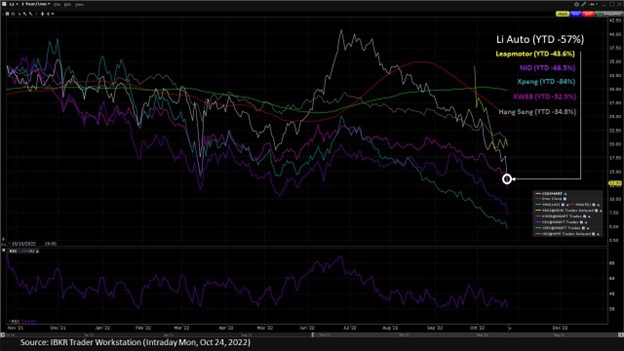

Shares of several Chinese electric vehicle producers have generally plummeted amid supply chain concerns, strict Covid policies. currency depreciation, and technology-driven, geopolitical uncertainties.

While sales in China’s EV manufacturing sector appear to benefit from increasing interest among shoppers, as well as government-supported tax-exemptions, a long list of catalysts has hampered the industry’s ability to produce on all cylinders, including recent U.S.-China tensions, strict Chinese Covid policies, as well as the strengthening U.S. dollar.

To date in 2022, companies such as Nio, Inc (NYSE: NIO), XPeng Motors (NYSE: XPEV), Li Auto (NASDAQ: LI), and battery behemoth BYD Co. (OTCMKTS: BYDDY), among others, have each lost significant share value.

Force Breaks

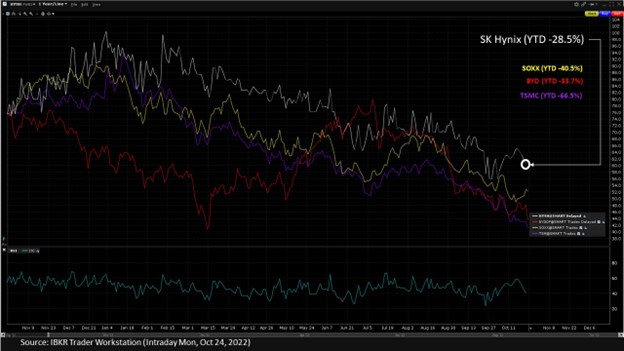

The plunge in these EV-sector companies’ stocks falls against a backdrop of increasingly aggressive U.S. policy aimed at slowing advancements in Chinese technological progress – notably in semiconductor manufacturing, which is critical to the industry’s ongoing production and innovation.

The activity has led to global ramifications, amid China’s dominant role in the industry.

“This is significant, considering China became the top global market for semiconductor sales in 2020 and some U.S. companies rely on the country’s firms for hundreds of millions of dollars in quarterly revenue,” wrote McAlinden Research Partners (MLP) in a recent note. “This crackdown will compound downward pressure on stocks already suffering from tumbling sales of PCs and smartphones.”

Global semiconductor sales totaled US$47.4 billion in August 2022, a meagre 0.1% year-on-year incline, and a fall of 3.4% compared to the prior month, according to the Semiconductor Industry Association (SIA).

Regionally, month-to-month sales increased in Europe (1.5%), but decreased in Japan (-1.4%), the Americas (-2.8%), Asia Pacific/All Other (-4.3%), and China (-4.9%). Year-to-year sales increased in Europe (14.9%), the Americas (11.5%), Japan (7.8%), but decreased in Asia Pacific/All Other (-2.9%) and China (-10.0%).

MLP added that semiconductor stocks have been “battered this year, as a massive bubble in industry valuations continues to be unwound by declining sales and geopolitical conflict between the US and China.”

Placing a Speed Trap

Meanwhile, chips play an integral role in the development of emerging technologies, such as artificial intelligence (AI), quantum computing, The Internet of Things (IoT), as well as virtual reality (VR) applications – and EVs.

Dezan Shira & Associates, a pan-Asia advisor to international investors, recently noted that while the longer-term geopolitical race concerns AI, “there are also impacts upon global industries, where the U.S. also wishes to become dominant, such as in electric vehicles.”

The advisory firm illustrated that analysts generally expect that the estimated one billion petrol vehicles driven globally will halve by 2030 – meaning that there is a growth market to provide potentially 500 million EVs between now and the end of the decade. “Washington wants its manufacturers to take the lion’s share of that – at least in the territories it has political sway over.”

Recent figures provided by Statista place China’s EV market revenues on track to reach US$160.4 billion in 2022 (41.8% of global revenue share), with sales expected to show a compound annual growth rate (CAGR) of 15.07% over a five-year period to 2027, resulting in a market volume of US$323.6 billion (37.2%, globally).

