Stocks – DIS, JPM, MU

Macro – SPY, VIX, Oil

Stocks started the day higher, but that didn’t last for very long, with the S&P 500 finishing the day lower by almost 70 bps closing at 4,360, erasing that big rally we had last Thursday while filling the gap. The S&P 500 is in a clear downtrend at this point, and there is no denying that with each high lower than the previous. The only thing left to be seen is if the next low is lower than the last. For that, we will need to break 4280; I don’t think that will happen tomorrow, but I think it will happen over the next few trading sessions.

The market mentality has changed; it is just that simple. It is not the same market it was before September; the tone has changed.

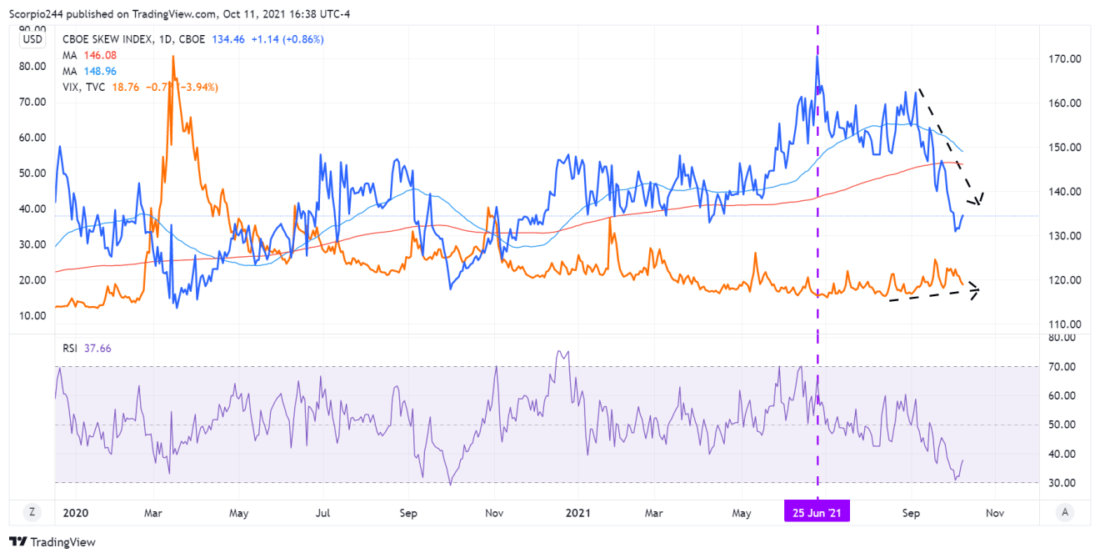

One such thing that has changed is the VIX. It moved up today back to around 20, after testing the lower end of its range around 18.5. Those waiting for the volatility sellers to come back may have a problem because it doesn’t look like they are coming back anytime soon. You can really see this on the SKEW chart, and perhaps I pointed it out here or not; I can’t remember. Anyway, on October 5, I noted in an RTM member article that I thought this time was different, noting all that tail-hedging that the SKEW index represents had topped out at the same time the VIX bottomed. It seems highly likely that the short-dated at-the-money volatility sellers were using out-of-the-money options to hedge against their short volatility positions. But if they are not shoring volatility anymore, then there is nothing to hedge, and why the SKEW index has remained lower during this period of time.

So if the Vol sellers aren’t coming back, then the real risk here is volatility to break out to the upside. There are plenty of reasons for that to happen. The first being increasing uncertainty around earnings. I noted that 25 is the break-out point on the VIX. I think that is still the level to watch on the VIX.

