Yesterday’s close brought us the release of Netflix’ (NFLX) earnings. Earlier this week we discussed how options markets were pricing in an unusually high likelihood of an upside reaction in the stock price, despite a poor historical record of that occurring even after positive earnings surprises. The company reported a slight miss, and NFLX shares are down about 6.5% as I write this. While NFLX has a different line of business than most of the other NASDAQ megacap leaders (though there are overlaps with Amazon (AMZN) and Apple (AAPL)), the largest technology stocks share a very similar mindset among investors. They have attracted their huge valuations because of their perceived ability to grow their earnings at a high and steady pace. It is important to see if that sort of enthusiasm is priced into the other leading names.

Next Thursday afternoon will be the mother of all earnings releases. We expect reports from AAPL, AMZN, Microsoft (MSFT), Facebook (FB) and Alphabet (GOOG, GOOGL). Those are the top 5 companies in the NASDAQ 100 Index (NDX), representing nearly 45% of NDX’ market capitalization! For perspective, those stocks represent about 22% of the S&P 500 Index (SPX) market cap as well. It is crucial to see what the options market expects for those names.

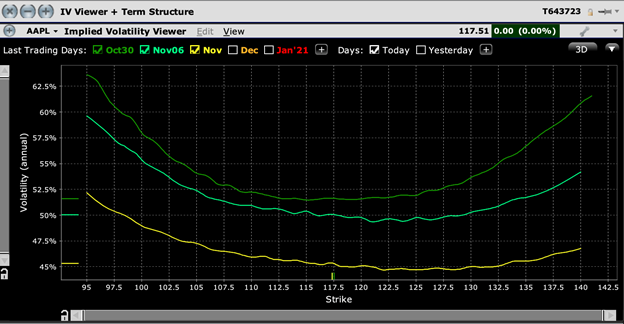

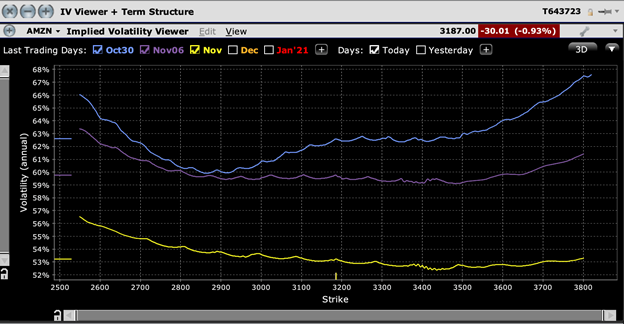

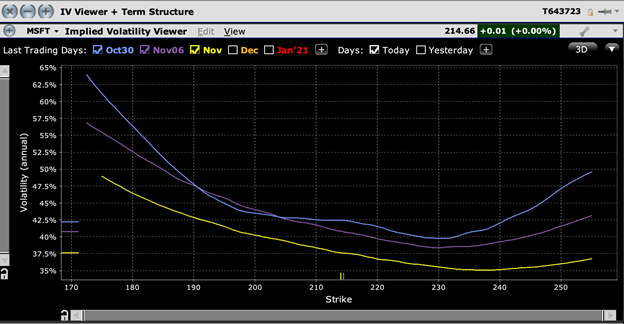

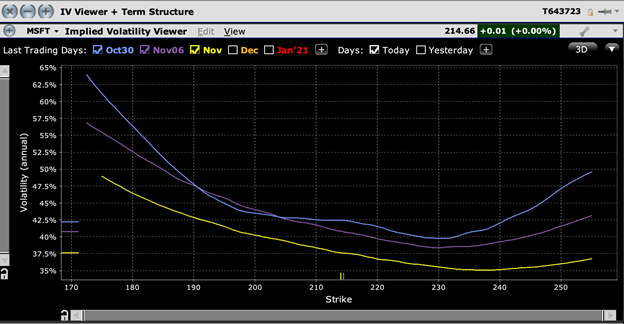

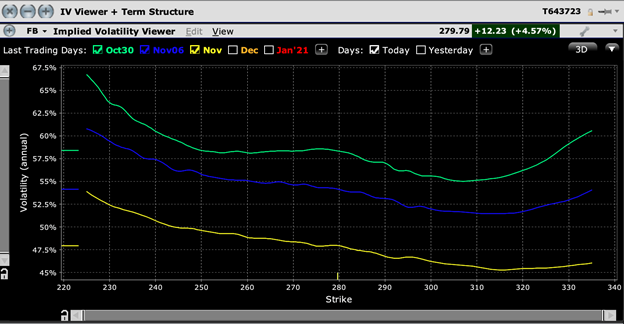

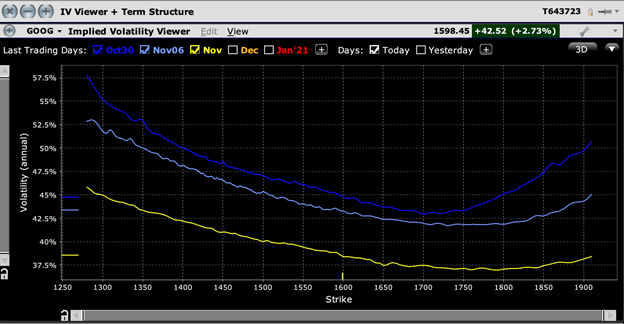

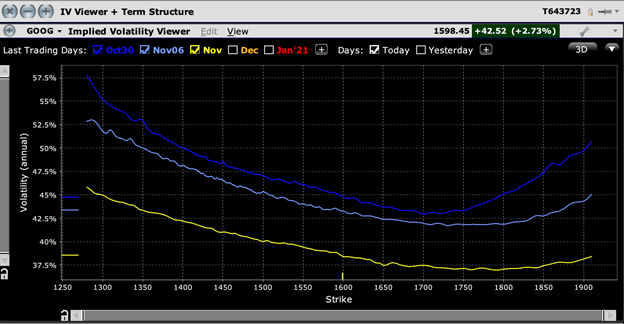

For that, we will use the Implied Volatility Viewer on the TWS, as we did for NFLX and Tesla (TSLA) recently. In all cases, we look at the 3 expirations that begin with the week of October 30th and a 20% range around the current stock price. Consider these charts:

Source for charts: Trader Workstation

