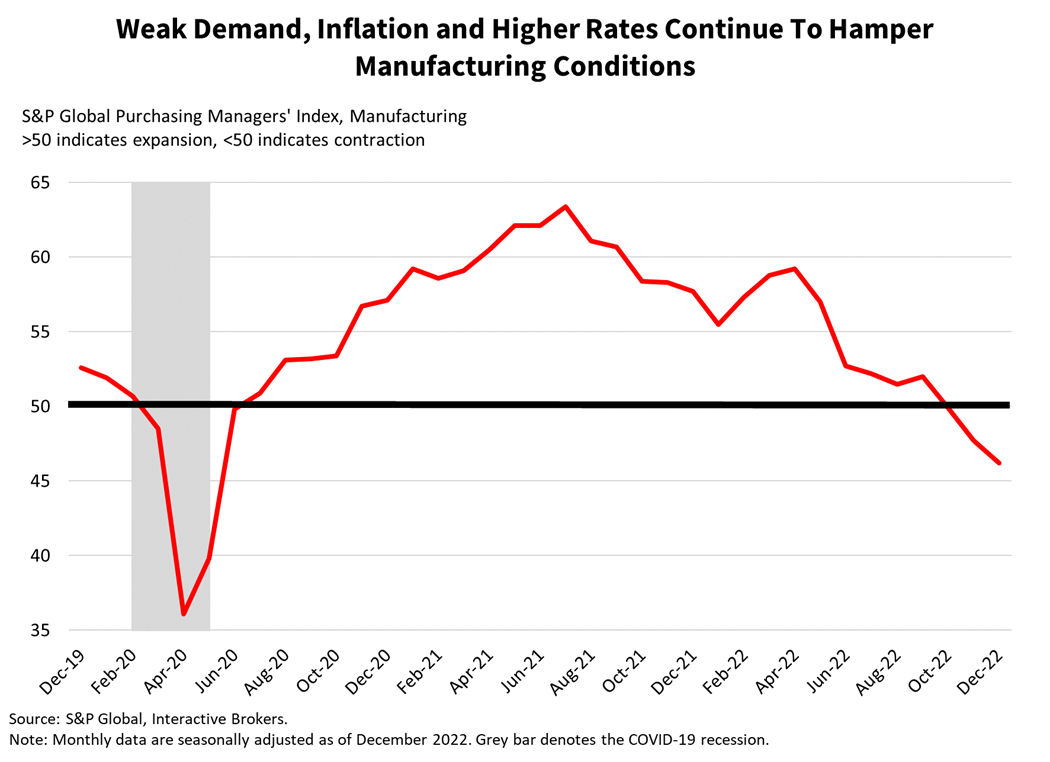

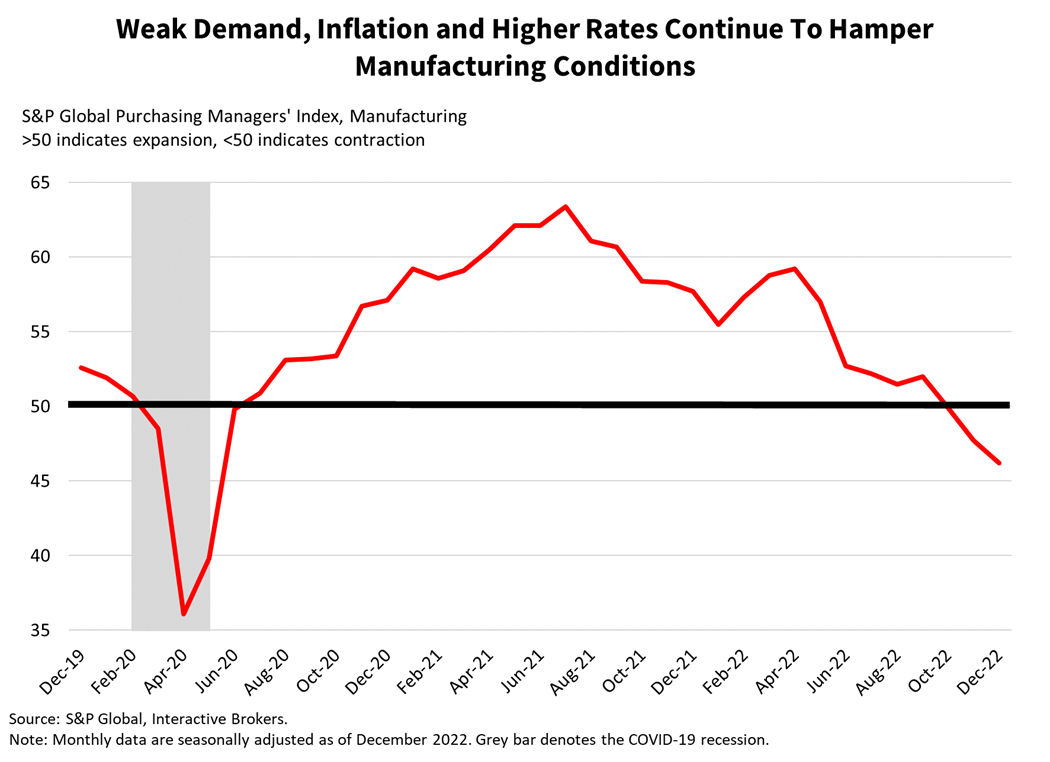

In another blow to investors’ already weakened sentiment, manufacturing conditions have dropped further into contraction territory, the result of three consecutive months of decline. Today’s December Flash Manufacturing PMI of 46.2 also reflects the third consecutive month below the expansion-contraction threshold of 50. The 46.2 index reading was worse than the 47.7 from last month and near expectations of 46. Customer orders were down again while input price pressures softened, indicative of a slowing consumer and supply chain improvements. The PMI report for the euro area showed a similar trend but its 47.8 reading was better than last month’s 47.1 result, indicating improved momentum. Since the release of the reports, equities have fallen further with the S&P 500 Index now down over 1%, yields climbing on the long-end while the short-end and the dollar remain roughly unchanged.

In today’s report, manufacturing new orders declined at the fastest rate since May 2020. The category is the heaviest weighted segment of the index and reflects pressure on company revenues and declining purchasing power among customers. The decline was less severe in the accompanying PMI-services report, which has been benefiting from pent-up demand among consumers who were unable to enjoy travel, live entertainment and dining out during COVID-19 pandemic lockdowns. Even though orders from services businesses declined less than other industries, the category experienced a slowdown in hiring, which is an encouraging development in the battle against inflation. The Federal Reserve (the Fed) has commented that inflation is moderating in goods and is likely to moderate in housing services, but non-housing services inflation has been persistent because the category is labor intensive and highly sensitive to wage pressures.