Oil

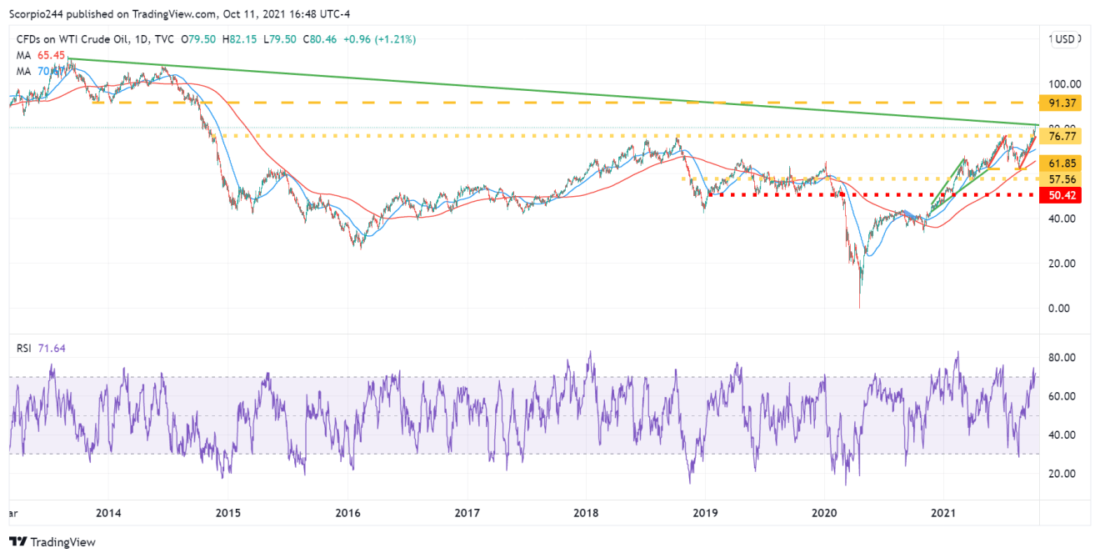

Meanwhile, oil is at a significant inflection point here at $82. This is the trend line that goes back to 2013 highs. If oil breaks out it could go substantially higher, perhaps to around $91. The weekly chart shows that oil is overbought here, and if the dollar keeps rising at some point, it will put the breaks on oil’s rise. This will need to be watched closely. So have my doubts it can keep pushing higher, but I also said that at $76.

JPMorgan (JPM)

Meanwhile, the banks were the worst-performing group today, dropping by 1%. Now JPMorgan reports Wednesday morning, and the price action today was curious, with the shares falling 2.1%. Now the stock is up a lot going into results, and as I noted yesterday expectations are very high for these banks. The market seems to be saying expectations are too high now. I could easily see this stock falling back to $153.

Micron (MU)

I’m so tired of Micron already. Why can’t it just break support and start heading lower already?

Disney (DIS)

Disney is kind of in the same boat as Micron. Just hugging support now for months, with all of these open gaps at much lower levels that need to be filled.

–

Originally Posted on October 11, 2021 – Stocks Dive On October 11 As Market Dynamics Change Rapidly

Disclosure: Mott Capital Management

Mott Capital Management is the portfolio manager for one portfolio offered by Interactive Advisors. Interactive Advisors clients do not invest directly with the Portfolio Managers like Mott Capital Management, and the Managers do not have discretionary trading authority over Interactive Advisors client accounts. The Portfolio Managers on the Interactive Advisors platform simply license their trade data to Interactive Advisors, which then allows its clients to have the same strategy and trading decisions mirrored in their accounts if the Portfolio is in line with their risk score. Portfolio Managers like Mott Capital Management implement their trading philosophy and strategy without knowing the identity of Interactive Advisors’ clients or taking into account these clients’ individualized circumstances.

Mott Capital Management has entered into a Portfolio Manager License Agreement with Interactive Advisors pursuant to which it provides trading data IA uses to offer a portfolio to its investment advisory clients. Mott Capital Management is not affiliated with any entities in the Interactive Brokers Group.

Interactive Advisors is an affiliate of Interactive Brokers LLC.

Pursuant to the Investment Management Agreement between Interactive Advisors and its clients, all brokerage transactions occur through Interactive Brokers LLC, an affiliate of Interactive Advisors. The use of an affiliate for brokerage services represents a potential conflict of interest as Interactive Brokers LLC is paid a commission on trades executed on behalf of Interactive Advisors. Interactive Brokers LLC does not consider this conflict material as it does not sell, solicit, recommend, trade against or otherwise attempt to induce Interactive Advisors to place any orders in any products. Interactive Advisors does not offer services through any other broker-dealer. All trading by Interactive Advisors is self-directed. Interactive Advisors clients acknowledge this potential conflict of interest and authorize Interactive Advisors to execute transactions through Interactive Brokers LLC when they open an Interactive Advisors account. Clients should consider the commissions and other expenses, execution, clearance, and settlement capabilities of Interactive Brokers LLC as a factor in their decision to invest in an Interactive Advisors Portfolio. Interactive Advisors believes it satisfies its best execution obligation by trading its clients’ trades through Interactive Brokers LLC. While there can be no assurance that it will in fact achieve best execution, Interactive Advisors does periodically monitor the execution quality of transactions to ensure that clients receive the best overall trade execution pursuant to regulatory requirements.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Mott Capital Management and is being posted with its permission. The views expressed in this material are solely those of the author and/or Mott Capital Management and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Options Trading

Options involve risk and are not suitable for all investors. Multiple leg strategies, including spreads, will incur multiple commission charges. For more information read the "Characteristics and Risks of Standardized Options" also known as the options disclosure document (ODD) or visit ibkr.com/occ