AMC Entertainment (NYSE: AMC) recently sold new high-yield notes at a deep discount, as the company grapples with market volatility, as well as a host of industry-specific headwinds.

Apart from the giant theater exhibitor facing a dire economic backdrop, riddled with rising inflation, uncertainties over the Federal Reserve’s interest rate hikes, and geopolitical jitters stemming from the ongoing Russia-Ukraine war, AMC also contends with a host of other headwinds, including increasing streaming video on demand (SVoD) competition, and shifting consumer behaviors.

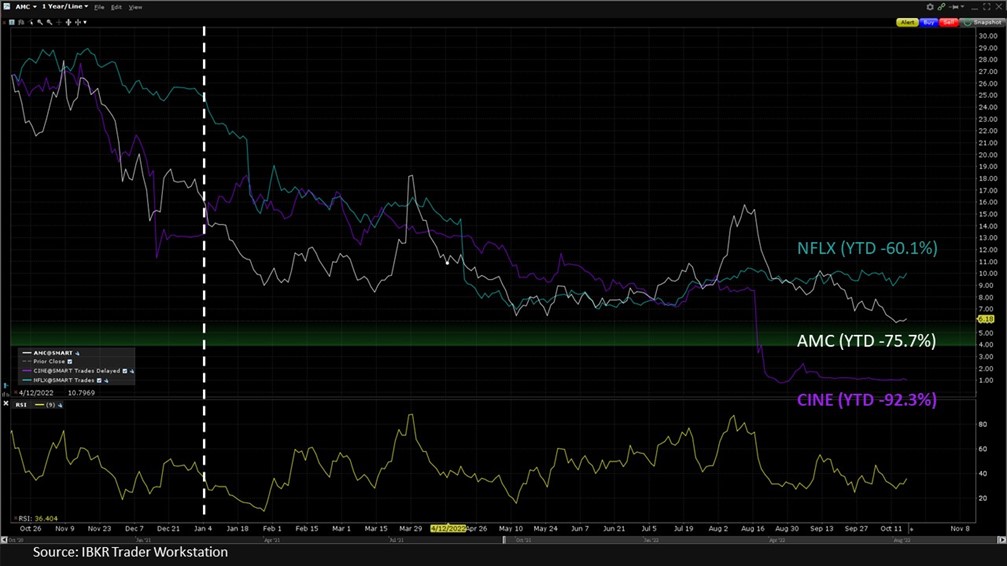

To date in 2022, AMC Entertainment’s stock has fallen roughly 75.7%, and certain of its bonds have cratered in value, such as its 7.5% notes due February 15, 2029, which last trading at around US$71.75, according to the IBKR Trader Workstation.

Couch-Surfing vs Balcony Sneaking

Entrenchment and proliferation of streaming platforms before, during, and after the COVID-induced lockdowns have primarily helped to reinforce the ongoing surge in in-home entertainment. Also, in response to the pandemic, HBO MAX had released online what were intended only as theatrical premieres – further stoking appetite for at-home viewing.

Writing for Statista, analyst José Gabriel Navarro cited a June 2020 study that revealed that just 14% of adults said that they “strongly preferred seeing a movie for the first time in a theater”, while 36% said that they “would much rather stream the film at home than visit a cinema”.

Navarro added that preferences for watching a new release in a cinema instead of via a streaming service in the U.S. “changed significantly between 2018 and 2020, signaling a shift in consumer behavior and potentially a risk for movie theaters in the country”.

The survey appears prescient given the projected revenues for SVoD compared to box office draw.

According to Statista, SVoD sales are likely to reach US$34.1 billion in 2022 and grow at a compound annual growth rate (CAGR) of 9.9% to US$54.66 billion by 2027. The figures dwarf those of the “cinema tickets” segment, which is projected to reach US$3.27 billion in 2022, with a CAGR of 2.57% to US$3.71 billion by 2027.

