The allure of plant-based foods may be plateauing, as carnivores continue to dominate the consumer landscape.

Food companies that focus on manufacturing sustainable sources of protein appear to be benefiting from healthy global demand, despite challenges on the supply chain and workforce fronts – and as consumption of “traditional” beef products heats up.

According to the Food Industry Association’s (FIA) 2022 Power of Meat Report, for example, meat eaters comprise 74% of consumers, an increase of 3% over the prior year, while flexitarians make up 16%, and vegans/vegetarians remain at 6%.

Meanwhile, the FIA observed that shoppers are “well aware of supply chain challenges and inflationary pressures, and are adjusting purchases.” The organization noted that 75% of consumers have seen higher prices for meat/poultry, with 43% noticing fewer promotions. In response, over 60% save by eating out/ordering in less and “instead try to recreate restaurant experiences at home”.

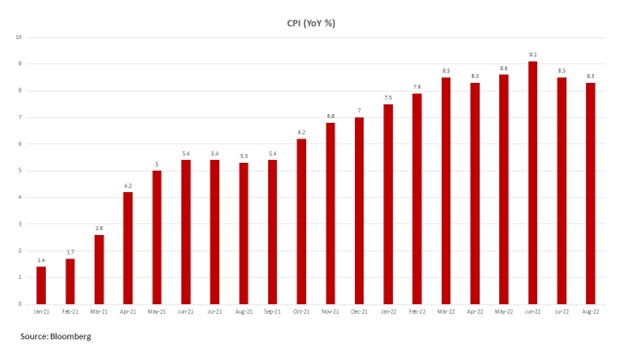

The changes in eating behaviors fall against a backdrop of stubbornly high levels of inflation. In August, the U.S. Consumer Price Index (CPI) rose 8.3% year-over-year, with the food component up 0.8% on the month and 11.4% over the past 12-month period.

Among the figures, the meats, poultry, fish, and eggs index; the fruits and vegetables index; and the non-alcoholic beverages index all increased 0.5% in August, while the food away from home index rose 0.9% in August after rising 0.7% in July.

Consumer Staples’ Pressure Cooker

Rising prices will undoubtedly place pressure on consumer staples companies, in general.

Dave Novosel, a senior analyst at corporate bond research service firm Gimme Credit, noted that Tyson Foods, Inc’s (NYSE: TSN) bottom line, for example, will face a host of headwinds, driven primarily by “soaring costs” that are running around 15% higher than last year, including for feed ingredients, labor, live animals, cooking oils, and freight costs. He also observed that the company is facing year-to-date declines in volumes for beef and pork, “stemming mostly from supply chain problems, as well as reduced demand because of the weaker economy.” However, overall, “the company is performing quite well”.

Sales at Tyson Foods increased 8% in the third quarter, as an 8% hike in average prices eclipsed a 2% decrease in volume. Revenues were mainly boosted by the continuing recovery in the foodservice channel and a 15% gain in e-commerce sales.

Gimme Credit expects the firm’s revenues to rise in the low double-digits for the full year 2022, including an estimated gain of more than 20% in chicken and more than 11% for beef.

In line with rising levels of inflation Tyson Foods said its average sales price increased in the first nine months of fiscal 2022, as input costs such as live cattle, labor, freight, and transportation increased, while demand for its beef products “remained strong”.

The current live cattle futures contract has risen roughly 7.5% year-over-year, after hitting a peak of more than US$152 in late April.

Tyson, the maker of brands such as Jimmy Dean, Hillshire Farm, and Ball Park, also noted that its average sales price fell slightly in the third quarter, driven by reduced demand for premium cuts of beef – a further sign that inflation is curbing consumers’ eating habits.

Wilting Plant Demand

In contrast, Beyond Meats (NASDAQ: BYND), a Los Angeles–based producer of plant-based meat substitutes, appears to be suffering from stagnant demand amongst a static audience.

In the second quarter of 2022, net revenues at the company fell 1.6% to US$147 million, compared to US$149.4 million in the same year-ago period. The company attributed the decline to changes in price, foreign exchange rates, and increased trade discounts.

However, consumers may generally be limiting their purchases of plant-based meats.

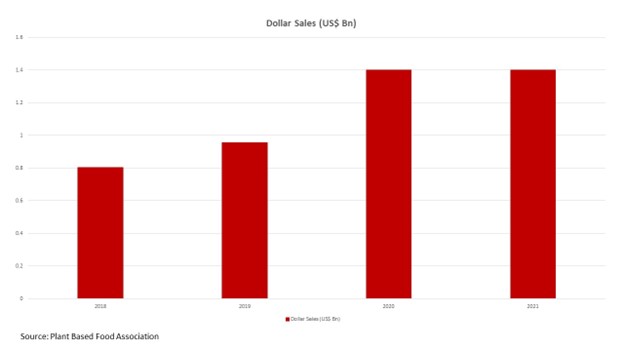

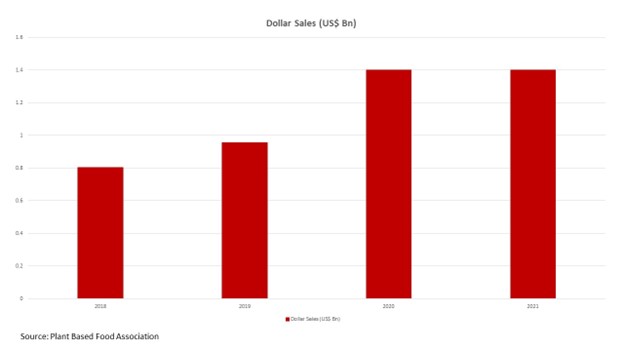

The Plant Based Foods Association cited that dollar sales of plant-based beef remained unchanged in 2021 from the prior year at US$1.4 billion, with a market share of 1.4% across the total meat category. Moreover, only 19% of households purchased plant-based meat in 2021—up just 1% from the prior year.

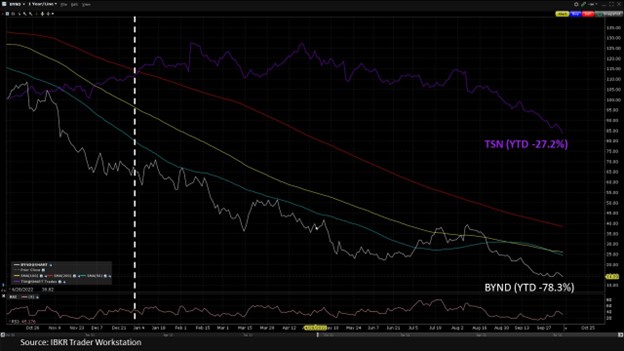

To date in 2022, shares of Tyson Foods have fallen around 27% compared to the plunge of more than 78% in Beyond Meats’ stock.

For more information about the state of the meat industry, as well as the future of bioengineered foods, visit IBKR Podcasts’ “Cooking it Up in a Lab – Investing in the Future of Bioengineered Foods” for an in-depth discussion with Christopher Gannatti, WisdomTree Europe’s head of research.

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.