Tomorrow morning, the Bureau of Labor Statistics (BLS) releases the Consumer Price Index (CPI) for the month of May. I refrain from using the phrase “eagerly awaited”, since I’m not sure who is eager about seeing an inflation report that is widely expected to be stubbornly high, but inflation has permeated all our psyches. If it’s bad news, we might as well hear it. And if it’s good news, well, we’d like to hear it.

According to Bloomberg data, CPI is expected to rise 8.2% on a year-over-year (YoY) basis and 0.7% on a month-over-month (MoM) basis. Those compare to 8.3% and 0.3% for April, respectively. The so-called “core” CPI, which exclude food and energy, are expected to rise 5.9% YoY and 0.5% MoM, versus 6.2% and 0.6% for April. We will also be looking for Real Average Hourly Earnings, which fell 2.6% on a YoY basis in April.

The real wage statistic goes a long way to explaining why so many people seem so miserable even amidst a tight labor market. The April statistics imply that nominal wages rose over 5% yet failed to keep up with inflation.

Bear in mind that while headline CPI is a very important statistic, since there are many payments that are pegged to changes in CPI, it is not the Federal Reserve’s preferred inflation metric. That honor goes to the PCE Core Deflator. That showed a rise of 4.9% in April, along with a headline rise of 6.3%. There are various reasons why CPI and PCE diverge, but it is quite possible that the FOMC is reflecting lower levels of inflation in their decision-making rubric than the public. It is also important to remember that even though economists prefer to remove volatile food and energy prices[i] in their calculus, most individuals don’t have that luxury. In fact, those are the prices that are creating much of the anxiety about inflation.

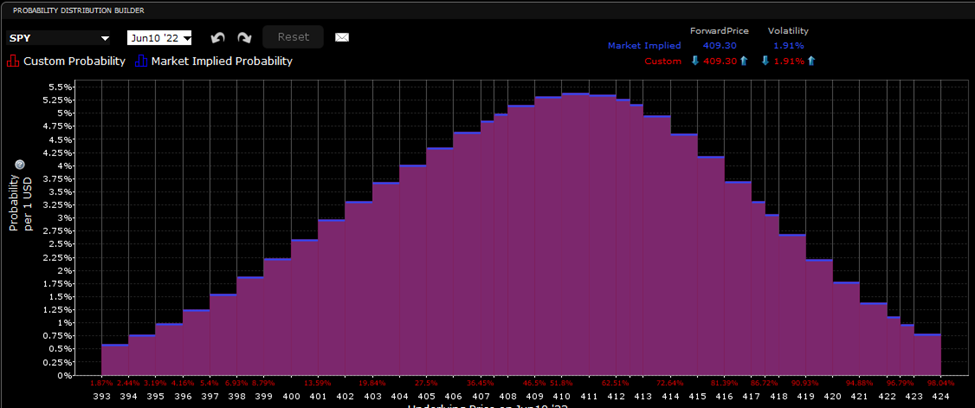

None of this is intended to make us dismissive about tomorrow’s CPI release. Inflation is simply too pervasive to ignore. We need to look at how traders are pricing in their expectations for the outcome, and for that we look to options expiring tomorrow (June 10, 2022) on the SPDR S&P 500 ETF (SPY). First, we will use the IBKR Probability Lab to check where the most likely outcomes are anticipated:

IBKR Probability Lab for June 10th SPY Options, as of June 9th

Source: Interactive Brokers

We see that the peak probabilities are close to the current price of 409.30 – in the 410-411 range. That is mildly bullish, but not overly so. We also see that the at-money implied probability is 1.91%. That seems high, but it is hardly out of character for the S&P 500 (SPX) to have a 2% intraday move in recent sessions (the most recent was on Tuesday).

