Old nicknames die hard. When I started in the business, voice trading was the norm. The stereotype of hoarse men (yes, almost exclusively men) shouting at each other was the only way that trades were executed.Though it proved an inefficient way to do business, it was colorful and fun – at least most of the time. One shorthand that traders used was to give nicknames to commonly traded stocks.

“I-Beam” for IBM was one example. Another was “Mister Softee” for Microsoft (MSFT). Those of you who live outside the New York area might not get the reference, though. Mister Softee is a popular brand of soft-serve ice cream trucks whose jingle burrows into one’s brain like a determined earworm. I apologize for a bit of nostalgia before launching into a very modern analysis of the options market’s expectations for this afternoon’s MSFT earnings release.

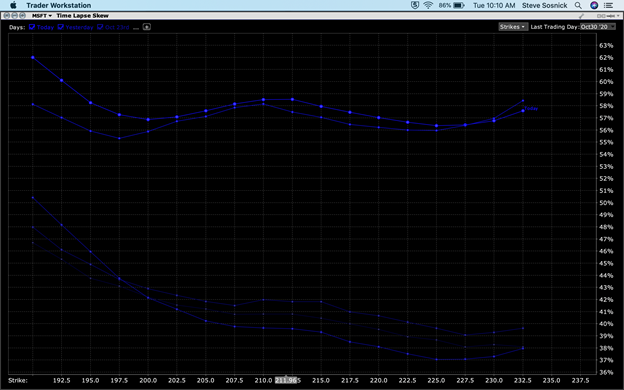

Heading into earnings, we don’t see the type of euphoria that the options market anticipated for stocks like Netflix (NFLX) and Tesla (TSLA). Options skews, as displayed in the TWS graph below (MSFT -> Time Lapse Skew with October 30th options displayed) are relatively normal. The only oddity appears to be the depression around the 200 level. The market appears to be relatively sanguine about the prospects for a 5% decline.

Source: Trader Workstation

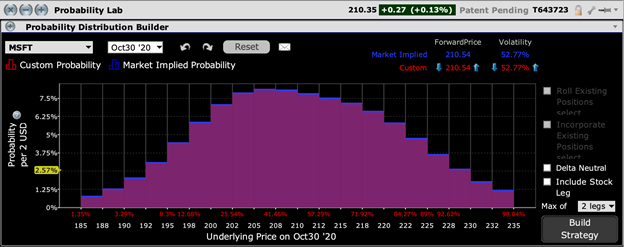

The Probability Lab shows something similar. The options market is implying its highest probability on outcomes in the 205-212 region, which is a slight decline from current levels. That is in line with much of what we have seen throughout earnings season thus far. Companies have generally been matching or beating their estimates, though most have declined slightly anyway. For years we have seen companies getting only moderately rewarded for beating their numbers and punished for missing. That phenomenon is in place this quarter, if not amplified

Source: Trader Workstation

According to Bloomberg Data, MSFT typically moves about 3.5% after its earnings release. The skew graph above shows an implied volatility of about 57, which converts to about 3.5% (using the rule of 16). That seems about right, no?

Despite the importance of MSFT to the tech sector and the markets as a whole, there is not much to be gleaned from the options market’s assessment of its earnings prospects. Quite frankly, it appears that a consensus view is priced in. We shall soon see what Mister Softee delivers this afternoon.

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.

Disclosure: Options Trading

Options involve risk and are not suitable for all investors. Multiple leg strategies, including spreads, will incur multiple commission charges. For more information read the "Characteristics and Risks of Standardized Options" also known as the options disclosure document (ODD) or visit ibkr.com/occ