Market dynamics remain largely healthy, and new developments continue to point to improving risk appetites. Still, Energy (XOP, RYE) is the only cyclical value Sector that has been able to decisively break to new price highs, while others remain in congestion. Therefore, our outlook remains neutral yet constructive overall, and we see pullbacks as buying opportunities.

- Risk Appetites Improving. We continue to see signs of improving risk appetites, including (1) new RS lows/underperformance from defensives such as Staples (XLP), Utilities (XLU), pharma (PJP, PPH), and telecom (IYZ), (2) small-caps beginning to outperform relative to large-caps, (3) China (MCHI, KWEB) displays a bullish RS reversal as price attempts to bottom, (4) high yield spreads are narrowing, (5) the 10-year Treasury yield is moving higher, (6) WTI crude oil is breaking above major long-term resistance at $77, (7) the Energy Sector (RYE and XOP)is breaking above major resistance at $47.50 and $100, respectively, (8) banks (KRE, KBE) display bullish price and RS reversals, and (9) Materials (XLB), Industrials (XLI), and Transportation (IYT) display bullish short-term RS reversals. This is risk-on behavior and is not what we would expect to see if the major averages were headed for a significant correction.

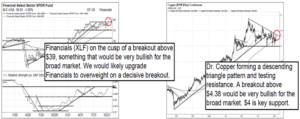

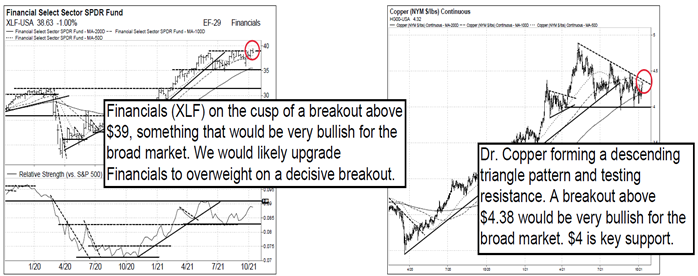

- Watching Financials, Copper, and the US Dollar. Financials (XLF) are on the cusp of a breakout above $39, while copper is on the cusp of a breakout above $4.38; breakouts above their respective resistance levels would be major bullish developments for the broad market, while a failure to break out would signal more consolidation. The US dollar (DXY) is testing longer-term resistance at $94.70-95; as long as the DXY is below $95, it is likely to be a risk-on signal for stocks… see charts below.

- S&P 500. The S&P 500 has struggled since breaking below its 50-day MA, a level that is now resistance. The S&P 500 is going through a normal pullback and forming a short-term falling wedge pattern. We expect consolidation to continue on the S&P 500, and are watching for support at 4300-4305 followed by 4257, 4233, and 4164. Alternatively, a break above 4430 would signal the pullback is over.

SOURCE: FACTSET

Disclosure: Vermilion Research

The information contained herein is privileged, confidential and protected from disclosure. Any unauthorized disclosure distribution, dissemination or copying of this material or any attachment is strictly prohibited; such information, whether derived from Vermilion Vermilion Capital Management, LLC or from any oral or written communication by way of opinion, advice, or otherwise with a principal of the company is not warranted in any manner whatsoever, is for the use of our customers only and may be obtained from internal and external research sources considered to be reliable. It is not necessarily complete and its accuracy is not guaranteed by Vermilion Capital Management, LLC, its operating entity or the principals therein. Neither the information nor any opinion expressed constitutes a solicitation for the purchase of any future or security referred to in Vermilion research publications. Principals of Vermilion Capital Management, LLC may or may not hold, or be short of, securities discussed herein, or of any other securities, at any time. The foregoing also expressly applies to any trial subscription.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Vermilion Research and is being posted with its permission. The views expressed in this material are solely those of the author and/or Vermilion Research and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.