The eurozone’s increasingly diversified sector mix warrants investor reappraisal.

After a decade of underperformance, eurozone equities are finally roaring back.

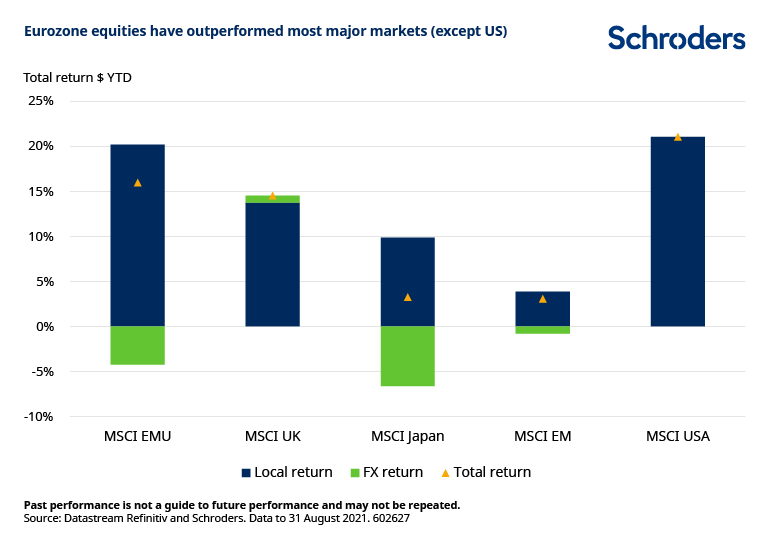

The MSCI EMU Index of stocks across the 10 developed markets in the Economic and Monetary Union is up 16.0% in dollar terms this year versus 9.7% for the MSCI All-Country World ex US Index.

In fact, in local currency terms, eurozone equities have even rallied as much as their US peers.

So why has investor sentiment turned so bullish on the region? Here are four emerging trends about eurozone equities that may surprise you.

1. Many “old economy” sectors are no longer in the return driving seat

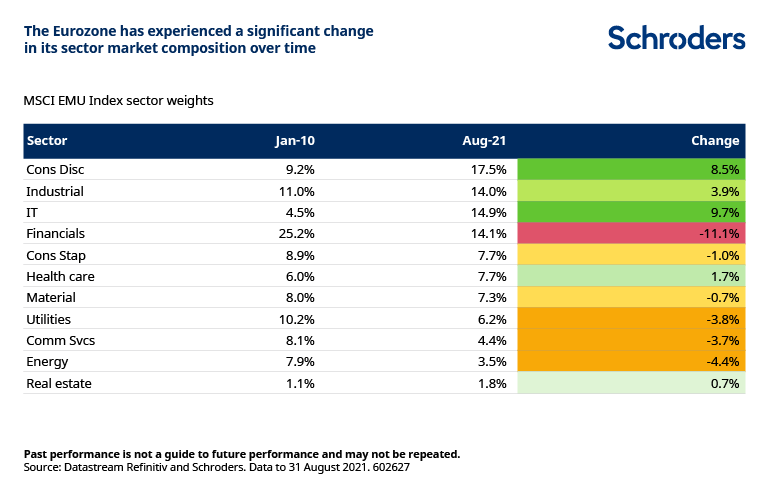

The eurozone is often perceived to offer high market exposure to “old economy” sectors such as financials and low exposure to growth-orientated sectors such as technology.

However, while this was once true, it no longer is. Over the past decade, the market cap weight of IT stocks in the eurozone has more than tripled from 4.5% to 14.3%. This has made IT the third largest sector in the region.

Meanwhile, financials have seen their weight collapse by 11.1%, down from 25.2% in 2010 to 14.1% today.

2. The eurozone has shifted from a value-bias to a growth-bias

One consequence of the eurozone’s changing sector mix is that growth stocks (i.e. those with above-average forecast profit growth) have become a more important source of returns.

