As a long-suffering fan of the New York Jets, I know quite a bit about disappointment, missing low expectations, and blown leads. Those who try to go long US equities ahead of FOMC meetings should also know some of those feelings.

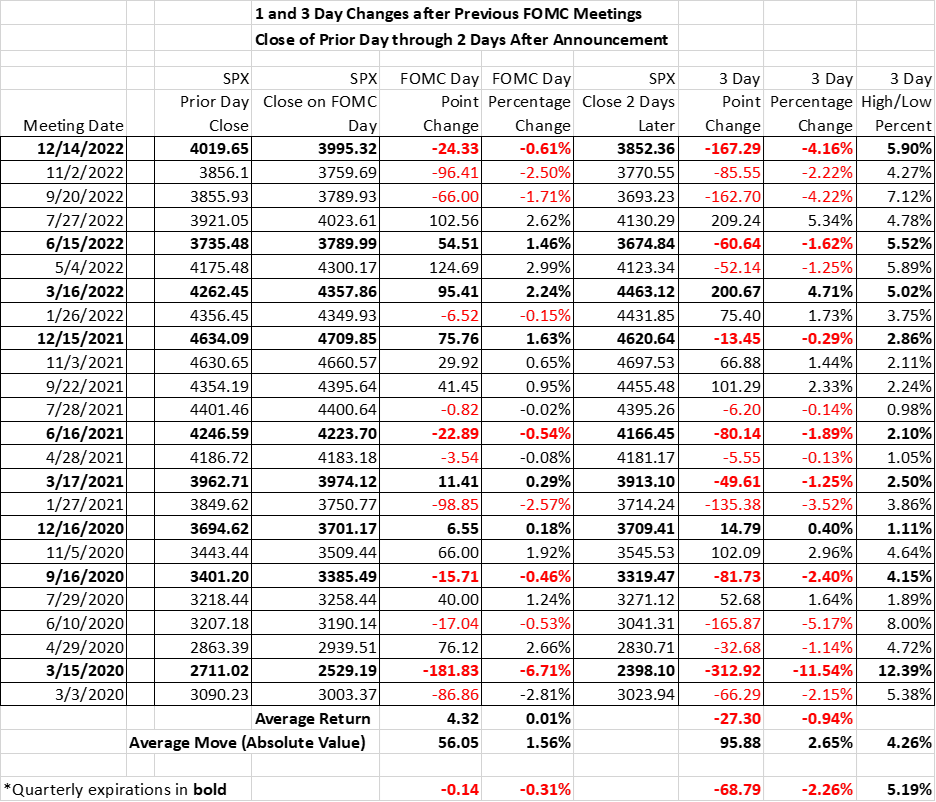

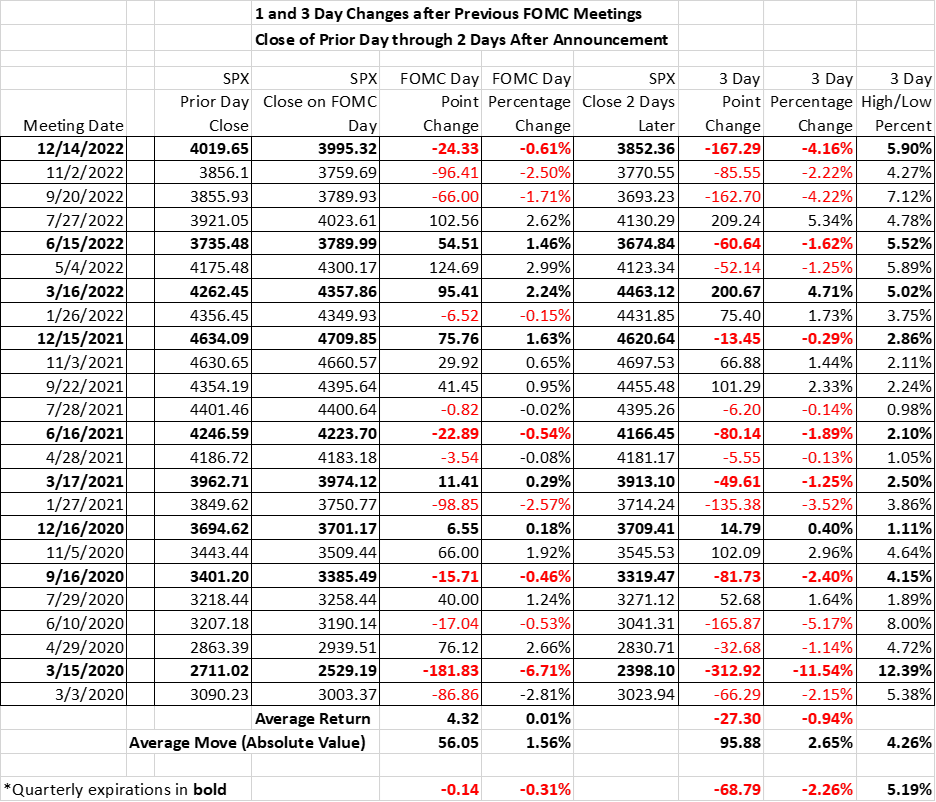

The table below tracks the performance of the S&P 500 Index (SPX) on FOMC meeting days and over the Wednesday-Friday period that includes and follows those events. We focus on the three-day period rather than just FOMC itself because, as we have noted, traders react instantly while investors require more time to consider their moves. SPX closed lower after 5 of the last 6 three-day periods. Even the Jets have only lost 4 of their last 6 games. And after those last 6 meetings, on 2 occasions we saw SPX give back a lead – twice closing lower in 3 days despite gaining in the immediate aftermath of the meeting. After a promising start to the season, the Jets are now 7-7; SPX is 5-9 after the last 14 FOMC meetings.

Source: Interactive Brokers

But there is a key difference between football and markets: in football, the spectators have very little impact on the outcome. With markets, the spectators are also the on-field participants. And while fans often clamor for a change in the coaching staff after a period of losses, that’s usually because it’s easier to change the coach than the players. In the case of the market, Coach Powell is here to stay for a while. It’s up to the players to change their strategies.

Last week we offered a pre-game scouting report, so to speak. On Wednesday morning, we noted the tendency for stocks to fall after FOMC meetings:

