Yesterday we noted that with major bank earnings largely behind us, we can now focus on the more important stages of the affair that is quarterly earnings season. We also noted that traders seemed a bit more charitable, willing to reward companies that beat their estimates and/or provide positive guidance and less inclined to harshly punish those that disappointed. We see that in this morning’s reaction to Netflix (NFLX), up about 3.5% after losing fewer subscribers than feared and offering tepid guidance. Considering mercilessly that stock had been punished after its prior two reports, this constitutes a solid win.

This afternoon we will turn to a stock that rose about 3% after its most recent report but fell about 11% in January. It is the sixth-largest US company by market capitalization but is the perpetually most active stock on the IBKR platform. We are speaking of course of Tesla (TSLA). Its Chairman, Elon Musk, has been ubiquitous in the media recently, but most of that is because of his bizarre pursuit of Twitter (TWTR) rather than the auto company that allowed him to ink a deal of that type. Today we refocus our attention on TSLA and the electric car business.

According to Bloomberg data, analyst consensus is for second quarter earnings per share of $1.83, a decline from last quarter’s $2.86. That beat analysts’ $2.27 consensus and beat by even more after the myriad adjustments to the company’s GAAP earnings. They also show an average post-earnings move of 7.33%.

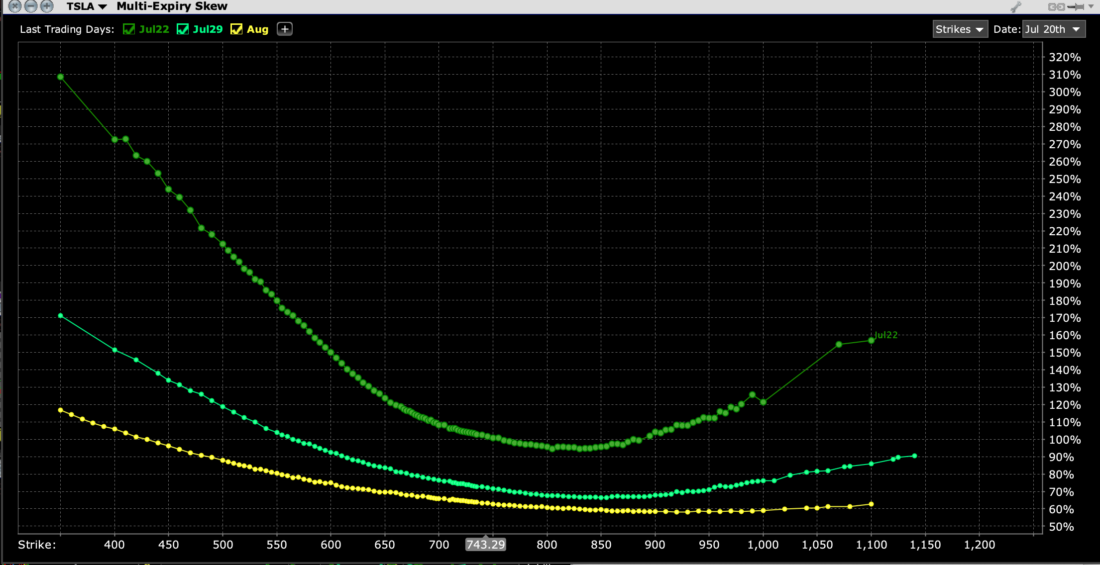

It appears that traders are not particularly fearful about a major move in TSLA over the coming two days and beyond. We see a steep skew in options expiring this Friday, which is not at all unexpected, but skew flattens out in options that expire next week and beyond. We also see at-money implied volatility of about 101. Using the “rule of 16”, that implies an average daily move of about 6.4% between now and Friday afternoon, which is well within the range that traders might expect.

TSLA Options Skew, July 22nd (top), July 29th (middle), August 19th (bottom) Expirations

Source: Interactive Brokers

In fact, I find it quite notable that the skew for the August monthly expiry is rather flat. This is the case for QQQ options as well. It appears that once earnings season has passed, traders are not finding it as necessary to hedge downside risks with out-of-the-money puts.

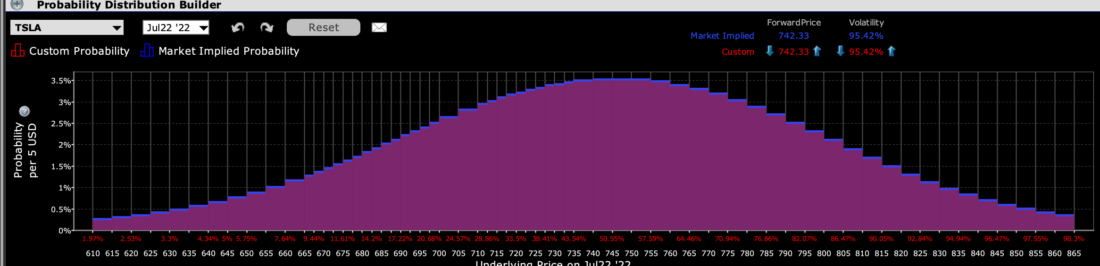

The IBKR Probability Lab also shows a relatively sanguine view. When TSLA was trading around $741 this morning, we saw peak probabilities in the $740-$750 range and a very symmetrical distribution without particularly fat tails. Again, this shows traders taking today’s earnings in relative stride.

IBKR Probability Lab for TSLA Options Expiring July 22nd

It is not apparent why options markets are displaying a relative lack of fear ahead of TSLA earnings. Perhaps the worst is already expected after a quarter punctuated by continuing Covid issues in China and a distracted CEO. Perhaps options traders have decided that market psychology has turned sufficiently so that it TSLA stock could pass relatively unscathed if there is an earnings or outlook shortfall. Or perhaps the TSLA faithful believe that the stock has been punished enough recently.

We’ll find out soon enough.

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.

Disclosure: Probability Lab

The projections or other information generated by the Probability Lab tool regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results and are not guarantees of future results. Please note that results may vary with use of the tool over time.

Disclosure: Options Trading

Options involve risk and are not suitable for all investors. Multiple leg strategies, including spreads, will incur multiple commission charges. For more information read the "Characteristics and Risks of Standardized Options" also known as the options disclosure document (ODD) or visit ibkr.com/occ