Luxury goods sales just went from dip to rip.

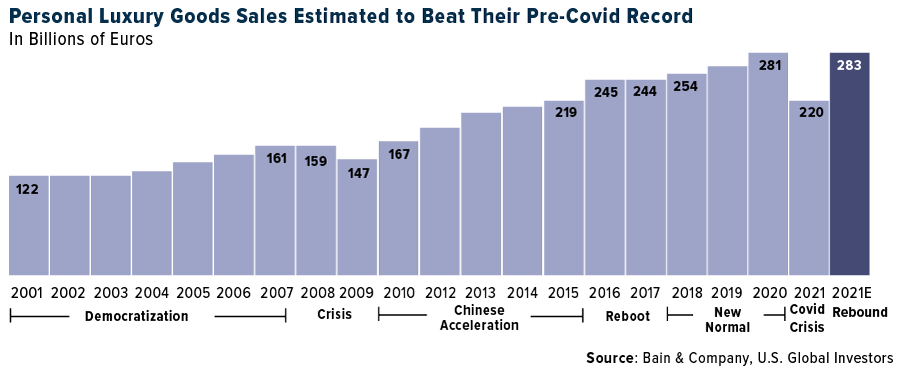

After plunging due to the global health crisis, the personal luxury goods market returned to pre-pandemic growth in 2021, with sales estimated to top 283 billion euros ($325 billion) by year-end, according to a new report by Bain & Company. That would represent a slight increase from then-record sales of 281 billion euros ($318 billion) in 2019.

Bain analysts note that these figures include only high-end merchandise, from leather handbags to jewelry to fragrances. Luxury “experiences,” such as travel and dining, still lag 2019 levels due to the ongoing pandemic.

Young Consumers In The U.S. And China Powering Growth

The V-shaped recovery was largely powered by the U.S. and China, with U.S. consumers outspending their Chinese counterparts by 1.5 times, the report says.

That’s despite the fact that the luxury market in China has nearly doubled since 2019. Consumers there are so hungry for luxury brands that Louis Vuitton is reportedly considering opening its first duty-free store in China, on the island-province of Hainan, which has rapidly become a luxury shopping destination for Chinese tourists unable to travel overseas due to pandemic restrictions.

Louis Vuitton, or LV, is the largest brand in the giant stable of luxury goods companies owned by LVMH Moët Hennessy Louis Vuitton. The Paris-based conglomerate reported record revenue of 44.2 billion euros ($51 billion) in the nine months ended September 30, an 11% increase from the same period in 2019.

Looking at demographics, the biggest contributors to the global sales recovery in 2021 were millennials and Gen Z, the oldest of whom are 40, according to Bain. These two cohorts are expected to make up 70% of all spending on luxury items by 2025.

Betting On Future Luxury Growth

Bain’s report helps underscore the reason why I was interested in providing an easy way for investors to gain access to the luxury goods market. As I’ve said before, there was initially some pushback to the idea, especially during the pandemic.

Click here to read the full article

—

Originally Posted on November 18, 2021 – Luxury Goods Sales Have Recovered To Pre-Pandemic Growth: Report

Performance data quoted above is historical. Past performance is no guarantee of future results. Results reflect the reinvestment of dividends and other earnings. For a portion of periods, the fund had expense limitations, without which returns would have been lower. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance does not include the effect of any direct fees described in the fund’s prospectus which, if applicable, would lower your total returns. Performance quoted for periods of one year or less is cumulative and not annualized. Obtain performance data current to the most recent month-end at www.usfunds.com or 1-800-US-FUNDS.

Mutual fund investing involved risk. Principal loss is possible. Stock markets can be volatile and share prices can fluctuate in response to sector-related and other risks as described in the fund prospectus. Foreign and emerging market investing involves special risks such as currency fluctuation and less public disclosure, as well as economic and political risk. Companies in the consumer discretionary sector are subject to risks associated with fluctuations in the performance of domestic and international economies, interest rate changes, increased competition and consumer confidence.

The S&P Composite 1500 serves as a benchmark indicator for U.S. equity market performance, aggregating price movements of S&P 500, S&P MidCap 400 and S&P SmallCap 600. A basis point in one hundredth of a percent, equivalent to 1% of 1%.

Fund portfolios are actively managed, and holdings may change daily. Holdings are reported as of the most recent quarter-end. Holdings in the Global Luxury Goods Fund as a percentage of net assets as of 9/30/2021: LVMH Moet Hennessy Louis Vuitton 1.00%, Tesla Inc. 7.49%, Toyota Motor Corp. 0.00%, Bayerische Motoren Werke AG 2.91%.

Disclosure: US Global Investors

All opinions expressed and data provided are subject to change without notice. Holdings may change daily.

Some of these opinions may not be appropriate to every investor. By clicking the link(s) above, you will be directed to a third-party website(s). U.S. Global Investors does not endorse all information supplied by this/these website(s) and is not responsible for its/their content.

About U.S. Global Investors, Inc. – U.S. Global Investors, Inc. is an investment adviser registered with the Securities and Exchange Commission (“SEC”). This does not mean that we are sponsored, recommended, or approved by the SEC, or that our abilities or qualifications in any respect have been passed upon by the SEC or any officer of the SEC.

This commentary should not be considered a solicitation or offering of any investment product.

Certain materials in this commentary may contain dated information. The information provided was current at the time of publication.

Some links above may be directed to third-party websites. U.S. Global Investors does not endorse all information supplied by these websites and is not responsible for their content.

Please consider carefully a fund’s investment objectives, risks, charges and expenses. For this and other important information, obtain a fund prospectus by clicking here or by calling 1-800-US-FUNDS (1-800-873-8637). Read it carefully before investing. Foreside Fund Services, LLC, Distributor. U.S. Global Investors is the investment adviser.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from US Global Investors and is being posted with its permission. The views expressed in this material are solely those of the author and/or US Global Investors and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Forex

There is a substantial risk of loss in foreign exchange trading. The settlement date of foreign exchange trades can vary due to time zone differences and bank holidays. When trading across foreign exchange markets, this may necessitate borrowing funds to settle foreign exchange trades. The interest rate on borrowed funds must be considered when computing the cost of trades across multiple markets.