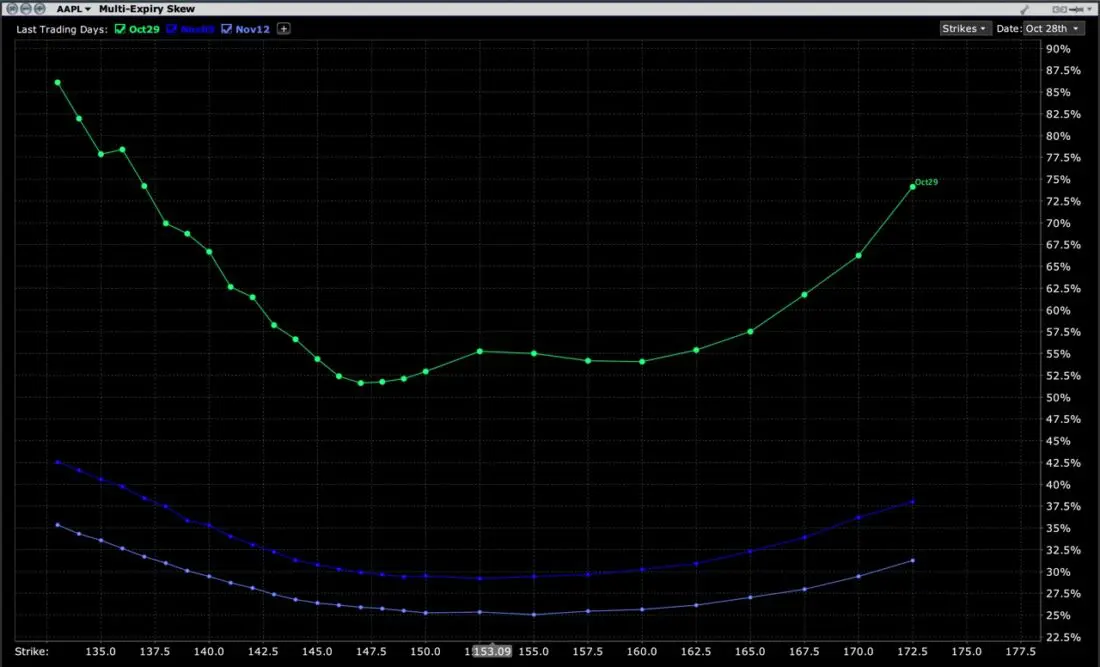

It is clear that options traders are thinking positively about AAPL, as evidenced in the chart below[i]:

Multi-Expiry Skew for AAPL With Sequential Three-Week Expirations

Source: Interactive Brokers

The skew is relatively symmetrical, especially in subsequent weeks, meaning that traders are generally not especially concerned with hedging downside risk. Interestingly, the lowest implied volatilities in the current weekly options are at the $147.5 level. Bloomberg data shows that AAPL’s average post-earnings move is 4.29%, and that AAPL traded lower after each of its last 4 releases. Traders are saying that the most likely historical outcome is the one they fear the least. The probability lab[ii] demonstrates a relatively sanguine view as well, with an at-money implied volatility of about 57% implying a roughly 3.5% daily move[iii] and with more area under the upside portion of the curve than the downside:

