Shares of Credit Suisse (NYSE: CS) plunged Thursday, as the Zürich-based investment bank contends with enormous headwinds, including a massive US$4 billion loss, strategic restructuring, and social media stigma.

Credit Suisse’s stock fell a record 19% Thursday to US$3.89, after the firm posted a net loss of CHF 4.0 billion (US$4.04 billion) in its third quarter financial figures, driven largely by weak investment banking (IB) performance, as well as somewhat lower client activity across the enterprise.

Winding Up with Losses

In Q3, IB net revenue at the bank plummeted 58% year-on-year, while its wealth management division sank 18% – contributing to its overall, net sales loss of CHF 3.8 billion (-30%).

Credit Suisse CFO Dixit Joshi said that the firm’s Q3 financial performance reflected the continued “challenging conditions” of “heightened market volatility, weak customer flows, and ongoing client deleveraging.” Joshi attributed the key drivers of the latest numbers to “substantially lower levels of activity across the industry in equity capital markets and leveraged finance, which contributed to a weak performance in the investment bank, and subdued client activity in wealth management, especially in terms of transaction-based activity.”

Total net revenues at its wealth management unit, for example, dropped to CHF 1.36 billion in Q3 from CHF 1.66 billion in the same year-ago quarter, amid CHF 6.4 billion worth of net outflows – apparently due to deleveraging, as well as “proactive derisking”.

Credit Suisse also blamed the macro environment for its woes, including geopolitics, as well “significant” monetary tightening by major global central banks in response to continued, elevated levels of inflation.

Social Media Mayhem

The firm further said its reputation fell victim to social media trolls, who Joshi held accountable for, among other adverse results, an estimated US$13 billion worth of new asset outflows in Q3 across the franchise.

At the beginning of October, Ellen Chang, a columnist for The Street, wrote thatsocial media accounts on Twitter and Reddit began “speculating about the potential fallout of Credit Suisse” as shares of the well-known Swiss bank fell to new record lows, mirroring its bonds.

Chang explained that the Swiss investment bank has “faced rumors for several months since the behemoth said in July it would alter the focus of its business and exit some businesses to lower its risks.”

Three-Year Plan

Indeed, Credit Suisse Thursday had rolled-out a series of strategic maneuvers it plans to execute over the coming three years, including “a radical restructuring of the Investment Bank, an accelerated cost transformation, and strengthened and reallocated capital,” all of which are designed to create a ‘new Credit Suisse’.

The series of changes may be underscored by the shedding of thousands of positions, as well as the sale of its securitized products group, and a capital increase of CHF 4 billion.

Credit Suisse chair Axel Lehmann said that the 166-year-old firm has become “unfocused” in recent years, prompting the employment of “a radical strategy and a clear execution plan to create a stronger, more resilient and more efficient bank with a firm foundation.”

The bank’s CEO Ulrich Körner echoed the chair’s comments while highlighting that the new formation of its executive board is “focused on restoring trust through the relentless and accountable delivery of our new strategy, where risk management remains at the very core of everything we do.”

Dealing with Debt as Credit Confidence Wanes

Meanwhile, on the bank’s earnings call, concerns arose about Credit Suisse’s ability to finance / refinance its debt obligations – notably since S&P Global downwardly revised its outlook on the company earlier in October – a couple of months after Fitch cut its credit rating one notch to ‘BBB’ from ‘BBB+’.

While the company expects to tap the debt markets in Q4 2022—perhaps to the tune of around US$6.5 billion, including US$4.5 billion at the holdco issuer level – certain of its U.S. dollar-denominated, long-dated bonds have been suffering material losses, and were trading Thursday at deep discounts.

For instance, issuer Credit Suisse AG/London’s 2.55% notes due March 2030 were last bid at around US$72 (7.49% yield-to-maturity), while its 2% October 2029s were trading in the area of US$78 (5.86% ytm).