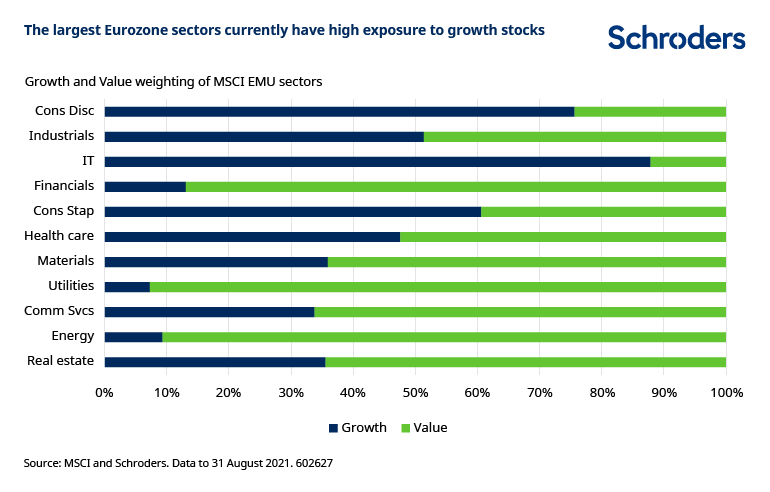

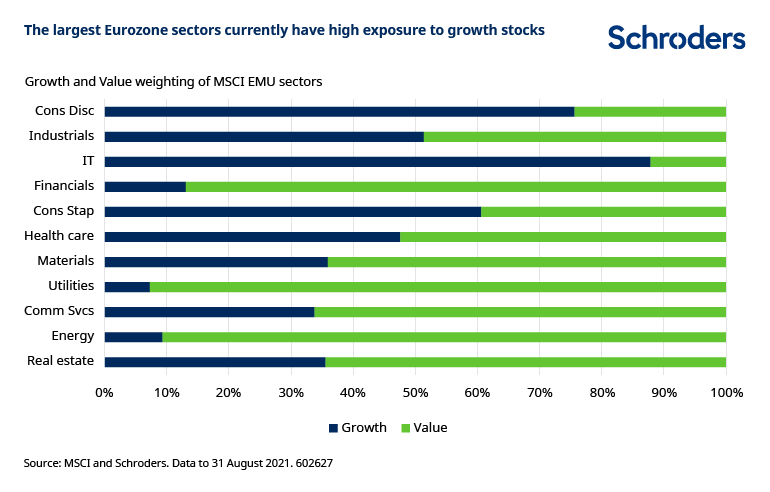

For example, 78% of consumer discretionary stocks (the largest sector in terms of market cap) are classified as having a growth tilt by the index provider MSCI. The IT sector also has a strong growth bias.

On the other hand, the sectors which have the least exposure to the growth style (financials, utilities, and energy) are also those which have shrunk most as a proportion of the market.

