The Kroger Company (NYSE: KR) unveiled a mega-supermarket tie-up Friday with Boise-based Albertsons (NYSE: ACI) worth around US$24.6 billion, as consumers continue to experience sticker shock on the shelves.

Among the terms of the agreement, Kroger said it will pay an estimated US$34.10 per share of all outstanding Albertsons’ stock – a premium of about 32.8% – while assuming about US$4.7 billion of its net debt. For its part, Albertsons – responsible for banners such as Shaw’s, Acme, Star Market, and Balducci’s Food Lovers Market – will issue a special US$4.0 billion dividend to its shareholders prior to the transaction’s close.

The two firms also expect to divest stores in a bid to help facilitate regulatory clearance. Their aim would be to spin-off an Albertsons Cos. subsidiary (“SpinCo”) – comprised of anywhere between 100 and 375 stores – which would operate as a standalone public company to be completed prior to the merger closing.

Both Albertson’s US$4.0 billion dividend and the value of the SpinCo would ultimately reduce Kroger’s final purchase price, which it expects to finance with cash-on-hand, as well as proceeds from new debt financing.

Rating Outlook Dims

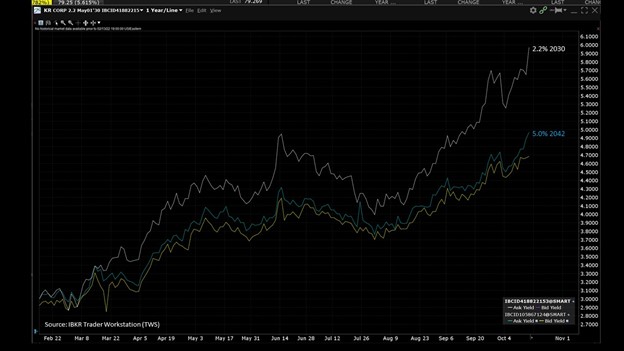

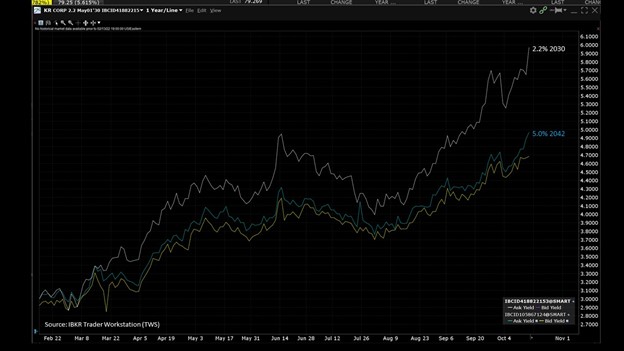

The expected rise in Kroger’s debt burden from the deal prompted Moody’s Investors Service to change its outlook on the firm to ‘negative’ from ‘stable’, while affirming its ‘Baa1’ investment-grade credit rating.

Moody’s analyst Chedly Louis noted that Kroger’s acquisition of Albertson’s “will result in meaningfully higher debt levels which will result in a long term negative impact to credit metrics, particularly interest coverage.”

The ratings agency’s negative outlook considers that the deal will be the largest in Kroger’s history and that “integration and execution risks will be very high”. Louis added that “strong free cash flow is key to the company’s deleveraging goals and the potential for operational shortfalls will remain elevated given the size and complexity of the transaction.”

Kroger said it expects to continue to have a “solid balance sheet” supported by “strong free cash flow” from the combined business. The company has further engaged with rating agencies and noted that it is “strongly committed” to an investment-grade credit rating.

The Cincinnati-based company has already paused its share repurchase program to prioritize de-leveraging following the merger to achieve its net leverage target of 2.5x EBITDA in the first 18–24 months post-close.