IBKR Probability Lab for AAPL Options Expiring October 29, 2021

Source: Interactive Brokers

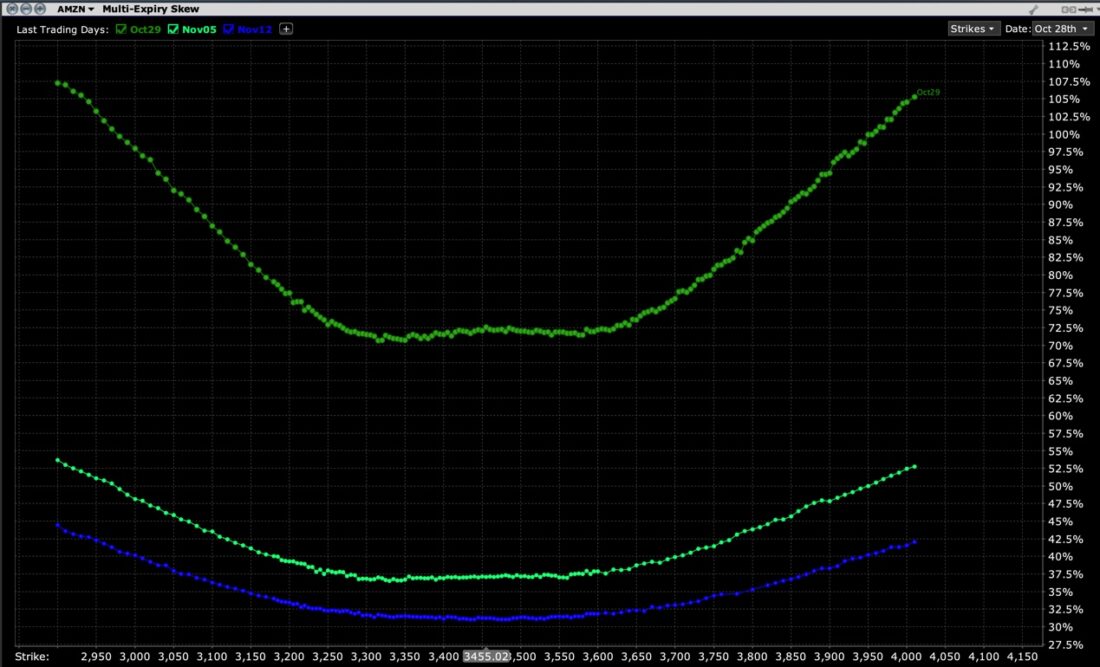

AMZN shows a similarly symmetrical skew, but with a much broader range of outcomes near the current price. The wider range is not surprising, considering that Bloomberg data shows an average post-earnings move of 6.4%, but the story here is that the market is almost completely agnostic about direction.

Multi-Expiry Skew for AMZN With Sequential Three-Week Expirations

Source: Interactive Brokers

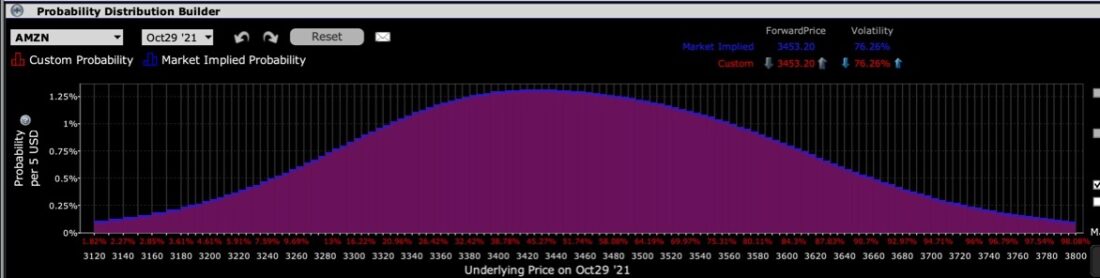

Bear in mind that like AAPL, AMZN stock moved lower after each of the past 4 earnings releases. That doesn’t appear to be a concern today. The probability lab also shows a quite sanguine view, with a remarkably symmetrical set of probabilities. The at-money implied volatility is 76, while high in an absolute sense, implies a daily move of about 4.75, which is below average.

IBKR Probability Lab for AMZN Options Expiring October 29, 2021

Source: Interactive Brokers

Bear in mind that while the options market can get it right, they can also get it wrong. But it did a good job with FB. We are being told right now that traders are relatively complacent about this afternoon’s AAPL and AMZN earnings. They are paying less for implied volatility than history would suggest is appropriate and believe that an upside surprise is about as likely as one to the downside. Remember that it is usually easier to surprise a sanguine market than a nervous one.

—

[i] On your TWS, Analytical Tools -> Options Analysis -> Multi-Expiry Skew, then set the desired expirations and strikes

[ii] On your TWS, Analytical Tools -> Options Analysis -> Probability Lab

[iii] We divide by 16 to convert annualized implied volatility into a daily number. More here: https://ibkrcampus.com/traders-insight/securities/options/understand-the-rule-of-16/

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.

Disclosure: Options Trading

Options involve risk and are not suitable for all investors. Multiple leg strategies, including spreads, will incur multiple commission charges. For more information read the "Characteristics and Risks of Standardized Options" also known as the options disclosure document (ODD) or visit ibkr.com/occ