Today’s report illustrates how fighting inflation often comes at a cost—slowing economic growth. On a positive note, manufacturers’ output expectations increased to the highest level in three months, driven by modest supply chain improvements and moderating increases in input costs. The expectations, however, are still at historically low levels due to customer weakness and work backlogs falling for the third consecutive month. In addition to the Fed’s rate increases weakening customer demand, the central bank’s balance sheet reduction program is also contributing to challenges with corporate financing. Challenges with tighter financial conditions are unlikely to ease soon, with U.S. Fed Chairman Jerome Powell emphasizing on Wednesday that the central bank won’t back off its tightening until it is confident that inflation is under control. Powell added that he doesn’t expect the central bank to lower rates next year, which was contrary to investor expectations and the trigger that started the current market selloff from right beneath the S&P 500’s 200-day moving average and the year-to-date downtrend line. Powell added that the central bank expects U.S. GDP to grow only 50 basis points (bps) in 2023, significantly below trend.

Monetary policy tightening typically works its way through the interest-rate sensitive sectors first, like manufacturing, before the cooling in those sectors begins to negatively affect the broader economy. The Fed is forecasting a 90-bp increase in the unemployment rate while expecting GDP to grow only 50 bps in 2023, an ideal scenario. However, the economy has never avoided recession after a 90-bp increase in the unemployment rate. Chairman Powell’s goal of threading the needle to submerge job openings and cool wage growth while barely affecting unemployment may prove to be an economic miracle of which he’d deserve a high-five. Or a high-six, if the dynamics of the current economy push the Fed to raise the fed funds rate even higher than current expectations.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.