By John Del Vecchio and Brad Lamensdorf

While market sentiment has hit extremes, it’s mostly the “dumb” Money that is feeling giddy and greedy.

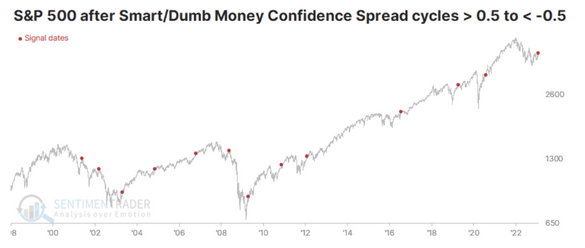

On the following chart, the red dots highlight periods of excessive optimism among the Dumb Money crowd versus the Smart Money crowd.

While there have been a couple of periods of strong momentum that carried the market higher despite over-enthusiasm by the Dumb Money group (no one is wrong all of the time), most periods are characterized by falling or stalling markets.

We have now hit just the thirteenth signal this century.

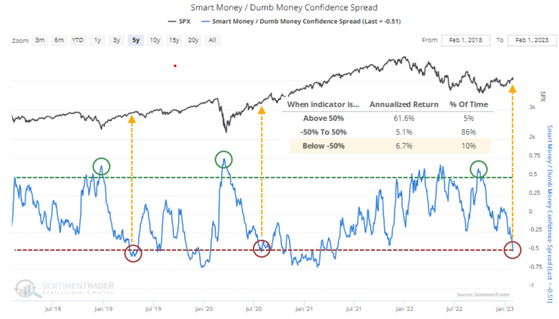

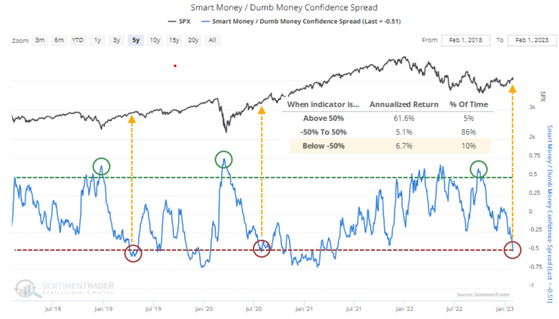

These extreme levels are reached about 10% of the time.

While the returns are positive, they are just 1/10th of the performance when the situation is reversed. When Smart Money is bullish and Dumb Money is bearish, the annualized return is 61.7%.

Of course, this is a rare occurrence and something we see just 5% of the time.

After a solid start for the year, the excessive reading of this indicator suggests that the market digesting the move or a pullback is highly probable.

It’s time to tighten stops or consider hedges.

—

Originally Posted February 13, 2023 – The “Dumb” Money is Ecstatic

Disclosure: Lamensdorf Market Timing Report

Lamensdorf Market Timing Report is a publication intended to give analytical research to the investment community. Lamensdorf Market Timing Report is not rendering investment advice based on investment portfolios and is not registered as an investment advisor in any jurisdiction. Information included in this report is derived from many sources believed to be reliable but no representation is made that it is accurate or complete, or that errors, if discovered, will be corrected. The authors of this report have not audited the financial statements of the companies discussed and do not represent that they are serving as independent public accountants with respect to them. They have not audited the statements and therefore do not express an opinion on them. The authors have also not conducted a thorough review of the financial statements as defined by standards established by the AICPA.

This report is not intended, and shall not constitute, and nothing herein should be construed as, an offer to sell or a solicitation of an offer to buy any securities referred to in this report, or a “buy” or “sell” recommendation. Rather, this research is intended to identify issues portfolio managers should be aware of for them to assess their own opinion of positive or negative potential. The LMTR newsletter is NOT affiliated with any ETF’s.

Active Alts is affiliated with Lamensdorf Market Timing Report. While LMTR uses charts from SentimenTrader, they do not have a financial arrangement with SentimenTrader. Past performance is not indicative of future results.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Lamensdorf Market Timing Report and is being posted with its permission. The views expressed in this material are solely those of the author and/or Lamensdorf Market Timing Report and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.