TLDR: The cult of Musk is creaking and that might put the brakes on Tech’s ability to rally. Also, we snatched 2nd place in FT Alphaville’s Meme of the Year contest!

The Cult of Musk is creaking, and that’s bad for Tech

TLDR: retail investors are withdrawing from the market and institutional investors would rather buy bonds and utilities. Who’s left to buy Tech?

On Monday Alphaville wrote about the souring mood amongst some of Musk’s long-time supporters.

This is an interesting piece per se, in particular when it comes to the responsibility of the current Board of Directors – how the heck did they allow Elon to scamper away and leave TSLA unattended.

But TSLA’s 70% fall from peak reaches much further than its understandably sour shareholders. You might not remember but at one point in 2021 TSLA’s options accounted for 50% of the option market in the US by volume – including SPX!

The persistent bear market in TSLA has far reaching implications for the withdrawal of retail traders from the market – which in turn underpinned the rally in tech stocks up to 2021.

It is fair to ask if the time has come for Tech stocks to shine again, especially as we look ahead to a) the end of the Fed hiking cycle and b) narrowly avoiding a recession.

But the retail traders who might be there to believe and buy the stocks are kind-of exhausted and out of money or willingness to trade.

And don’t look at institutionals: with 2-year US Treasuries offering a risk-free 4.2% yield, institutions will be much less inclined to buy into growth stories this year.

The Peak & Valley Indicators

The Valley Indicator flashed green a few days back. Keep an eye on the Peak indicator for a possible peak.

New: the P&V Indicators are soon coming to TOGGLE, along with RangeFinder. Stay tuned.

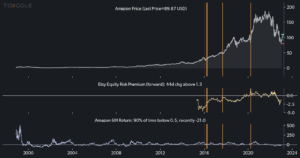

Idea Spotlight: Amazon

According to the Goldman chart above, Amazon had the 3rd highest average daily option volume in the lead up to Nov 15 – almost $150b worth.

TOGGLE observed that equity yield indicators for Etsy rose and historically, this led to a median increase in Amazon’s stock price.

—

Originally Posted January 11, 2023 – The cult of Elon cracks

Disclosure: Toggle AI

IB Global Investments LLC, a subsidiary of Interactive Broker Group Inc., the parent company of Interactive Brokers LLC, is a minority owner of Toggle AI.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Toggle AI and is being posted with its permission. The views expressed in this material are solely those of the author and/or Toggle AI and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Options Trading

Options involve risk and are not suitable for all investors. Multiple leg strategies, including spreads, will incur multiple commission charges. For more information read the "Characteristics and Risks of Standardized Options" also known as the options disclosure document (ODD) or visit ibkr.com/occ