By: subSPAC

EXECUTIVE SUMMARY

- Over a dozen companies focused on building out Electric Vehicles have gone public through a SPAC merger in the past two years, albeit with mixed results.

- Legendary Motorcycle Maker Harley Davidson shocked the public markets in 2021 when it announced that it was spinning off its EV segment LiveWire through a $1.8 billion SPAC merger.

- The move came as the legacy bike maker has faced a period of slowing sales, losing market share to competitors, and failing to reach younger first-time riders.

DETAIL

Over a dozen companies focused on building out Electric Vehicles have gone public through a SPAC merger in the past two years, albeit with mixed results. Legendary Motorcycle Maker Harley Davidson shocked the public markets in 2021 when it announced that it was spinning off its EV segment LiveWire through a $1.8 billion SPAC merger. The move came as the legacy bike maker has faced a period of slowing sales, losing market share to competitors, and failing to reach younger first-time riders. Can LiveWire avoid the pitfalls of its parent company and lead the two-wheel EV Revolution?

An Iconic Brand

You don’t need to be a biker to know about the Harley-Davidson brand. Harleys have been big, loud, fast, and inherently American, representing a culture that some now call ‘Vintage.’ There’s a saying which perfectly captured the brand in all its glory – “Until you’ve been on a Harley-Davidson, you haven’t been on a motorcycle.” Harley’s brand dates back to 1903, with the company being one of the few to survive every major recession since its inception.

For nearly a century, Harley-Davidson went unchallenged, but things changed during the great financial crisis. Sales of the motorcycle company peaked at 260,000 units in 2007 and have been falling since. Competition from foreign brands has been eating into market share, while many legacy brands have positioned themselves towards the ESG-focused younger first-time riders by starting development on EV bikes.

For its part, Harley Davidson is looking to do the same with the spinoff of its EV-only division. Announced in 2021 and completed last year, LiveWire went public at a $1.8 billion valuation. However, unlike its parent company which doesn’t need any introductions, LiveWire isn’t a household name in the US. This is all the more surprising, given that Harley Davidson has been developing the concept (called Project Hacker) since 2010.

The company’s first vehicle LiveWire 1, comes in at 562 pounds, with a horsepower of 100, a range of 145 miles on a battery that can fast charge in 60 minutes and hit 0-60 mph in 3 seconds. Despite the combination of best-in-class style, range, and power, the whole package comes in at a hefty price tag of $22,799, making it hard to sell.

Class Leading or Just Another E-Bike Maker?

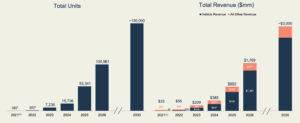

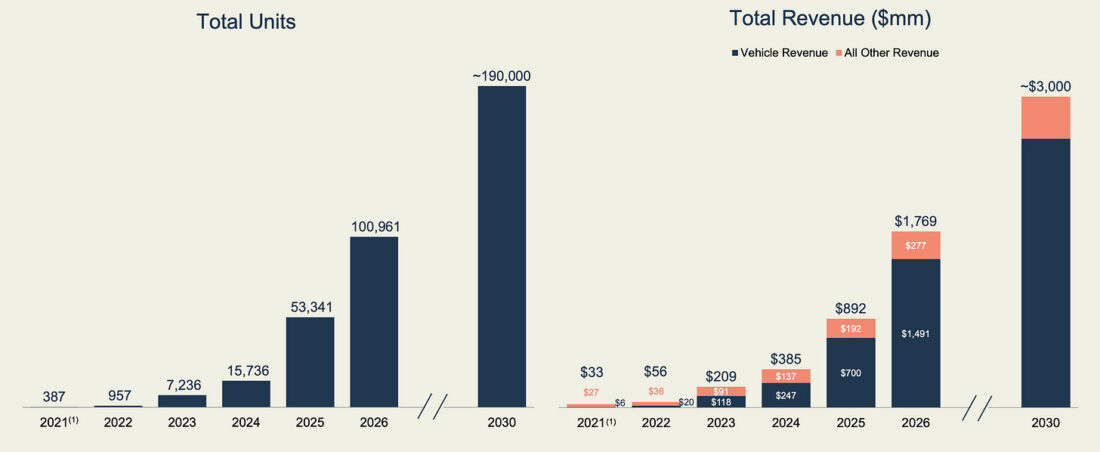

LiveWire has only sold a few hundred EV Bikes so far, but its ambitions are larger than life for the brand, targeting 100,000 unit sales in 2026 and 190,000 units by the end of the decade. These projections show that LiveWire will outsell its parent company (Harley sold 117,100 units in 2022) and generate nearly as much revenue, which is ambitious, to say the least. Setting aside the audacious goals, there are a few key challenges for LiveWire to reach its targets.