Bleak Road Ahead

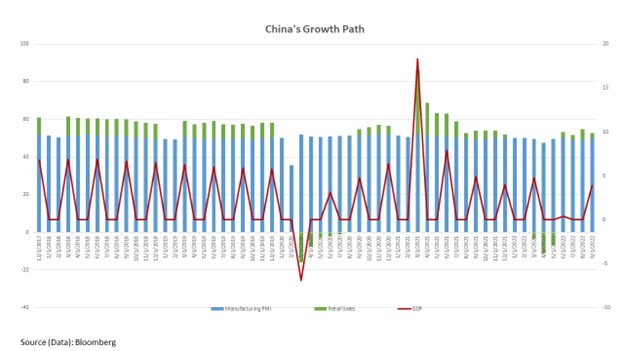

The journey to achieve Statista’s projected revenues will undoubtedly be fraught with a myriad of obstacles, as China’s manufacturing landscape has been beset by COVID-19-related disruptions, temporary closures, and logistics issues.

Dr. Wang Zhe, senior economist at Caixin Insight Group, recently said that “the pandemic situation is still severe and complex, and the negative impact of Covid controls on the economy is still pronounced.”

Zhe observed that in the manufacturing industry, both supply and demand contracted in September, “the job market was weak, logistics and transportation were slightly sluggish, cost of production and prices charged continued to decline, and purchases and inventories fell slightly.”

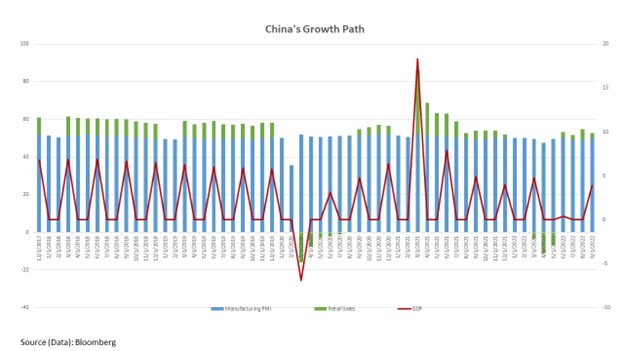

The Caixin China General Manufacturing PMI in September fell 1.4 points from the previous month to 48.1, marking the second consecutive month of contraction.

Overall, China registered 3.9% year-on-year economic growth for the third quarter, a material increase from 0.4% in the prior three-month period, but a far cry from the country’s 5.5% target. Year-to-date in 2022, China’s GDP resides at 3%.

Against this backdrop, automobile manufacturing surged by nearly 24% year-on-year in September, while the country produced more than twice the number of new energy vehicles compared with a year ago, but sales of autos, one of the largest retail sales categories by value, rose only 14.2% over the same period.

At the start of October, Chinese EV automaker Nio boasted delivery of more than 31.6k vehicles in the third quarter of 2022, a 29.3% rise year-over-year, while XPeng Motors’ deliveries amounted to around 29.6k, up 15%, and Li Auto counted 26.5k vehicles delivered, a 5.6% increase over the same period.

Stronger Steering Controls

Looking forward, it is likely the domestic policy picture in China will instill further uncertainties over the direction of the country’s economy and financial markets, after Chinese President Xi Jinping consolidated power and control with loyalists at the Communist Party congress.

IBKR’s chief strategist Steve Sosnick noted Monday that it became clear over the weekend that Xi was “cementing power even further, packing the Politburo with allies. This was interpreted by investors as a furtherance of China’s zero-Covid policies and a greater likelihood of government interference or control of private enterprise. The former is worrisome for the economy, the latter is worrisome for investors in Chinese companies.”

Indeed, the leadership shifts, along with recent US-China tensions, and the potential delisting of Chinese ADRs (American Depositary Receipts), have led to a massive downturn of related assets, including those of XPeng and Nio, as well as the KraneShares CSI China Internet ETF (NYSEARCA: KWEB), and many others.

According to Marc Chandler, chief market strategist at Bannockburn Global Forex, the direction China is moving is “more nationalistic, less interested in market reforms, and more strident in its desire to challenge the international order.” In fact, Chandler added that the end of the Chinese Congress has seen the yuan weaken to new lows.

To date in 2022, China’s renminbi has sunk around 12.5% to the U.S. dollar, the offshore yuan is down 13.2%, the South Korean won off 17.7%, the yen has plunged 22.8%, and India’s rupee has fallen around 10%.

The stronger dollar will also likely add to the woes of those chipmakers needing to import raw materials for their production needs – with reverberating impacts on EVs, globally.

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.

Disclosure: Alternative Investments

Alternative investments can be highly illiquid, are speculative and may not be suitable for all investors. Investing in Alternative investments is only intended for experienced and sophisticated investors who have a high risk tolerance. Investors should carefully review and consider potential risks before investing. Significant risks may include but are not limited to the loss of all or a portion of an investment due to leverage; lack of liquidity; volatility of returns; restrictions on transferring of interests in a fund; lower diversification; complex tax structures; reduced regulation and higher fees.

Disclosure: ETFs

Any discussion or mention of an ETF is not to be construed as recommendation, promotion or solicitation. All investors should review and consider associated investment risks, charges and expenses of the investment company or fund prior to investing. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.