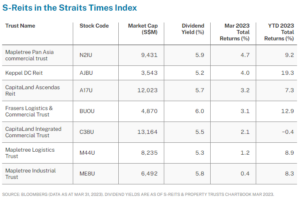

In march, the iEdge S-Reit Index declined 0.7 per cent in total returns, shaving its year-to-date (YTD) total returns to 4.3 per cent but still outperforming the Straits Times Index’s (STI) 0.8 per cent YTD total returns.

Key market drivers during the quarter, which also extended into March, continue to include global interest rate hikes, decelerating growth, persistent inflation, geopolitical tensions as well as global financial stability.

Globally, the FTSE EPRA Nareit Developed Index saw steeper declines of 4.3 per cent in total returns last month and ended the first quarter of the year flat.

All sub-segments within the Singapore-listed real estate investment trusts (S-Reits) and Property Trusts sector averaged negative total returns in March. Diversified, Industrial and Healthcare S-Reits saw the least declines, averaging -1.6 per cent, -3.4 per cent and -3.6 per cent total returns respectively.

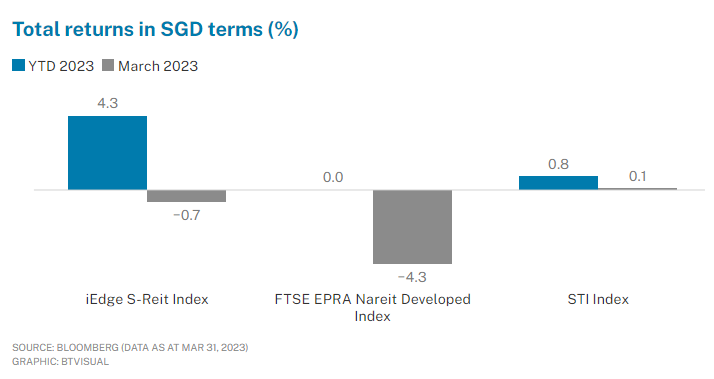

The seven largest weighted constituents of the iEdge S-Reit Index, which are also constituents of the STI Index, averaged 2.7 per cent total returns last month. All seven S-Reits outperformed both the iEdge S-Reit Index and the broader STI Index. This added to their average YTD total returns of 9.4 per cent.

On the other hand, four out of the six S-Reits within the iEdge S-Reit Index that saw double-digit declines over the month have pure exposure to the US market.

Manulife US Reit, in a statement to address investor concerns, said that none of its lenders is a regional bank in the US and its lenders are mainly Singapore and multinational banks. The Reit also added that its unsecured sustainability-linked loan facility has been fully drawn to refinance its US$105 million Phipps mortgage loan, and that it will not have any refinancing requirements until 2024.

In terms of fund flows for March, retail investors were a key driver in the sector’s fund inflow activities, accumulating net retail inflows of S$142 million. On the other hand, institutional investors net sold S$245 million.

By sub-segments, in March, diversified S-Reits received the most net retail inflows of S$101 million and the most net institutional outflows of S$130 million, while data centre S-Reits saw the most net retail outflows of S$6 million and most net institutional inflows of S$2 million.

On a quarterly basis, the sector saw S$283 million of net institutional outflows and S$185 million of net retail inflows. Two S-Reits received net inflows from both retail and institutional investors. ParkwayLife Reit received net inflows of S$0.6 million and S$1.5 million from retail and institutional investors respectively. OUE Commercial Reit received net inflows of S$0.9 million and S$0.08 million from retail and institutional investors respectively.

REIT Watch is a weekly column on The Business Times, read the original version

—

Originally Posted April 10, 2023 – REIT Watch – S-REITs in STI end 1Q23 with 10% gains, outperforming the Index

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Singapore Exchange and is being posted with its permission. The views expressed in this material are solely those of the author and/or Singapore Exchange and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Alternative Investments

Alternative investments can be highly illiquid, are speculative and may not be suitable for all investors. Investing in Alternative investments is only intended for experienced and sophisticated investors who have a high risk tolerance. Investors should carefully review and consider potential risks before investing. Significant risks may include but are not limited to the loss of all or a portion of an investment due to leverage; lack of liquidity; volatility of returns; restrictions on transferring of interests in a fund; lower diversification; complex tax structures; reduced regulation and higher fees.