Stocks – NONE

Macro – SPY, QQQ, XBI, HYG, XLU

Stocks jumped on November 29 as volatility came down sharply. I noted this was highly likely on Sunday, but the S&P 500 wasn’t able to get up to 4700. Instead, it stalled at 4,675. The VIX jumped too much on Friday, and this snapback was obvious once we didn’t get a significant drop at the open.

S&P 500 (SPY)

The IV crush pushed the S&P 500 higher to 4675, which was a resistance level, and that is where it stopped rising. It was also the 61.8% retracement of what I believe was wave three down; therefore, today’s up move could be the completion of wave 4. Thus, we should start wave five tonight or tomorrow in the futures, resulting in that drop to support I have looked for at 4530. Let’s see what happens first before we think further out.

NASDAQ (QQQ)

There is a broadening wedge right now in the Qs, and these broadening wedges have been breaking in the direction of the previous move. The broadening wedge going into October was preceded by a rising trend, which led to a breakout. This wedge was proceeded by a down move and should result in a move down to around $383.

High Yield (HYG)

All the recent gaps in the HYG are now filled, except for the lower one. That corresponds nicely to the predicted moves more down in the SPX and QQQ.

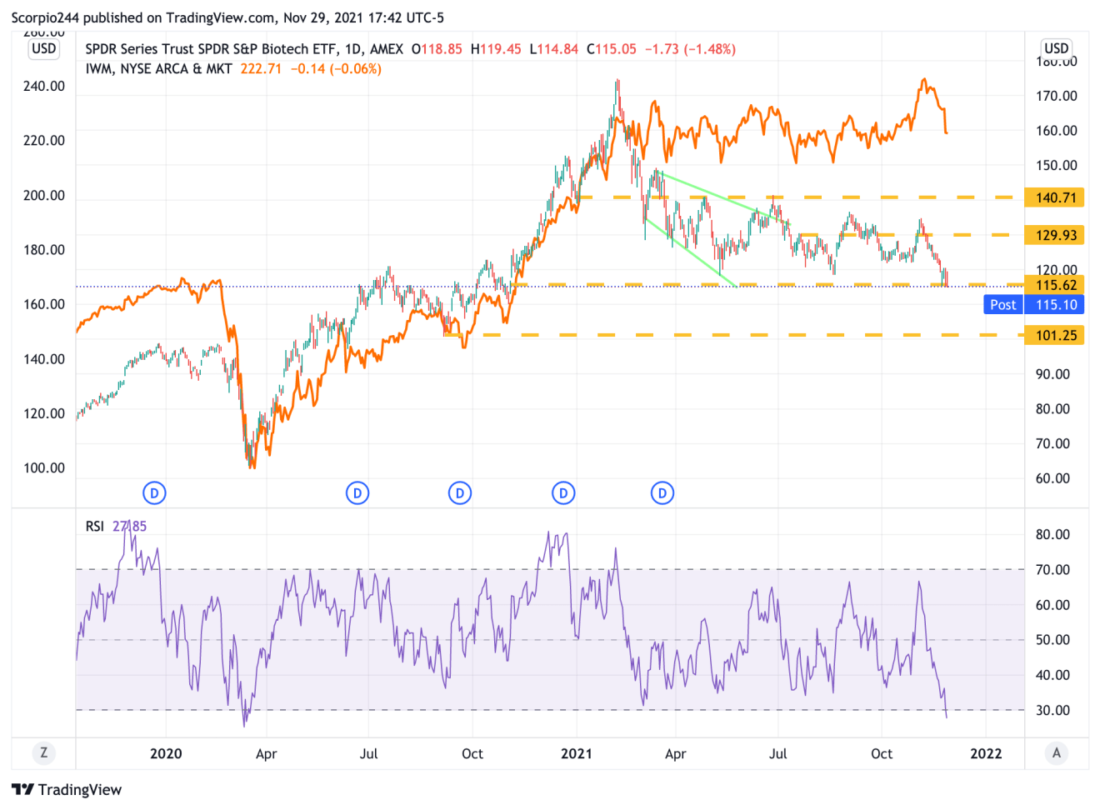

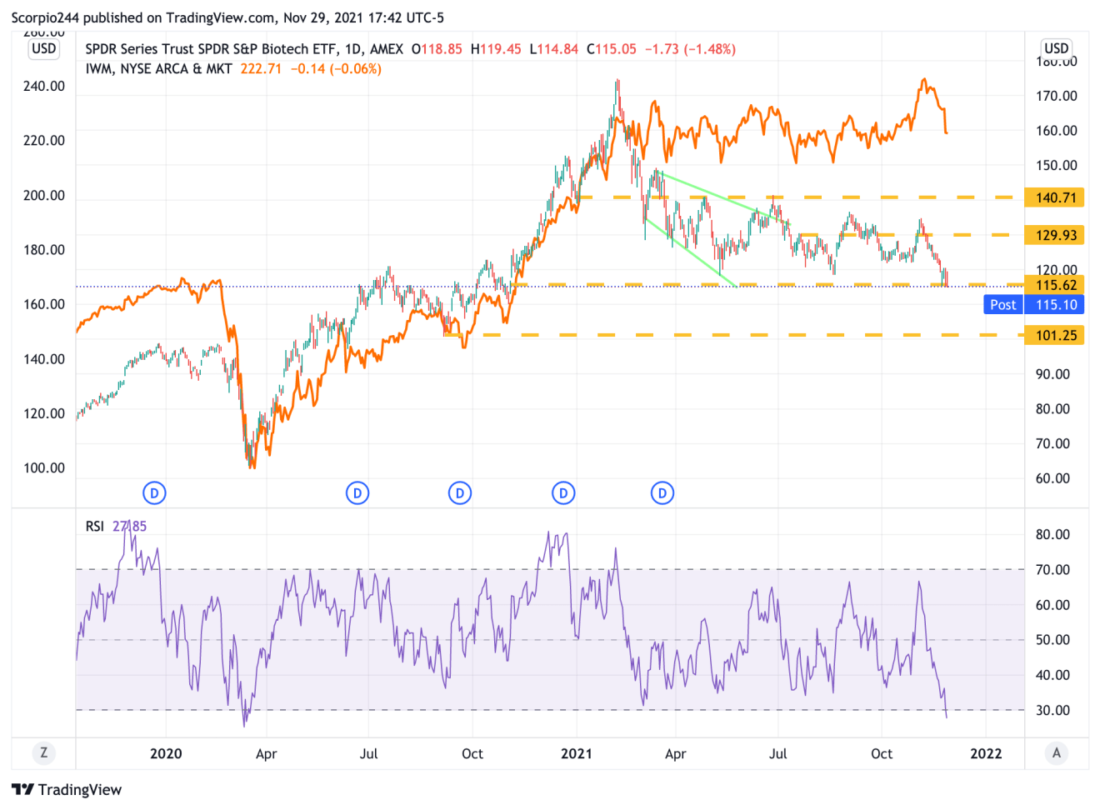

Biotech (XBI)

The Biotech ETF (XBI) is close to breaking a significant support level here, $115. It could set up a drop back to $100 over time. It is terrible news for those Russell 2000 fans, too, because many biotech stocks help move the Russell around.

RISK (XLU/XBI)

Meanwhile, the risk appetite in the market may be ready to take a turn for the worse, based on the ultimate risk-on/risk-off gauge. The biotech (XBI)/Utility (XLU) ratio has a giant reverse Head and Shoulder pattern present and is about to break the neckline, up. It would mean the XBI underperforms XLU; it is probably not a good sign of what’s to come anytime that happens.

Anyway, that’s all for today. I do not see anything for individual stocks today.

–

Originally Posted on November 29, 2021 – Stocks Rise on November 29 On Predictable Volatility Crush

Disclosure: Mott Capital Management