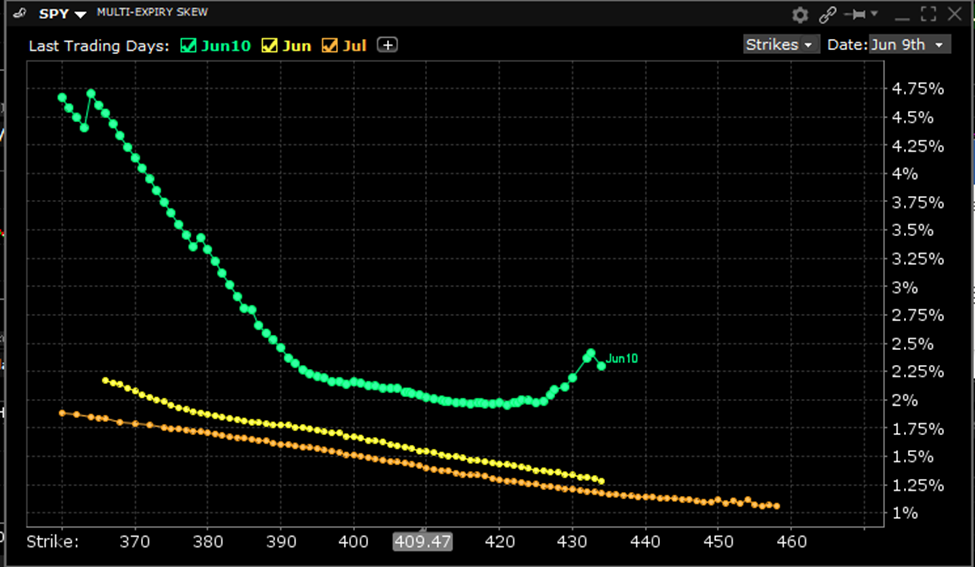

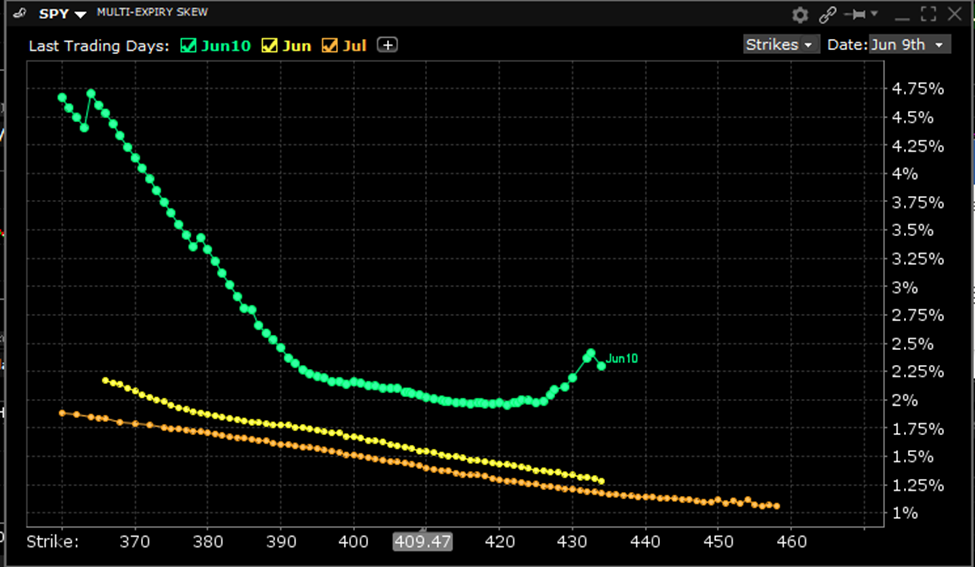

We also see that volatility skew is relatively flattish, at least around the money, as shown below. That implies only modest risk aversion:

Multi-Expiry Skew for SPY, June 10th expiry (green), June 17th (yellow), July 15th (orange)