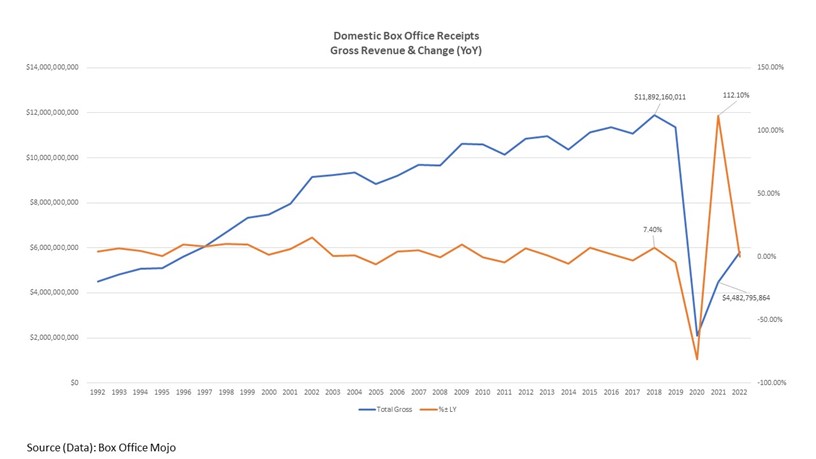

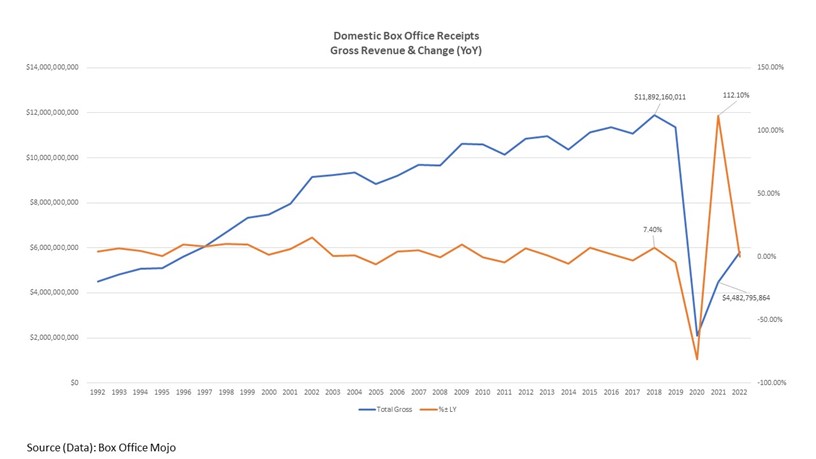

The dismal growth outlook for theater ticket sales appears to fall in line with the recent trajectory of gross domestic box office revenues.

Indeed, over the past 30 years, box office receipts had hit a peak in 2018 with a gross total of nearly US$12 billion – a year-over-year uptick of 7.4% — while 2021, the last full-year, post-COVID lockdowns, saw just under US$4.5 billion – despite a 112% rise over 2020.

Playing Both Sides of the Aisle

The lackluster performance of theatrical releases has prompted some investors to question AMC’s CEO Adam Aron about his outlook on the company when faced with the threat from streaming services.

Aron has generally responded optimistically and enthusiastically about the moviegoing experience, citing the success of theatrical releases such as Top Gun: Maverick and Spider-Man: No Way Home. Moreover, he said on the firm’s second-quarter 2022 earnings call that Hollywood has realized “how much money can be made by releasing movies in theaters exclusively first” and pointed out that “it’s kind of well-known that the share price of some major streaming companies” have started to take a hit and have started to lose subscribers.

Aron may have been taking a shot at Netflix (NASDAQ: NFLX), which has seen its stock plunge more than 60% year-to-date in 2022, as the company navigates intensifying streaming video on demand (SVoD) competition, subscriber loss, and likely consumer cutbacks.

As “Wall Street is turning away from streaming,” Aron continued, “Hollywood is coming back to theatrical exhibition.” AMC now has agreements in place with every major studio “to take their movies that are released in our theaters on a theatrical basis exclusively for a sufficient period of time where we believe the studio and AMC can make money,” he added.

Although Aron warned that the third-quarter would lack a lot of new big movie titles, he’s very upbeat on the fourth quarter, when the likes of Halloween Ends, and sequels to Black Panther, Shazam, and Avatar are due out in theaters.

Still, AMC appears to be hedging its bets, as the world’s largest theater exhibitor recently partnered with Uber Eats (NYSE: UBER) to deliver certain of its concession stand items to its customers’ homes, including ‘AMC Theaters Perfectly Popcorn, pretzel bites, and more’.

Final Curtain?

The faltering resurgence of moviegoing further took a toll on London, England-based Cineworld Group (OTCMKTS: CNWGQ; LON: CINE) – the world’s second largest cinema chain – which saw certain of its subsidiaries file on September 7 for protection under Chapter 11 of the U.S. Bankruptcy Code.

Moody’s senior analyst Fiona Knox noted that Cineworld has “an unsustainable capital structure following the significant deterioration in the company’s operating and financial performance driven by the prolonged shutdown of its movie theatres in the wake of the coronavirus pandemic, despite efforts to restructure its cost base and raise additional financing during the pandemic.”

Cineworld said it had reviewed and revised down its short and medium‐term cinema admission outlooks, “prompted by the slower‐than‐expected recovery being experienced in 2022 combined with external forecasts indicating a lower volume of theatrical releases in 2023 and 2024.”

Unsurprisingly, other companies in the theater exhibition industry’s ecosystem have also been subjected to dimmed financial prospects by the downturn.

Among other recent actions, Moody’s, for example, lowered its outlook on in-theater, on-screen advertiser Screenvision to ‘negative’ from ‘stable’, while affirming its junk-status, ‘Caa1’ credit rating, on the back of its “weak liquidity and operating performance as ad spending continues to lag cinema attendance.”

While Screenvision has a relationship with AMC Entertainment, it is not directly exposed to Regal theaters, whose owner, Crown UK HoldCo Ltd, filed for Chapter 11.

Cineworld Group Plc is the parent company of Crown UK HoldCo Ltd.

Moody’s also cut its credit rating and outlook on National CineMedia (NASDAQ: NCMI), another triple-‘C’ rated cinema advertiser, to ‘Caa3’ negative from ‘Caa1’ stable, due in large part to the bankruptcy of Crown UK HoldCo Ltd, along with weak liquidity, a high likelihood of a covenant breach as soon as March 2023, as well as refinancing risk, a difficult macro environment, and weak advertising demand.

Shares of National CineMedia have plummeted nearly 82% to date in 2022 and were last trading at just US$0.57.

Learn More from Across the IBKR Campus:

AMC’s New Note Sale Sends Buyers to Concession Stand

AMC CEO Wants Movies From Netflix, Apple And Other Streamers In His Theaters

IBKR Podcasts: Ep 20. Inflation, Rates & Recession – What’s the Worst that Could Happen?

Introduction to U.S. Corporate Bonds

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.