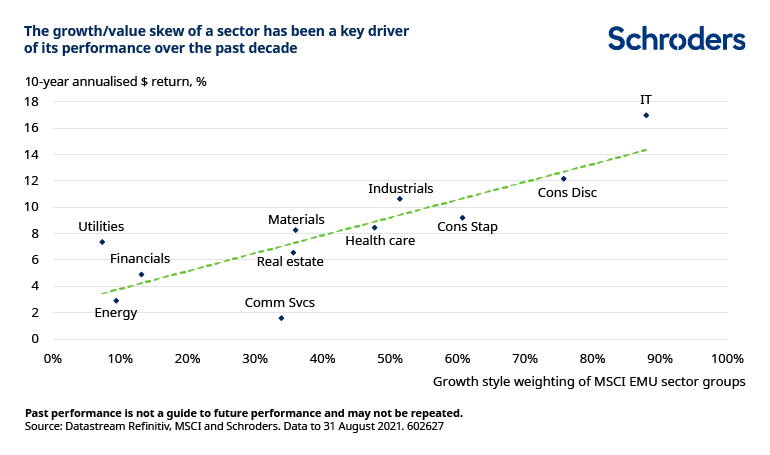

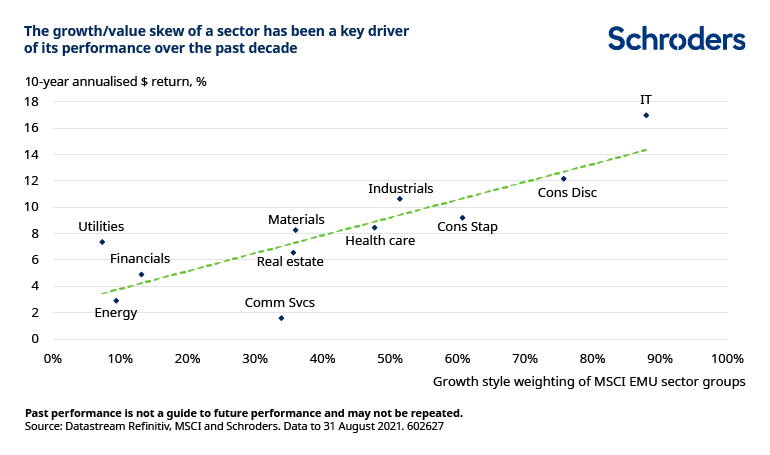

his shift matters because one of the key reasons for the eurozone’s underperformance over the past decade has been its low exposure to fast growing companies.

Indeed, the best performing sectors in the eurozone have had a growth skew, while the worst performing sectors have had more of a value skew. This is illustrated in the chart below.

European Equities fund manager Martin Skanberg said: “The eurozone’s profile has changed in recent years. The region is home to many innovative, fast-growing companies but investors’ perceptions have not necessarily kept up with that reality.

“There are numerous companies in the eurozone who are environmental leaders. Such firms will only see demand for their products and services increase due to the imperative of meeting climate goals. These aren’t just companies operating in power generation but also, for example, suppliers in the materials or industrials sectors who are helping to create more efficient, environmentally-friendly products.

“Then there are the technology leaders. Notable among these are semiconductor equipment firms who are well-placed to benefit as the world digitalises and chipmakers build out capacity while also seeking to re-shore supply chains.

“We can also point to the life sciences sector where Europe is a global leader; one example is the novel mRNA vaccine used not only for Covid vaccines but also enabling a new range of immunotherapies in the near future. Many of the building blocks and equipment are supplied by European firms.

“There is substantial fiscal stimulus still coming through in Europe in the wake of the pandemic, with a particular focus on the €750 billion Next Generation EU scheme. This is designed to build a greener, more digital and more resilient Europe. Companies whose products and services can make that a reality should continue to see robust demand.”

