Despite making a post-pandemic recovery, this company is priced as if profits will never return to pre-pandemic levels. ManpowerGroup (MAN: $99/share) remains a Long Idea after 3Q21 earnings.

We leverage more reliable fundamental data, as proven in The Journal of Financial Economics[1], and shown to provide a new source of alpha, with qualitative research to highlight this firm whose stock present excellent risk/reward.

ManpowerGroup’s Attractive Risk/Reward

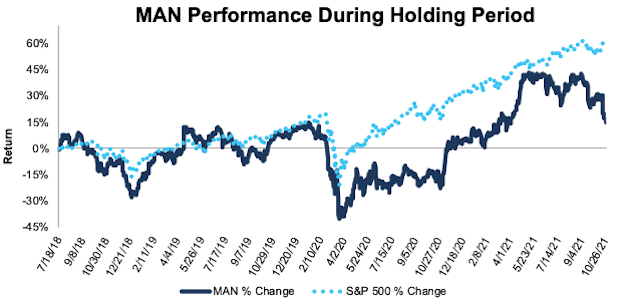

We made ManpowerGroup a Long Idea in July 2018 and the stock has underperformed the market since then. However, the stock’s 20% decline since September 2, 2021 is overblown and presents investors with an opportunity to “buy the dip” in a stock with plenty of upside.

Figure 1: Long Idea Performance: From Date of Publication Through 10/26/2021

Sources: New Constructs, LLC and company filings

What’s Working:

ManpowerGroup’s total revenue rose 12% year-over-year (YoY) in 3Q21, while its Experis and Talent Solutions segment revenues exceeded pre-pandemic levels. Experis and Talent Solutions accounted for 37% of the company’s total 2020 gross profit, so the growth in these segments bodes well for a future rebound to and above 2019 levels. The company expects its business recovery to continue as it guided for 5-9% YoY revenue growth in 4Q21.

Growth in the company’s higher margin Experis and Talent Solutions segments have improved ManpowerGroup’s profitability, despite operating in a highly competitive industry. The company steadily improved its net operating profit after tax (NOPAT) margin from 1.1% in 2010 to 2.6% in 2019 before the pandemic. After falling to 1.6% in 2020, margins have improved to 1.9% over the TTM. Rising margins drive ManpowerGroup’s return on invested capital (ROIC) from 5% in 2010 to 9% in 2019. Over the trailing-twelve-months (TTM), the company’s ROIC is 7%, which is up from 5% in 2020.

As one of the largest staffing companies in the world, ManpowerGroup leverages its global presence to deliver innovative offerings to clients, which creates a long runway for continued growth. For example, ManpowerGroup’s Experis Career Accelerator, an AI-driven platform, leverages the company’s large amount of employer and employee data to assist the company in finding in-demand roles and provide better job matches across its network.

Unlike most other businesses, which are struggling to manage inflationary pressure, ManpowerGroup’s fee structure means that inflation has little effect on the company’s operations, as increased costs are passed directly to its clients.

What’s Not Working:

As a provider of staffing, recruiting, and workforce consulting services, the decline of supply in the labor market is a headwind for ManpowerGroup’s growth.

Even though revenue from Southern Europe, the company’s largest region, grew 13% YoY in 3Q21, the company expected a stronger showing from France after many of the heavy, pandemic-related restrictions were lifted in the country. While investors may have been disappointed with the lackluster growth in 3Q21, we expect employment service demand to eventually reach pre-pandemic levels, given the expected growth rate of the industry.

In the United States, the long-term decline in labor participation remains in place. The labor force participation rate in the U.S. steadily fell from 67% in 1998 to 63% in 2019. In 2020, the participation rate fell even lower to 62%, its lowest level since 1975. More recently, the pandemic caused many baby-boomers to retire and exit the labor force completely, while others have delayed reentering the labor force due to unemployment benefits and concerns about childcare and personal health.

Nevertheless, there is still room for employment service companies, such as ManpowerGroup, to grow. Despite the unfavorable labor participation trends, ResearchAndMarkets expects the global employment services market to grow 9% compounded annually from 2021-2025.

Click here to read the full article

—

This article originally published on October 27, 2021.

Disclosure: David Trainer, Kyle Guske II, and Matt Shuler receive no compensation to write about any specific stock, sector, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1] Our research utilizes our Core Earnings, a more reliable measure of profits, as proven in Core Earnings: New Data & Evidence, written by professors at Harvard Business School (HBS) & MIT Sloan and published in The Journal of Financial Economics.

Click here to download a PDF of this report.

Disclosure: New Constructs

David Trainer, Kyle Guske II, Sam McBride, Matt Shuler, Alex Sword, and Andrew Gallagher receive no compensation to write about any specific stock, style, or theme.

The information and opinions presented in this report are provided to you for information purposes only and are not to be used or considered as an offer or solicitation of an offer to buy or sell securities or other financial instruments. New Constructs has not taken any steps to ensure that the securities referred to in this report are suitable for any particular investor and nothing in this report constitutes investment, legal, accounting or tax advice. This report includes general information that does not take into account your individual circumstance, financial situation or needs, nor does it represent a personal recommendation to you. The investments or services contained or referred to in this report may not be suitable for you and it is recommended that you consult an independent investment advisor if you are in doubt about any such investments or investment services.

Information and opinions presented in this report have been obtained or derived from sources believed by New Constructs to be reliable, but New Constructs makes no representation as to their accuracy, authority, usefulness, reliability, timeliness or completeness. New Constructs accepts no liability for loss arising from the use of the information presented in this report, and New Constructs makes no warranty as to results that may be obtained from the information presented in this report. Past performance should not be taken as an indication or guarantee of future performance, and no representation or warranty, express or implied, is made regarding future performance. Information and opinions contained in this report reflect a judgment at its original date of publication by New Constructs and are subject to change without notice. New Constructs may have issued, and may in the future issue, other reports that are inconsistent with, and reach different conclusions from, the information presented in this report. Those reports reflect the different assumptions, views and analytical methods of the analysts who prepared them and New Constructs is under no obligation to insure that such other reports are brought to the attention of any recipient of this report.

New Constructs’ reports are intended for distribution to its professional and institutional investor customers. Recipients who are not professionals or institutional investor customers of New Constructs should seek the advice of their independent financial advisor prior to making any investment decision or for any necessary explanation of its contents.

In-depth risk/reward analysis underpins our stock rating. Our stock rating methodology grades every stock according to what we believe are the 5 most important criteria for assessing the quality of a stock. Each grade reflects the balance of potential risk and reward of buying that stock. Our analysis results in the 5 ratings described below. Very Attractive and Attractive correspond to a “Buy” rating, Very Unattractive and Unattractive correspond to a “Sell” rating, while Neutral corresponds to a “Hold” rating.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from New Constructs and is being posted with its permission. The views expressed in this material are solely those of the author and/or New Constructs and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Tax-Related Items (Circular 230 Notice)

The information in this material is provided for informational purposes only and does not constitute tax advice and cannot be used by the recipient or any other taxpayer to avoid penalties under any federal, state, local or other tax statutes or regulations, or to resolve any tax issue.