The S&P 500 closed up 2.65% on Monday, reversing a 2%+ drop on Friday. That, too, reversed a prior move: a rise of more than 2% on Thursday. This brings the total to six daily moves bigger than 2% this month, compared with only two in September – and we are only halfway through the month. What’s going on?

The catalyst for the move was Bank of America’s surprisingly strong quarterly earnings report that beat expectations. It came right alongside the news of a complete U-turn of the UK Prime Minister Liz Truss’s tax plan, which had rattled markets. Remarkably, every one of the 11 S&P 500 sectors finished higher. In fact, nearly every stock in the index rose.

First, 2% days aren’t especially common: less than 7% of all trading days in the index extend beyond 2%. But streaks of three 2% days – Thursday, Friday, and then Monday – are even less common. In fact, according to the Bespoke Group blog there have been only 25 going back to the 1990s, and 11 of those extended to a fourth day.

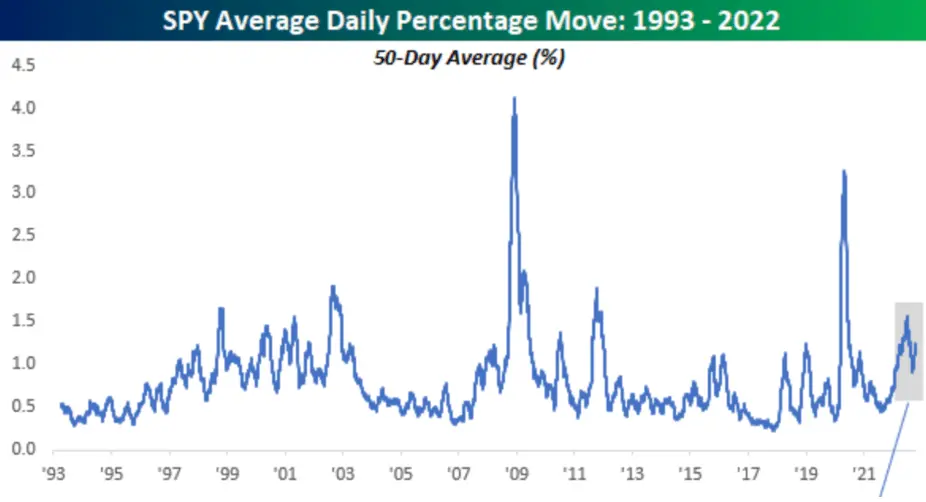

More to the point, the average daily moves have been rising in the past few months to levels that are reminiscent of some tough periods in history. But it’s also an inevitable part of the bottoming process.

Source: Bespoke Group

By this point in the bear market, many investors are out of the market entirely or – as the chart below shows – have hedged their longs with short positions in liquid instruments like SPX futures. In fact, speculative short positions in SPX futures reached a level not seen in over 10 years. This kind of setup creates a very fertile ground for powerful short squeezes on good news like we saw on Monday, only to reverse again when bears reassert themselves.

Ok, but is all this volatility good for the market outlook? Yes, but only marginally. Volatility of that magnitude usually appears closer to the low rather than the peak of a bear market.

For example, the intraday swing like the S&P 500 experienced on Thursday – it dropped almost 2.5% before finishing up over 2.5% – is exceedingly rare. There have only been nine other times since 1983 with the intra-day range that wide. According to Bespoke Group data, the S&P typically declined more over the next 3 months but rose an average of almost 15% in the 12 months after.

Buckle up.

Idea Spotlight: Netflix

Analyst revision indicators for NFLX:NASD are coming down and historically, this led to a median increase in price of 10.49% over the following 1M. TOGGLE analyzed 9 similar occasions in the past to produce the median projection.

Netflix is set to announce earnings post-market after launching a new ad-supported tier. Heres what you could expect:

—

Originally Posted October 18, 2022 – Are 2%+ swings in SPX bullish?

Disclosure: Toggle AI

IB Global Investments LLC, a subsidiary of Interactive Broker Group Inc., the parent company of Interactive Brokers LLC, is a minority owner of Toggle AI.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Toggle AI and is being posted with its permission. The views expressed in this material are solely those of the author and/or Toggle AI and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.