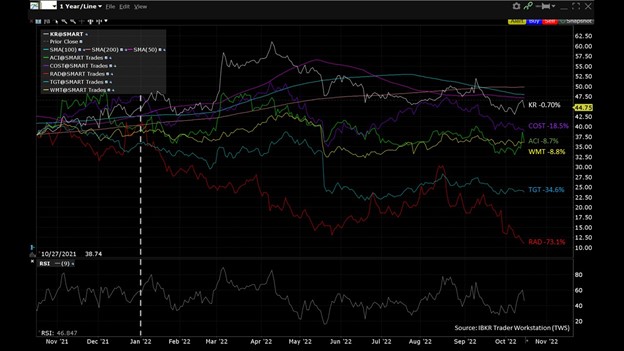

Kroger’s stock had fallen around 5% in intraday trading ahead of the weekend to around US$44.25 per share, while Albertsons’ stock plunged more than 7% to about US$26.61. Market participants observed that rumors of the tie-up had pushed the target company’s shares down Thursday by as much as 14%.

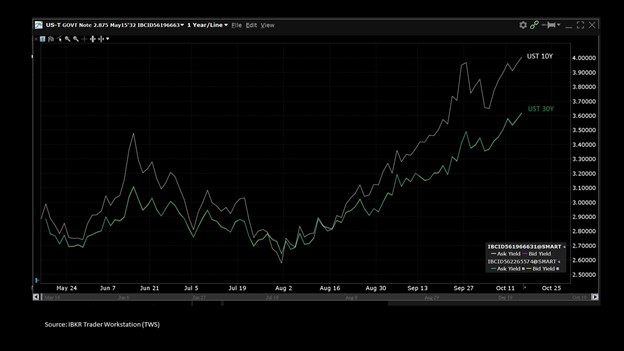

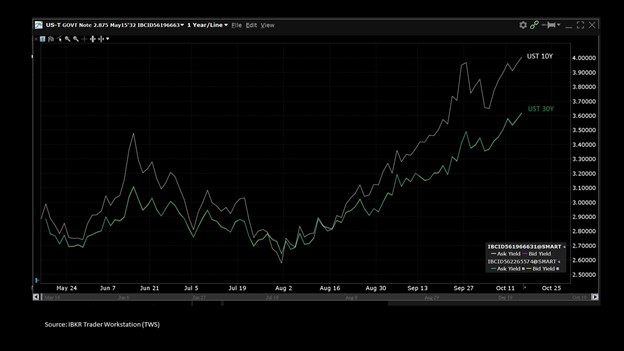

Some of Kroger’s bonds have also witnessed deterioration, amid the Federal Reserve’s recent hefty interest rate hikes and ongoing tightening of monetary policy to combat stubbornly high levels of inflation.

The Rising Cost of Food at Home

In fact, Kroger noted that its purchase of Albertons comes at a time “when people are increasingly shopping for groceries and eating at home”, and the combined company “will be better positioned to relieve the inflationary pressures facing shoppers.”

Indeed, in the latest Consumer Price Index figures for September, the U.S. Bureau of Labor Statistics unveiled still-staggering numbers for the “food at home” category.

The food at home index rose 13.0% over the last 12 months, with the index for cereals and bakery products up 16.2% over the year, and the index for dairy and related products up 15.9%.

The remaining major grocery store food groups posted increases ranging from 9.0% (meats, poultry, fish, and eggs) to 15.7% (other food at home).

Gimme Credit analyst Carol Levenson recently noted that Kroger “benefits from a move towards eating at home since the global pandemic hit. Inflation is manageable.” She added that the merger with Albertsons presents Kroger with an increase in scale and geographic reach, which “would be a plus for Kroger’s business risk.

“In short, we can easily envision a way this could be done without material harm to Kroger’s credit profile, and we rely upon management’s financial conservatism to exert financial discipline on such a transaction.”

Following the close of the deal, which is expected in early 2024, Rodney McMullen will continue to serve as Chairman and Chief Executive Officer, and Gary Millerchip will continue to serve as Chief Financial Officer of the combined company.

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.