By: subSPAC

EXECUTIVE SUMMARY

- Institutional Investors and Venture Funds have had a sharp reversal in fortunes over the past eighteen months, coming off the post-pandemic high to face the harsh reality of a severe recession, uncertain macroeconomic conditions, and a plunge in valuations of tech stocks.

- Despite this, Hedge Funds and Asset Management firms have largely outperformed other institutional investors, relying on alternative strategies and making unconventional bets.

- Wealth and Asset manager Alvarium Tiedmann, which recently merged through a $1.4 billion SPAC deal, is looking to disrupt the mid-market with its range of services and newfound scale.

DETAIL

Institutional Investors and Venture Funds have had a sharp reversal in fortunes over the past eighteen months, coming off the post-pandemic high to face the harsh reality of a severe recession, uncertain macroeconomic conditions, and a plunge in valuations of tech stocks. Despite this, Hedge Funds and Asset Management firms have largely outperformed other institutional investors, relying on alternative strategies and making unconventional bets. Wealth and Asset manager Alvarium Tiedmann, which recently merged through a $1.4 billion SPAC deal, is looking to disrupt the mid-market with its range of services and newfound scale. Can the investment firm outperform the market and deliver returns amidst macro headwinds and uncertainty?

Mega Merger

Alvarium Tiedmann, which went public through a SPAC merger with Cartesian Growth Corporation, was formed as a result of three investment firms coming together. This includes Tiedmann Advisors, Alvarium, and TIG. Let’s take a closer look at each company to understand the collective prowess of the company.

Founded in 1999, Tiedmann Advisors is a US multi-focused family office providing advisory services to ultra-high net worth individuals, entrepreneurs, and foundations with $28 billion in assets under advisory and 145 investment professionals working in the team. On the other hand, Alvarium, founded in 2009, manages $24 billion in assets with 260 professionals. The company offers wealth and asset management services, bespoke real estate solutions, and merchant banking focused on the innovation economy.

The final piece of the puzzle that closes out the trio is TIG, an alternatives management firm focused on delivering uncorrelated returns founded in 1980. TIG has $8 billion in assets under management, with 36 professionals working. All in all, the combined firm is a powerhouse, with $60 billion in assets under advisement and 450 investment professionals spread out across 23 major financial cities globally.

While now might be a strange time to go public (given the slowdown in public markets, macroeconomic uncertainty other headwinds), Alvarium Tiedmann is banking on several trends and market opportunities for future growth. According to a survey from the Federal Reserve, the top 1% of Americans gained a record $6.5 trillion in wealth in 2021, with collective assets reaching $45.9 trillion.

Furthermore, investment advisors should see a boom over the next decade due to retiring Baby Boomers and Gen X investors. Experts anticipate that $70 trillion of wealth will be transferred to Millenials, Gen Z, and charities. Both addressable markets will seek out independent advisors like Alvarium Tiedmann since they prefer lower-risk, independent, and customized advisory services that are aligned and integrated with their needs.

Differentiating Strategy

Asset and Wealth Management firms are a dime a dozen, so how does Alvarium Tiedmann plan to stand out from the competition? The answer is quite simple. Alvarium Tiedmann aims to differentiate itself by delivering uncorrelated returns, focusing on impact investing, and driving growth through a successful M&A strategy.

Alvarium Tiedmann offers four fund strategies, which include low volatile strategies like Event-Driven Merger Arbitrage and Real Estate Bridge Lending and exposure to overlooked sectors and markets like European Equities, Asian Credit, and Special Situations. Alvarium Tiedmann says that its strategies have largely outperformed the MSCI Global Index and HFRI Institutional Equity Hedge Index (which measures the performance of hedge funds with at least $500 million in assets under management). Complementary to this, the firm also has a Long Indexed Income REIT in the UK, focusing on inflation-protected income and capital growth (especially beneficial to investors over the past two years).

On the other end of the spectrum, Alvarium Tiedmann also has exposure to investment banking, advisory, and real estate services. The company has completed strategic advisory, private placements, M&A across Media Consumer, and Technology in private and public markets (with over 220+ transactions), and direct investments in private real estate deals (including 27 equity and 21 debt transactions.

ESG and Impact Investing has also been a major driver of business in the last few years (92% of High Net Worth Clients wanted to invest in ESG-focused companies), driving $5.6 billion in capital. Looking forward, institutional investors anticipate $25 billion in commitments in Impact strategies by 2030, which will prove to be a growing area for Alvarium Tiedmann. The investment firm’s third and final avenue for growth and differentiation is through an accretive M&A strategy to capitalize on the sizeable Mid-market opportunity.

More specifically, the firm has identified over 2,000+ funds with Assets under management between $500 million and $5 billion. Alvarium Tiedmann has a successful track record of acquiring mid-market investment advisory and wealth management firms like Presidio Capital Advisors, Holbein, and Salisbury Partners, implying that rolling-up services could continue to pay off in the future.