Mott Capital Management is the portfolio manager for one portfolio offered by Interactive Advisors. Interactive Advisors clients do not invest directly with the Portfolio Managers like Mott Capital Management, and the Managers do not have discretionary trading authority over Interactive Advisors client accounts. The Portfolio Managers on the Interactive Advisors platform simply license their trade data to Interactive Advisors, which then allows its clients to have the same strategy and trading decisions mirrored in their accounts if the Portfolio is in line with their risk score. Portfolio Managers like Mott Capital Management implement their trading philosophy and strategy without knowing the identity of Interactive Advisors’ clients or taking into account these clients’ individualized circumstances.

Mott Capital Management has entered into a Portfolio Manager License Agreement with Interactive Advisors pursuant to which it provides trading data IA uses to offer a portfolio to its investment advisory clients. Mott Capital Management is not affiliated with any entities in the Interactive Brokers Group.

Interactive Advisors is an affiliate of Interactive Brokers LLC.

Pursuant to the Investment Management Agreement between Interactive Advisors and its clients, all brokerage transactions occur through Interactive Brokers LLC, an affiliate of Interactive Advisors. The use of an affiliate for brokerage services represents a potential conflict of interest as Interactive Brokers LLC is paid a commission on trades executed on behalf of Interactive Advisors. Interactive Brokers LLC does not consider this conflict material as it does not sell, solicit, recommend, trade against or otherwise attempt to induce Interactive Advisors to place any orders in any products. Interactive Advisors does not offer services through any other broker-dealer. All trading by Interactive Advisors is self-directed. Interactive Advisors clients acknowledge this potential conflict of interest and authorize Interactive Advisors to execute transactions through Interactive Brokers LLC when they open an Interactive Advisors account. Clients should consider the commissions and other expenses, execution, clearance, and settlement capabilities of Interactive Brokers LLC as a factor in their decision to invest in an Interactive Advisors Portfolio. Interactive Advisors believes it satisfies its best execution obligation by trading its clients’ trades through Interactive Brokers LLC. While there can be no assurance that it will in fact achieve best execution, Interactive Advisors does periodically monitor the execution quality of transactions to ensure that clients receive the best overall trade execution pursuant to regulatory requirements.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Mott Capital Management and is being posted with its permission. The views expressed in this material are solely those of the author and/or Mott Capital Management and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.