Use the Securities Lending Dashboard to analyze short sale metrics for these and other stocks.

In the latest part of our Orbisa analysis series, tracking the impact of the banking turmoil which began with SVB, we look at the continued impact on securities lending as of March 23.

Orbisa data continues to track the impact of volatility within the banking sector on the securities finance marketplace. Nearly two weeks after the collapse of SVB, we are closely monitoring both macro and security-level momentum.

From a high-level, cost-to-borrow has begun to stabilize relative to the more severe swings of last week. This could be an indication that the marketplace does not expect a significant contagion effect among a high number of institutions. However, both First Republic Bank and Credit Suisse experienced cost-to-borrow increases over the past two days as liquidity issues and the latter’s emergency buyout have continued to stoke investor concerns.

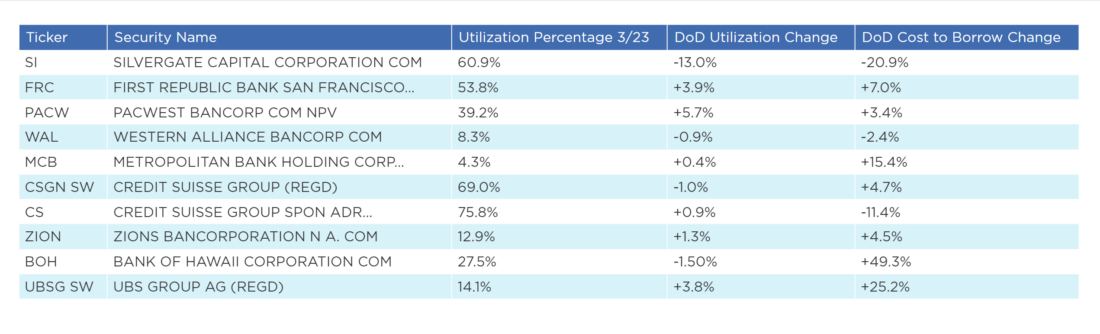

The following table highlights selected banking securities that have seen impact to the percentage of their shares that are out on loan and the relative cost to borrow those shares.

As the broader industry reacts to yesterday’s FED rate decision, Orbisa continues to monitor the impact on securities lending and provide up-to-date insights.

—

Originally Posted March 23, 2023 – SVB Financial (SIVB) and the Impact on Securities Lending Part 4

Disclosure: Orbisa

ORBISA (the “Firm”) is not registered as an investment advisor or otherwise in any capacity with any securities regulatory authority. The information contained, referenced or linked to herein is proprietary and exclusive to the Firm, does not constitute investment or trading advice, is provided for general information and discussion purposes only and may not be copied or redistributed without the Firm’s prior written consent. The Firm assumes no responsibility or liability for the unauthorized use of any information contained, referenced or linked to herein. © 2023 EquiLend Holdings LLC. All rights reserved.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Orbisa and is being posted with its permission. The views expressed in this material are solely those of the author and/or Orbisa and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.