Financials and Valuation

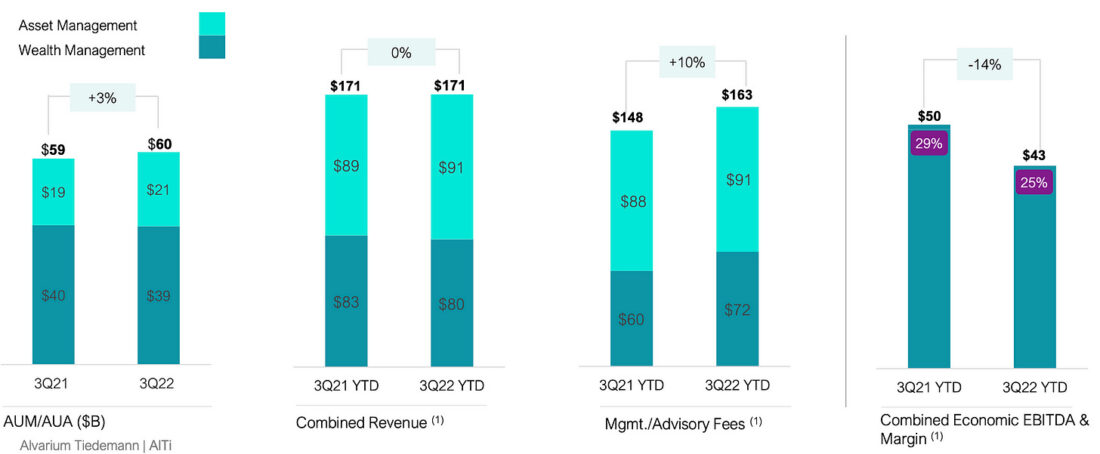

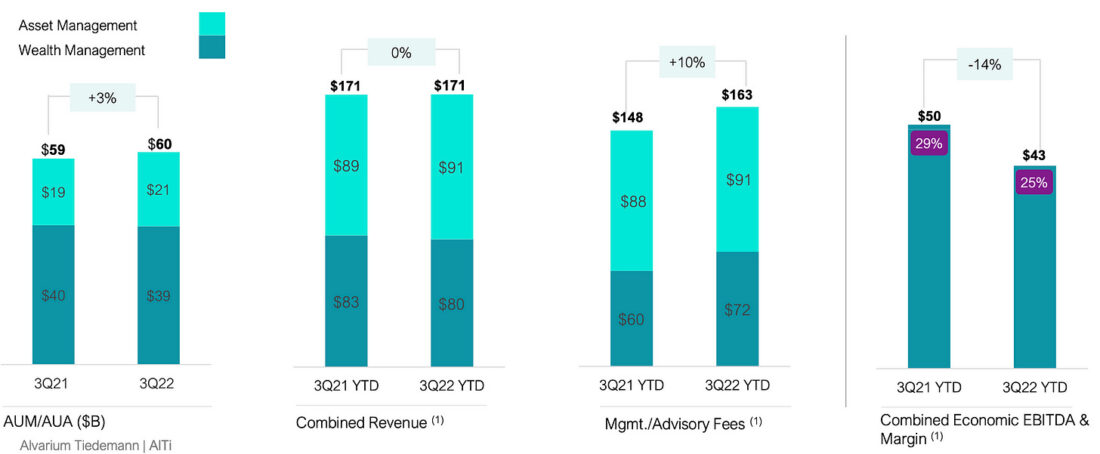

Alvarium Tiedmann has faced a challenging macroeconomic backdrop over the past quarter, with revenues and assets under advisement staying flat and margins taking a hit. In the third quarter of 2022, the company had $60 billion in assets under advisement, up 3% compared to the same quarter in 2021. Predictably, asset management saw growth, while the wealth management segment declined due to plunging valuations across public and private markets. Revenues stayed flat at $171 million year on year, while margins dropped due to the impact of valuations declining in public markets. EBITDA declined from $50 million in the third quarter year to date to $43 million.

The company is targeting a growth of assets under advisory in the high single digits. Cross-selling opportunities coupled with eliminating redundancies should result in the company growing its revenues at its target of low-teens, with EBITDA reaching a target of mid-30s percentage. However, the company will likely struggle to achieve growth in the near term, considering the market headwinds and uncertainty. The company’s balance sheet remains solid to weather a few quarters of uncertainty, at $133 million in debt (1.9x LTM EBITDA) and $41 million in cash. Once the economy rebounds and margins expand, the firm should be able to use the free cash flows to pay out dividends and buy back stock to unlock value.

Bottom Line

Investment firm Alvarium Tiedmann, formed from the merger of three firms and recently went public through a SPAC merger, aims to disrupt the mid-market with its range of services and newfound scale. The company is well-positioned to benefit from the wealth transfer to younger generations and the growing demand for customized advisory services. Alvarium Tiedmann plans to stand out from the competition by delivering uncorrelated returns, focusing on impact investing, and driving growth through a successful M&A strategy. Although the firm has faced a challenging macroeconomic backdrop over the past year, with revenues and assets under advisement staying flat and margins taking a hit, its differentiating strategies have largely outperformed market indices. With $60 billion in assets under advisement and a strong track record of acquisitions, Alvarium Tiedmann is poised for growth in the future.

—

Originally Posted February 26, 2023 – Rolling Up the Mid-Market

Disclosure: Smartkarma

Smartkarma posts and insights are provided for informational purposes only and shall not be construed as or relied upon in any circumstances as professional, targeted financial or investment advice or be considered to form part of any offer for sale, subscription, solicitation or invitation to buy or subscribe for any securities or financial products. Views expressed in third-party articles are those of the authors and do not necessarily represent the views or opinion of Smartkarma.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Smartkarma and is being posted with its permission. The views expressed in this material are solely those of the author and/or Smartkarma and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Alternative Investments

Alternative investments can be highly illiquid, are speculative and may not be suitable for all investors. Investing in Alternative investments is only intended for experienced and sophisticated investors who have a high risk tolerance. Investors should carefully review and consider potential risks before investing. Significant risks may include but are not limited to the loss of all or a portion of an investment due to leverage; lack of liquidity; volatility of returns; restrictions on transferring of interests in a fund; lower diversification; complex tax structures; reduced regulation and higher fees.

Disclosure: Hedge Funds

Hedge Funds are highly speculative, and investors may lose their entire investment.