Despite the many claims from industry experts regarding the penetration of EVs in the motorcycle segment primarily driven by the rise of environment concise first-time riders, very little demand has materialized. EV Motorcycle penetration in the US stands at a measly 1%, while a much more mature market in Europe has EV penetration at 2%, even as charging infrastructure has vastly improved, and pricing has come down over time.

China is leading the way on EV motorcycle adoption, but this is a certainty given that the market is 10x larger and one where everyday riders are more prevalent than the lifestyle riders that Harley and LiveWire are targeting. LiveWire plans to enter China and other Asian markets, where EV growth is expected to be the highest over the next five years, but competition in the segment will be heated.

Companies like Triumph, Ducati, and Royal Enfield all have or are in the process of launching their e-bikes. Further competition from automotive brands, including BMW, Audi, Mercedes-Benz, and Ford, who are launching electric versions of bikes, motorcycles, scooters, and mountain bikes, which are likely to eat into the company’s market share.

Financials and Valuation

LiveWire generated revenues of $47 million in 2022, up 31% compared to the $36 million generated in the previous year. Most of the company’s revenues are still being generated by the STACYC segment (electric balance bikes for kids), which isn’t expected to shift until at least 2024. As the company continues to expand its capacity, it expects losses to grow as well.

Net losses grew nearly 20% between 2021 to 2022 and stood at $79 million. In 2023, the company may generate revenues of close to $100 million but has already guided that losses will be between $115 and $125 million. The growing losses may be a concern, given the company’s balance sheet strength. It had $265 million in cash and a $200 million term facility available to drawdown, implying between 3-5 years of runway.

However, one thing to consider is that the company may not hit its projections, resulting in higher losses. In its investor presentation, LiveWire had initially targeted selling around 7,200 units of the LiveWire One, but the company recently said that it would be able to only produce between 750 and 2,000 units citing supply chain constraints and demand challenges with the macroeconomic issues.

This could indicate that the company may need to raise capital to scale, just like other EV SPACs that have gone public. One area of concern is the company’s valuation, which currently stands at $1.54 billion. Assuming revenues of $100 million, the company is trading at a Price/Sales of 15x, which is quite high, considering all of the operating and financial challenges around the company.

Bottom Line

Iconic Motorcycle maker Harley Davidson spun off its EV segment LiveWire in an attempt to appeal to younger riders and capitalize on the growing sentiment. However, there are several challenges, including lower EV penetration across the US and Europe, high competition from legacy Bike makers and new upstarts, and liquidity challenges due to high cash burn. LiveWire’s stock is trading at a very high multiple, despite the significant headwinds and macroeconomic uncertainty. Investors need to wait and see if the company can execute operationally by scaling production and reaching their target deliveries before investing in the stock.

—

Originally Posted February 12, 2023 – The Electric Dream

Disclosure: Smartkarma

Smartkarma posts and insights are provided for informational purposes only and shall not be construed as or relied upon in any circumstances as professional, targeted financial or investment advice or be considered to form part of any offer for sale, subscription, solicitation or invitation to buy or subscribe for any securities or financial products. Views expressed in third-party articles are those of the authors and do not necessarily represent the views or opinion of Smartkarma.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Smartkarma and is being posted with its permission. The views expressed in this material are solely those of the author and/or Smartkarma and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Alternative Investments

Alternative investments can be highly illiquid, are speculative and may not be suitable for all investors. Investing in Alternative investments is only intended for experienced and sophisticated investors who have a high risk tolerance. Investors should carefully review and consider potential risks before investing. Significant risks may include but are not limited to the loss of all or a portion of an investment due to leverage; lack of liquidity; volatility of returns; restrictions on transferring of interests in a fund; lower diversification; complex tax structures; reduced regulation and higher fees.