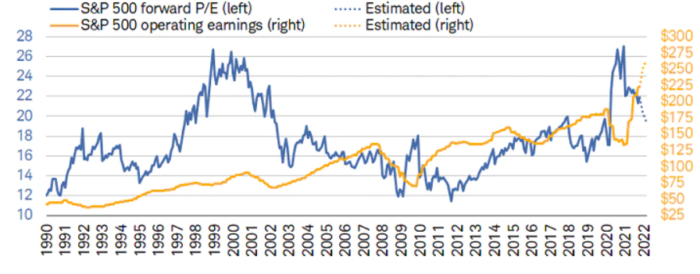

The market, by all intents and purposes, looks expensive based on most traditional valuation measures (the chart below courtesy of Liz Ann Sonders, Managing Director, Chief Investment Strategist, Charles Schwab) is one of my favorites since it a nice, clean visual of where we are from a valuation standpoint relative to history using multiple valuation stats.

Source: You’ve Got to Earn It: Earnings Growth Strong, But Descending

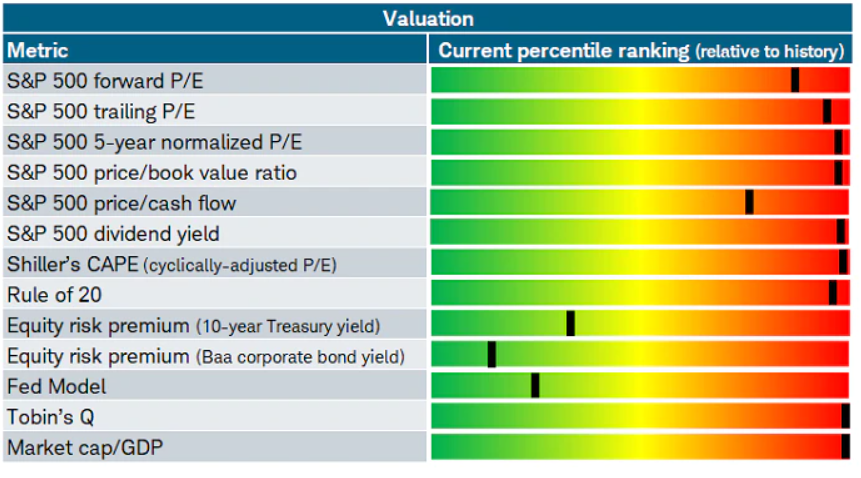

But there is another interesting valuation trend that might surprise you. If you look at the chart below, also from the Schwab piece, it shows the trajectory of the S&P 500 earnings and forward market P/E multiple. Because earnings are expected to continue to rise, the forward market P/E shows a decline. Unlike the 2000-2002 bear market, where valuations were high and earnings fell, the current market looks very different in that the market appears expensive but earnings continue to recover quickly (after falling off a cliff in early to mid-2020) and are reverting higher.

Both Wall Street and investors have underestimated how powerful the bounce back in profits would be over the last year and a half, and those low investor expectations combined with companies beating estimates (and by a lot) are one of the major reasons why stocks have performed so well. But at some point, the upward revisions to earnings start to become less frequent, and this is another point Sonders is making in this CNBC interview.

Earnings Revision Factor Dominating

Where it gets interesting from a stock selection perspective is that, as she highlights, investors want to be paying attention to those companies that are still revising earnings upward. As she points out, the “earnings revision factor” has been one of the best performing factor-based approaches this year and it organically combines both value and growth investing because if a firm is revising its earnings higher that means that the “E” (as in earnings) in the P/E Ratio is also growing higher, making the stock cheaper on a forward-looking basis (as the chart above showing the market’s forward falling P/E illustrates).

About a year ago I wrote a blog piece on Validea – A Systematic Earnings Revision Model To Help In Your Stock Picking Process – which highlighted the earnings revision model we run and track in our model portfolios. So far this year, it’s been one of the very top performing models we track, which is consistent with what Sonders points to as what has worked best this year.

4 Step Earnings Revisions Model

The model, which we based on the research paper, How to Profit From Revisions in Analysts’ Earnings Estimates, looks at few relatively straightforward revision data points.

- Stocks need to have sufficient analyst coverage on Wall Street so only those stocks with 4 or more analysts are considered for eligibility. This acts as the way to define the investable universe and screens out very small caps and microcap companies with very little analyst coverage to begin with.

- The screen favors companies where the current year EPS estimate today is greater than one month ago, which indicates recent revisions upward for current year earnings.

- It then applies the same measure to the next year and wants to see that next year’s earnings estimates have also been revised upward compared to one month ago.

- It then looks for more than one upward revision over the last 30 days for both the current and next year and that there are no downward revisions. This helps ensure that one estimate is not driving the passing of this criteria and that there is more herding of revised upward estimates by Wall Street.

Plenty Of Opportunity (For Now)

As of right now, there are at least 200-300 stocks that meet all of the criteria in the model we run at Validea. So, there is plenty of fertile ground to find opportunities. But as the recovery matures or as other factors come into play (i.e., inflation, supply chain issues, etc.) the pure amount of revision opportunities may be less and less over time. Therein also lies the opportunity. As less and less reversions happen, those firms that are seeing upward revisions may be rewarded and investors who find those companies or areas of the market in advance could also benefit. Despite the fact that positive revisions may be less frequent going forward, revisions could still be an interesting variable to consider in a stock selection process.

—

Originally Posted on November 24, 2021 – Factoring in Earnings Revisions

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Validea Capital Management and is being posted with its permission. The views expressed in this material are solely those of the author and/or Validea Capital Management and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.