Market participants’ perceptions of the company’s creditworthiness have also been deteriorating over the past three months, with spreads on its five-year credit default swaps (CDS) roughly 50 basis points wider to 260.9 bps. By comparison, five-year CDS spreads for Swiss rival UBS Group and Germany’s Deutsche Bank were around +5 bps (112.2 bps) and +6 bps (136.4 bps) over the same period, respectively – about half the cost.

Credit Suisse also seems to be particularly sensitive to macro volatility, which may impede – or even upend – the execution of the company’s strategic plans.

S&P Global analyst Anna Lozmann noted earlier in October that there appear to be increasing risks to Credit Suisse’s operating turnaround, given the “fast-deteriorating economic environment and recent market turbulence.”

At the same time, Lozmann gave some credit to the group’s commitment to strong capital, which remained a key support to its single-‘A’, and group’s ‘BBB’ ratings, “providing it some buffer for deteriorating financial prospects and to implement its updated strategy and expected business reorganization”.

At the end of Q3, Credit Suisse held roughly CHF 163 billion worth of long-term loans.

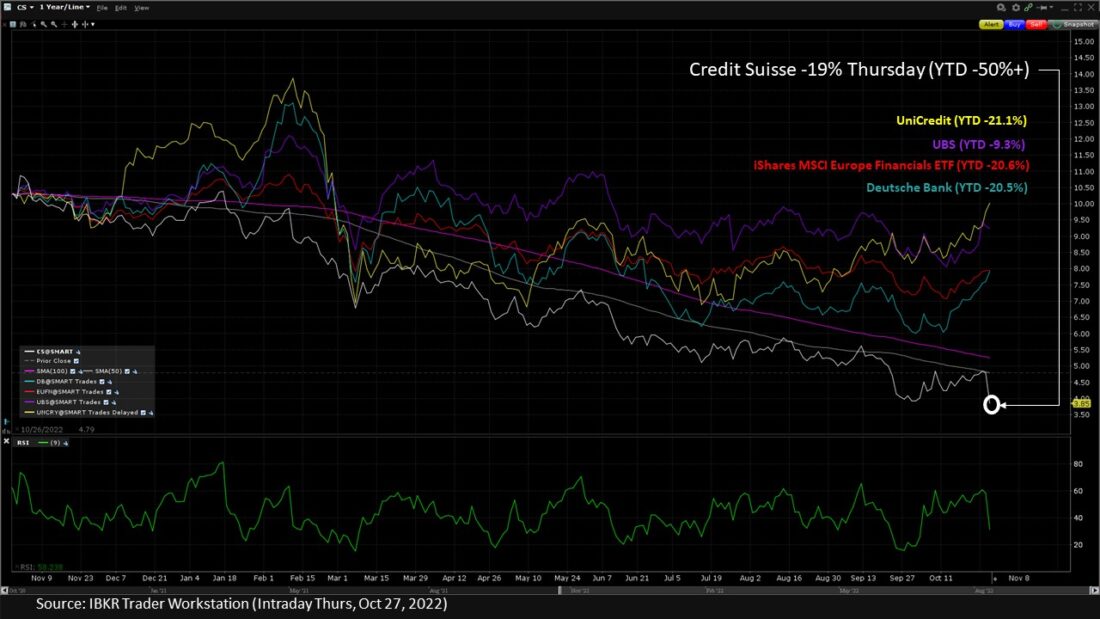

Year-to date in 2022, shares of Credit Suisse are down over 50%, while UBS Group is off about 9.3%, Deutsche Bank is down 20.5%, and the iShares MSCI Europe Financials exchange-traded fund (ETF) has fallen roughly 20.6%.

Learn More

Traders’ Academy: Corporate Earnings

Traders’ Academy: Introduction to U.S. Corporate Bonds

Traders’ Academy: Economic Indicators (European Union)

Traders’ Insight: Credit Suisse Floats Plan for $3B Debt Buyback to Reassure Investors (Benzinga)

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.