ZINGER KEY POINTS

- Long-short equity funds are among the worst performers

- Short selling strategies became problematic in 2023 as markets rallied

More than $100 billion was withdrawn from hedge funds in 2023, following similar outflows in 2022 as investors tired of strategies that have been underperforming the market for several years.

What Happened:

Data, provided by Nasdaq eVestment showed that among the worst-performing strategies was the equity long-short fund — where hedge fund managers buy stocks they think will perform well and bet against stocks they believe are likely to fall.

Indeed, investors have pulled more than $150 billion from this type of fund over the past five years as they have underperformed the market in nine of the past 10 years.

The equity long-short fund has been around for decades and was generally successful during periods of broadly calm market conditions as so-called “star stock pickers” were able to capitalize strongly on market fluctuations by buying long and selling short.

When more turbulent conditions persist, it becomes much more difficult for stock pickers to predict. One of the chief problems for pickers last year, however, was the expectation that several mega-cap stocks had become so overvalued that they had become ripe for shorting.

Why It Matters:

Short selling is tougher to do nowadays. Market gains gathered pace and data from S3 Partners, published last month, showed that short sellers in the U.S. and Canada lost a total of $194.4 billion over the year.

According to S3 Partners, the three most shorted stocks during the last couple of months of 2023 were Apple Inc., Microsoft Corp. and Tesla Inc., whose shares had reached record levels during the fourth-quarter rally.

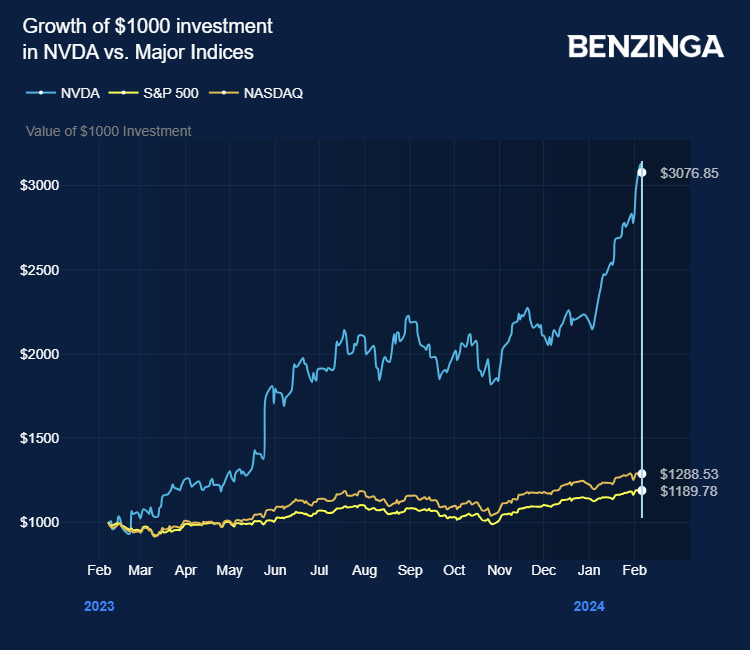

The most unprofitable shorts in 2023 were Tesla, with mark-to-market losses of $12.2 billion; Nvidia Corp. with losses of $11.2 billion; and Apple, with $7.3 billion of losses.

Morningstar data shows that global long-short equity funds made an average annual return of 1.98% in 2023, and only 4.18% over a three-year timescale. Investing during 2023 in a fund backing the S&P 500 index, would have netted investors a tidy 24.3%.

Among the star stock pickers, Terry Smith — who is not a long-short fund manager, but an equity value investor — performed shy of the market. His Fundsmith equity fund rose by 12.4% in 2023 after losing 13.8% in 2022.

Smith has also seen investors withdraw funds and has urged them to take a longer-term view of the market.

U.S. Treasury Funds

Among the poorest-performing strategies were funds linked to U.S. government bonds, whose yields saw some turbulence during the second half of 2023. USD Government Bond funds fell by an average 4% over the year.

By comparison, an ETF that holds Treasuries over a spread of maturities, climbed 1.5% over 2023.

What’s Next:

U.S. government bond fund strategies could be coming under threat from new rules introduced by the Securities and Exchange Commission (SEC) this week. The rule will require hedge funds and other traders that manage more than $50 million in assets to register as dealers with the SEC.

Managers say the new rules bring greater compliance risk and costs, as well as closer scrutiny of their activities. Many firms have lobbied against the ruling since it was first proposed last year.

—

Originally Posted February 7, 2024 – Hedge Fund Investors Pull $100B From Market As Stock Pickers Underperform

Disclosure: Benzinga

© 2022 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Benzinga and is being posted with its permission. The views expressed in this material are solely those of the author and/or Benzinga and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.