I expect to go into more detail in the coming days, since expectations can change as we approach the earnings date, but for now we can see relatively normal skews for the relevant options. AMZN is the largest exception, with a bias to the upside that is similar to what we witnessed in NFLX and TSLA. I have referred to TSLA as a somewhat faith-based stock, but AMZN was the original cult holding. As with Mr. Musk, those who based investment decisions on trust in Mr. Bezos rather than on conventional valuation metrics have been richly rewarded throughout most of the company’s history. That faith is displayed in traders’ willingness to pay higher implied volatilities for upside calls than for protective puts.

Of the remaining names displayed above, all have fairly typical skews. AAPL is flatter than normal, but that stock has risen 8 times after its last 10 earnings releases (AMZN rose 5, for comparison). I see that as traders playing the established odds more than displaying euphoria.

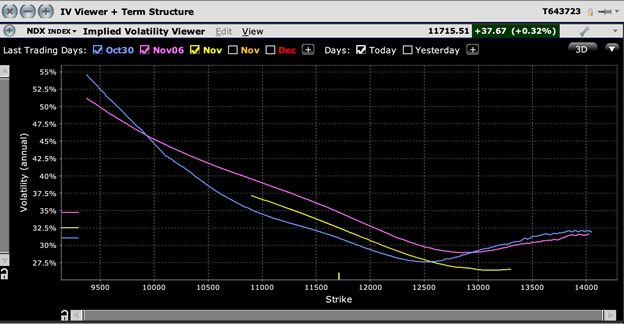

I was on a webinar with NASDAQ yesterday, discussing hedging strategies with NDX and NQX options, and this mega-earnings date came up in conversation. While this may be an excellent opportunity to utilize NDX as a hedge, because of the potentially market moving news that will affect an immense index weight, remember that the news is idiosyncratic. For example, let’s say AAPL rises as AMZN falls. The two moves could balance each other out, causing little movement in the overall index. But just for comparison, we should see if the index itself is telling us a different story:

Source for charts: Trader Workstation

We see a normal skew and implied volatilities that are generally lower than the following week. To be fair, the following week contains Election Day, which is more likely to move indices in one direction than potentially conflicting earnings.

As of now, the options markets are not signaling anything too crazy for the megacap earnings release expected next week. But traders need to stay tuned and stay vigilant if those signals change in the coming days.

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.

Disclosure: Options Trading

Options involve risk and are not suitable for all investors. Multiple leg strategies, including spreads, will incur multiple commission charges. For more information read the "Characteristics and Risks of Standardized Options" also known as the options disclosure document (ODD) or visit ibkr.com/occ