The MEGA “Caps” are Making Equities Great Again!!! The 10 largest companies have been making headlines of late, as they have driven more than 80% of the S&P’s year to date return. After a more than 1 year old bear market, this force of nature has elevated an index that, without them would be hovering near its 2023 starting point.

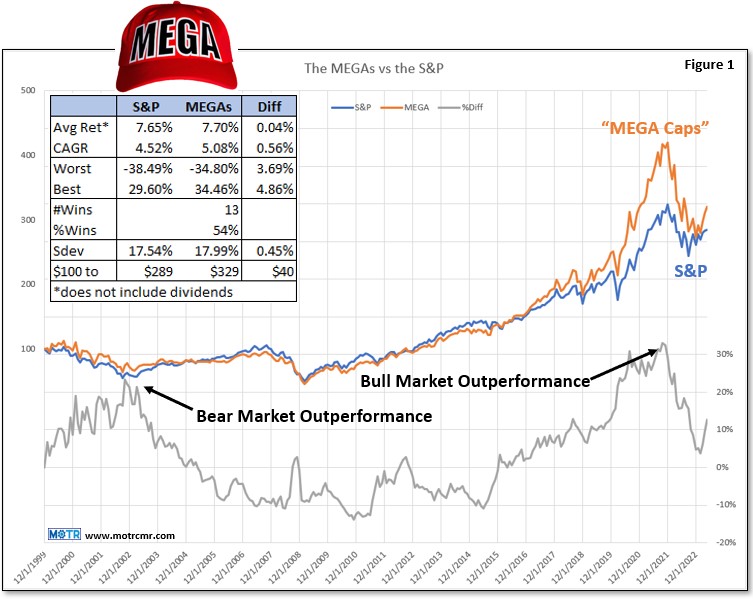

Just prior to blasting off in January, the MEGA “Caps” had just landed their rocket ship on “terra firma” after soaring into the stratosphere during the COVID bull market. Figure 1 shows the performance of a hypothetical portfolio that buys the 10 largest companies in the S&P since 2000, the peak of the last secular bull run.

In essence, the MEGA “Caps” have made no progress vs the S&P over this period (see table, inset). In fact, after their crash landing in 2022, the MEGA “Caps” were trading virtually inline with the S&P.

Intuitively, it makes sense that the “law of large numbers” eventually presents a performance challenge to the MEGA “Caps”. Once they have achieved a certain size, it becomes very difficult to continue to produce market leading gains.

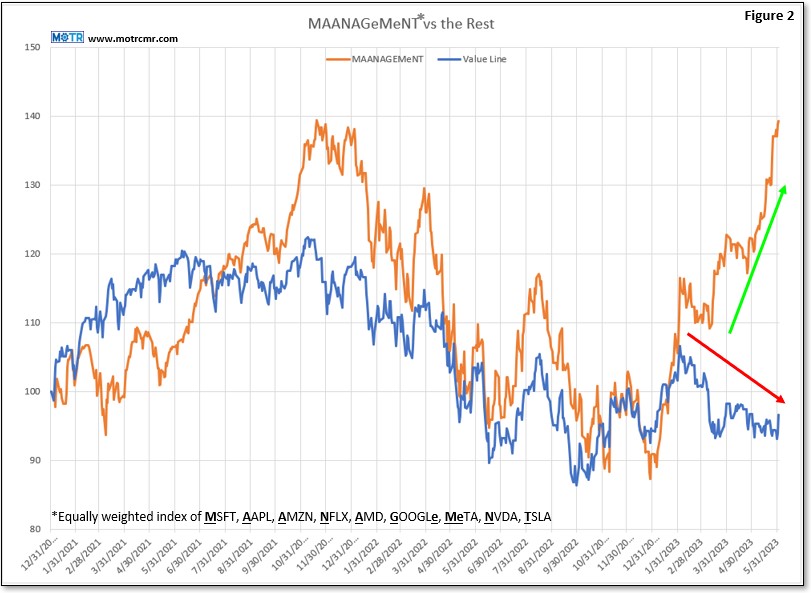

We have touched on this theme in recent notes, referring to our MAANAGeMeNT Index, which is an acronym for today’s top 10 MEGA “Caps”. Today’s breadth readings present a hopeful message that the lagging small caps may be set to finally join the party. While the MAANAGeMeNT Index was up a meager +0.37% today, the average stock in the 2500 stock MOTR Universe surged +2.99%.

As Figure 2 demonstrates, this unfortunately does not change the overall picture as of yet, since the Value Line Average (blue line) is still very much range-bound, even after today’s massive gain. Still, 90% of stocks advanced, and although we only saw just over 400 base breakouts today, over half of them were actual trend reversals, so that is a good indication of structural improvement at the margin.

We will have more to say about this in Monday’s Weekly MOTR Report (WMR), but for now, our strategy holds firm. We continue to build our long exposure in the top four leadership sectors (Technology, Industrials, Consumer Discretionary, and Health Care), while largely avoiding the rest.

Our short exposure is very low, but per last week’s CMI, if this surge in breadth does not result in sufficient trend change, we will increase our short exposure once again.

—

Originally Posted June 2, 2023 – Charting My Interruption (CMI): “MEGA ‘Caps’…Making Equities Great Again!!”

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.

Leave a Reply

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from MOTR Capital Management & Research and is being posted with its permission. The views expressed in this material are solely those of the author and/or MOTR Capital Management & Research and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

AMEN i shall keep my eyes peeled thanks for the reminder