Source: Interactive Brokers

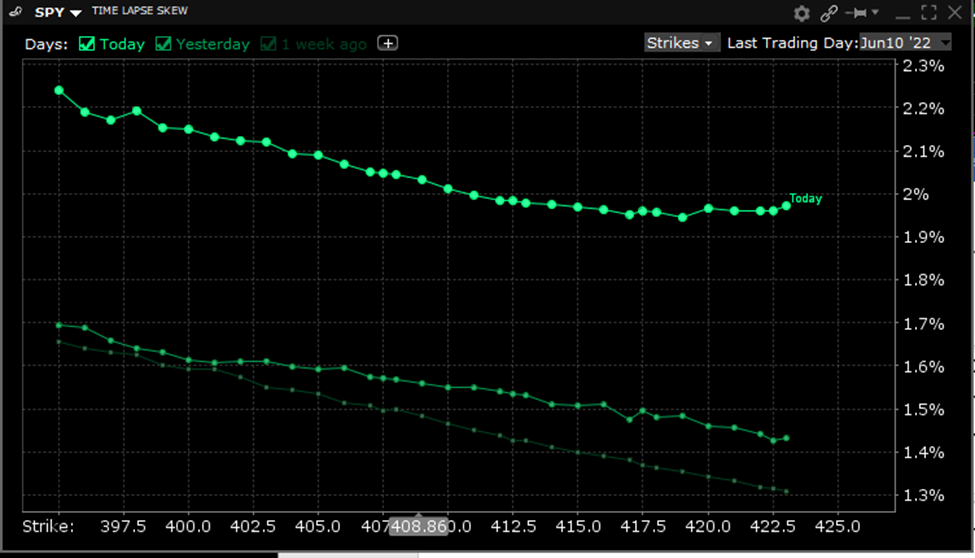

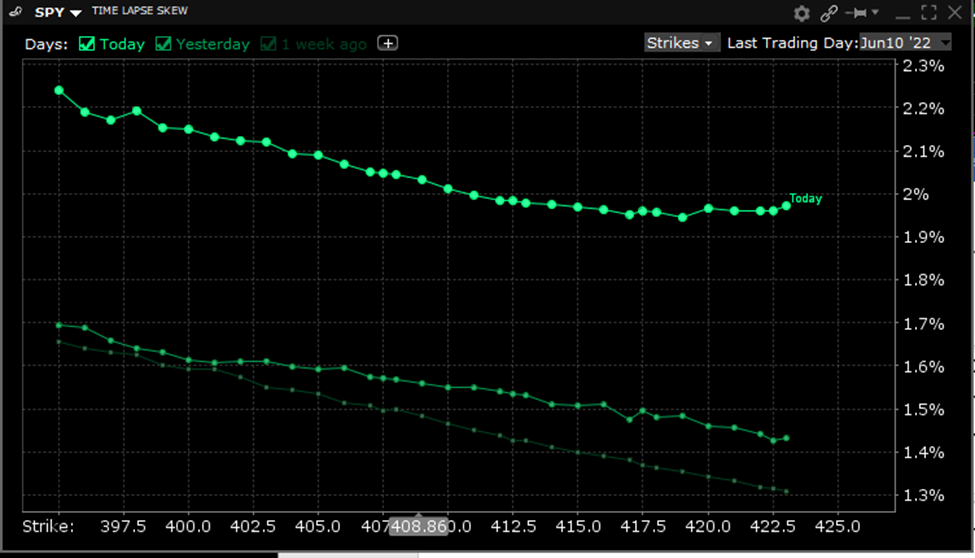

Finally, we see that skew has remained relatively constant, with the notable exception of a parallel move higher during today’s trading. That isn’t at all surprising, given today’s focus on tomorrow’s CPI:

Time Lapse Skew in SPY Options Expiring June 10th, 2022, as of June 9th, 8th, 1st (top to bottom)

Source: Interactive Brokers

Bottom line – if you’re paying any attention at all to financial media, tomorrow’s CPI report is a key source of concern and a key driver about perceptions regarding future Fed activity. The options market is less convinced. Traders are pricing in a bit of extra volatility for tomorrow, but not enough to imply that they are particularly worried. Interpret that relative complacency as you will.

—

[i] Yet another in a long series of reminders that volatility counts in both directions

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.

Disclosure: Probability Lab

The projections or other information generated by the Probability Lab tool regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results and are not guarantees of future results. Please note that results may vary with use of the tool over time.

Disclosure: Options Trading

Options involve risk and are not suitable for all investors. Multiple leg strategies, including spreads, will incur multiple commission charges. For more information read the "Characteristics and Risks of Standardized Options" also known as the options disclosure document (ODD) or visit ibkr.com/occ