3. Analyst sentiment is turning more bullish

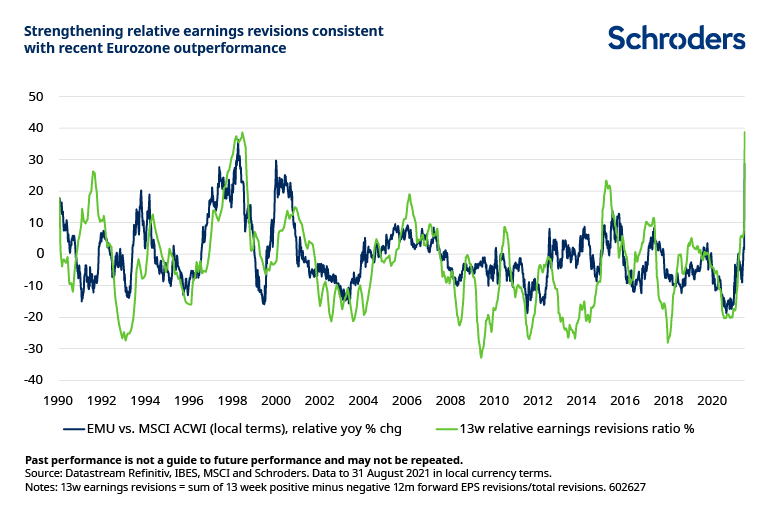

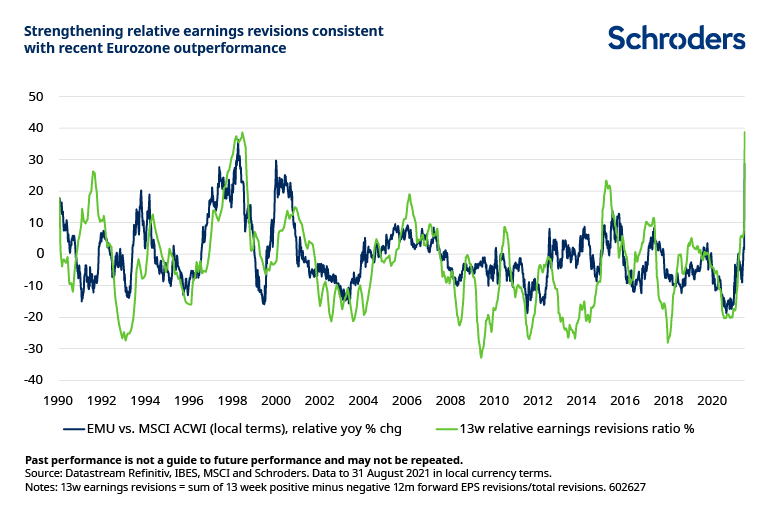

After a difficult 2020, the eurozone is experiencing a bounce-back in profit expectations. For instance, the 13-week earnings revision ratio (upgrades vs downgrades) has been rising faster in the eurozone compared to the rest of the world.

Historically, whenever analysts have become relatively more upbeat in their assessment of future expected earnings, eurozone equities have outperformed global equities, as shown in the next chart.

4. Eurozone valuations have re-rated

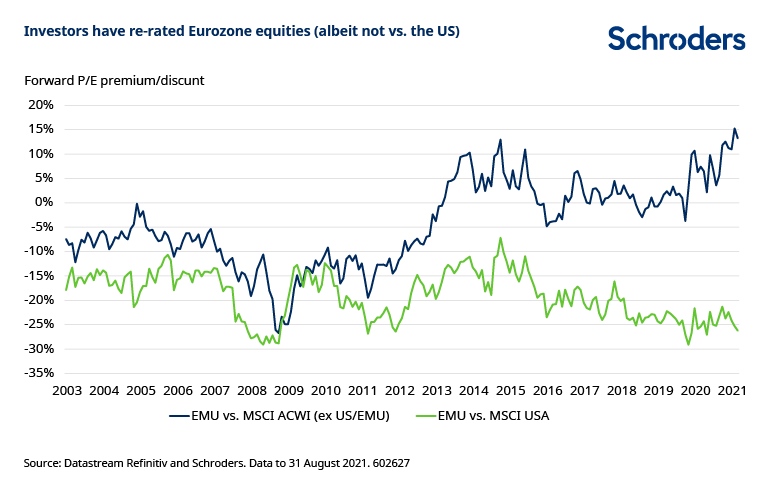

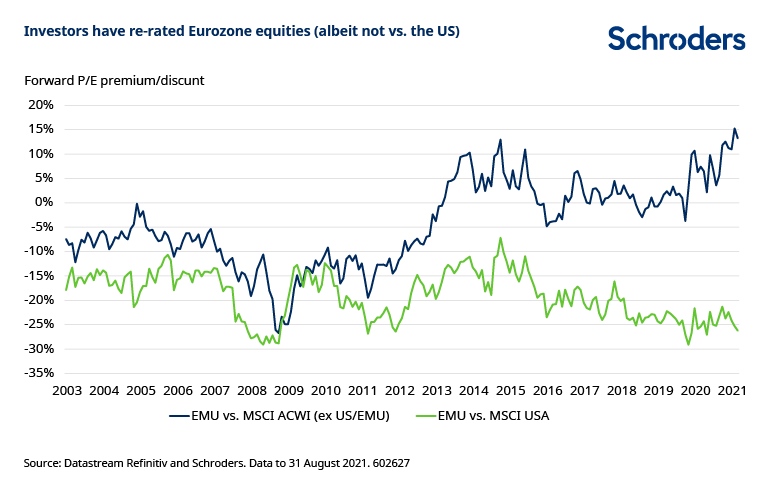

With profit forecasts being revised upwards and an improving sector composition, investors are slowly reappraising the investment case for the eurozone.