The one takeaway is that the equity market tends to reverse after a consensus expectation goes beyond the Fed’s comfort level. During the relentless accommodation of 2020 through mid-2021, the S&P 500 Index (SPX) tended to sell off after the FOMC. Once the rhetoric, and later the actual policies, shifted to a more restrictive stance in mid-2021, SPX tended to rally. Around the past two meetings, when investors began to hope for something accommodative – a pivot, a peak, a pause – equities reacted negatively when none was forthcoming. As noted above, both stocks and bonds have been pricing in a switch to Fed policy over the coming year.

As we have seen all-too-often, traders and investors got ahead of the Fed, and that proved problematic. It’s up to market participants to manage their expectations and recognize that the Fed remains quite committed to fighting inflation and far less concerned with markets’ adverse reactions. Remember that the last time we saw equities rally after the FOMC meeting was in July. That enthusiasm arose because traders largely misinterpreted Powell’s use of the term “neutral” during the press conference. The ensuing rally lasted about a month, at which point it came to an abrupt end after Powell’s Jackson Hole speech. Since then, the bulk of commentary from Fed talking heads has been seemingly designed to quash enthusiasm about a potential change to policy.

Just as the Jets fans need to lower their expectation because the team is saddled with subpar quarterback for the near-term, Federal Reserve fans need to lower their expectations for an imminent change to Fed policy. The Fed is reckoning with a tough battle against inflation, and they seem quite resolute in their fight. Until or unless they have reason to change their game plan, investors should be like Jets fans – expecting disappointment despite some encouraging signs.

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.