Do you have these retail stocks on your August 2023 watchlist?

The retail industry is all about selling goods directly to people like you and me. It’s a big world that includes everything from small local shops to huge global chains. Think of places where you buy clothes, groceries, or electronics – that’s retail. Lately, this industry has been changing a lot, mainly because more people are shopping online and because our buying habits are evolving.

Thinking about investing in retail stocks? That’s like betting on people’s shopping habits. These stocks are parts of companies that sell directly to customers, whether in physical stores or online. When the economy is doing well and people feel secure in their jobs, they tend to spend more money. That’s usually good news for retail companies and the people who invest in their stocks.

But investing in retail isn’t a surefire win. It’s important to do your homework and be strategic, as this industry can be sensitive to changes in the economy and trends in consumer behavior. In other words, when times are tough, people might cut back on shopping, and that can hurt retail companies. So, investing in this sector can offer significant rewards, but it comes with its own set of risks, and it’s essential to stay informed and be prepared for ups and downs. Keeping this in mind, here are two retail stocks to watch in the stock market today.

Retail Stocks To Watch Right Now

Target Corporation (TGT Stock)

First up, Target Corporation (TGT) is one of the largest retail corporations in the United States. The company operates over 1,800 stores across the country. Additionally, Target is known for offering a wide variety of products, including clothing, electronics, groceries, and home goods.

Today, Tuesday, Target announced when it will webcast its second quarter 2023 earnings results. In detail, the company is set to report its Q2 2023 earnings on Wednesday, August 16, 2023. To briefly recap, back in May, Target reported a beat for its Q1 2023 earnings notching in earnings of $2.05 per share, on revenue of $25.32 billion.

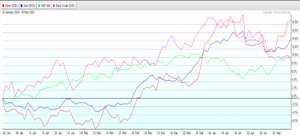

Though, year-to-date shares of TGT stock have fallen by 16.31% so far. Meanwhile, during Tuesday morning’s trading session, Target stock is trading lower off the open by 1.93% at $126.92 a share.

Source: TD Ameritrade TOS

The Home Depot (HD Stock)

Second, The Home Depot Inc. (HD) is the world’s largest home improvement retailer. Home Depot has more than 2,200 stores across the United States, Canada, and Mexico. The company offers a broad selection of building materials, home improvement products, lawn and garden products, and decor items.

Just this morning, Tuesday, Home Depot announced better-than-expected second-quarter 2023 earnings results. Diving in, the company reported earnings of $4.65 per share with revenue of $42.92 billion for Q2 2023. This was in comparison to analysts’ consensus estimates which were earnings of $4.46 per share and revenue estimates of $42.25 billion.

Moreover, in 2023 so far, shares of Home Depot stock have advanced by 5.11%. While, during Tuesday’s mid-morning trading session, HD stock is trading up on the day so far by 0.61% at $331.96 a share.

Source: TD Ameritrade TOS

—

Originally Posted August 15, 2023 – 2 Retail Stocks To Watch In The Stock Market Now

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from StockMarket.com and is being posted with its permission. The views expressed in this material are solely those of the author and/or StockMarket.com and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.