For example, on a forward P/E basis, the MSCI EMU Index now trades at a growing premium to other non-US markets (MSCI All-Country World ex US/EMU Index). This is a welcome change as better growth prospects should warrant a higher valuation.

Eurozone valuations have not narrowed against the US, which has a much larger IT sector (29% of the index) and growth style tilt.

However, when we look at analyst earnings expectations for 2022 and 2023, we find that the eurozone is forecast to grow at a similar rate to the US (9%~ p.a.), suggesting there may be room for valuations to still climb higher.

Martin Skanberg said: “It’s been a strong year so far for corporate profits. However, price pressures are now coming through on a number of fronts, including logistics/transport as well as from rising raw materials costs. Demand has been so buoyant that most sectors can simply pass on these rising costs but some areas are starting to feel the squeeze. Investors will need to be selective in picking those companies who have pricing power and can protect their profit margins.

“The end to deflation is real, and rising costs are becoming more endemic throughout the entire economy. Rising wage expectations will likely anchor higher inflation.

“Ultimately central banks will need to alter monetary policies with profound implication for asset allocation. A new set of winners will of course emerge, but the equity playbook of the last two decades may well need to be read in reverse.”

The eurozone deserves a second look

After years of underperformance, market sentiment towards the eurozone has finally turned a corner.

Sector composition is now much more diversified than in the past, exposure to growth-orientated sectors has risen and earnings momentum is currently stronger than the rest of the world.

Taken together, this suggests a brighter future for the region. With valuation momentum underway, investors would be wise to reconsider their scepticism towards the eurozone.

—

Originally Posted on October 12, 2021 – Four Trends in Eurozone Equities That May Surprise You

The views and opinions contained herein are those of Schroders’ investment teams and/or Economics Group, and do not necessarily represent Schroder Investment Management North America Inc.’s house views. These views are subject to change. This information is intended to be for information purposes only and it is not intended as promotional material in any respect.

Disclosure: Schroders

Important Information: This communication is marketing material. The views and opinions contained herein are those of the author(s) on this page, and may not necessarily represent views expressed or reflected in other Schroders communications, strategies or funds. This material is intended to be for information purposes only and is not intended as promotional material in any respect. The material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. It is not intended to provide and should not be relied on for accounting, legal or tax advice, or investment recommendations. Reliance should not be placed on the views and information in this document when taking individual investment and/or strategic decisions. Past performance is not a reliable indicator of future results. The value of an investment can go down as well as up and is not guaranteed. All investments involve risks including the risk of possible loss of principal. Information herein is believed to be reliable but Schroders does not warrant its completeness or accuracy. Some information quoted was obtained from external sources we consider to be reliable. No responsibility can be accepted for errors of fact obtained from third parties, and this data may change with market conditions. This does not exclude any duty or liability that Schroders has to its customers under any regulatory system. Regions/ sectors shown for illustrative purposes only and should not be viewed as a recommendation to buy/sell. The opinions in this material include some forecasted views. We believe we are basing our expectations and beliefs on reasonable assumptions within the bounds of what we currently know. However, there is no guarantee than any forecasts or opinions will be realized. These views and opinions may change. Schroder Investment Management North America Inc. is a SEC registered adviser and indirect wholly owned subsidiary of Schroders plc providing asset management products and services to clients in the US and Canada. Interactive Brokers and Schroders are not affiliated entities. Further information about Schroders can be found at www.schroders.com/us. Schroder Investment Management North America Inc. 7 Bryant Park, New York, NY, 10018-3706, (212) 641-3800.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Schroders and is being posted with its permission. The views expressed in this material are solely those of the author and/or Schroders and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.