A perfect storm of events that has been churning throughout the real estate market this year has continued to weigh on home builders, with October building permits dropping 2.4% from a month earlier compared to the 1.8% decline expected by a consensus of analysts. The seasonally adjusted annual rate of 1.526 million was the lowest level since August 2020.

The headline number, while discouraging, reflects an even more significant change—home builders are shifting their focus from single-family houses to apartments, a reflection of housing affordability hitting multi-decade low levels. In a similar fashion to the months leading up to the 2008 real estate market debacle, the percentage of average monthly payments to household income and personal income have been at record high levels throughout this year, which is creating demand for rental units among Americans who can’t afford homes. In July, I highlighted these brewing risks in a Business Insider interview. Since then, the consensus outlook regarding serious risks of home price declines has shifted more in-line with my views and I continue to believe that the residential real estate market is poised for a double-digit decline in prices.

Permits for single-family home structures in October declined a whopping 3.6% month-over-month (m/m) and 22.1% from the same period a year ago. Apartment buildings, on the other hand, were stronger, declining only 1.9% m/m but rising 11.2% year-over-year (y/y). Starts and completions, released in the same report this morning, reflect the same trend of single-family construction being weaker than apartment building construction. From a regional perspective, today’s data shows that overall building permit contractions were driven by the West and the Northeast with declines of 12.9% and 7.0 % during the period. The South was a bright spot in the report, with permits rising 2.4% while the Midwest remained unchanged. Meanwhile, housing starts and completions weakened faster than permits with declines of 4.2% and 6.4% on the month.

In a similar manner, yesterday’s NAHB/Wells Fargo Housing Market Index release, which measures the perceived strength of the single-family housing market, dropped for the tenth consecutive month and reflected the worst homebuilder sentiment since 2012 excluding low pandemic readings in April and May 2020. Higher monthly mortgage payments driven by high prices and rising rates have led to a lack of homebuyers. Construction costs have also climbed substantially due to higher prices for materials and rising worker wages, resulting in compressed profit margins for builders.

New home supply has risen significantly and home builders have resorted to discounts and concessions to make sales. Existing home supply, on the other hand, remains subdued, as owners who locked in low rates have little incentive to sell. At some point early next year, homeowners who need to sell will have to lower their prices to compete with prices of new homes.

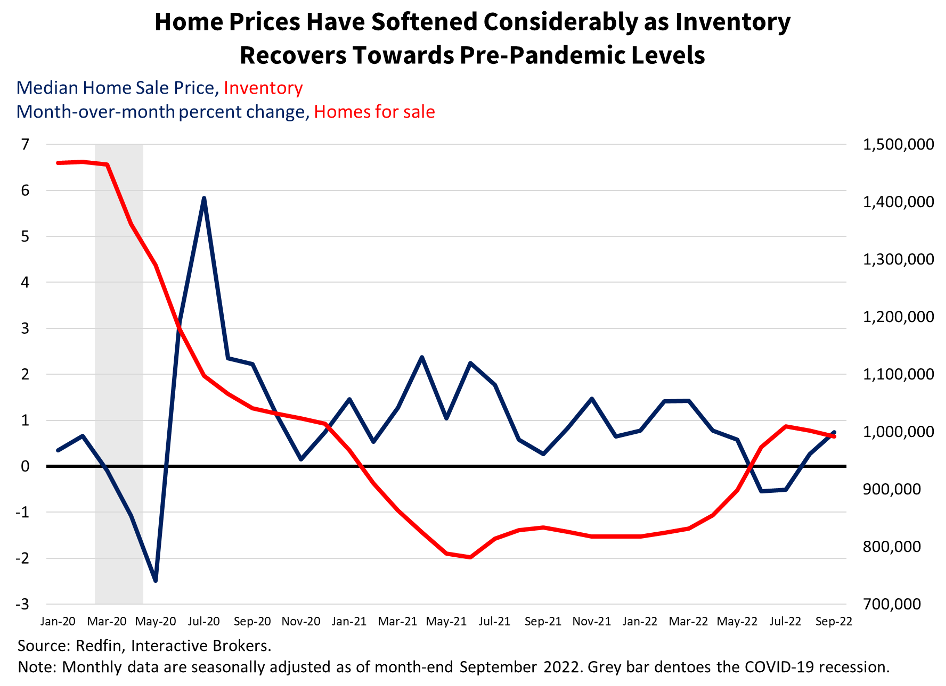

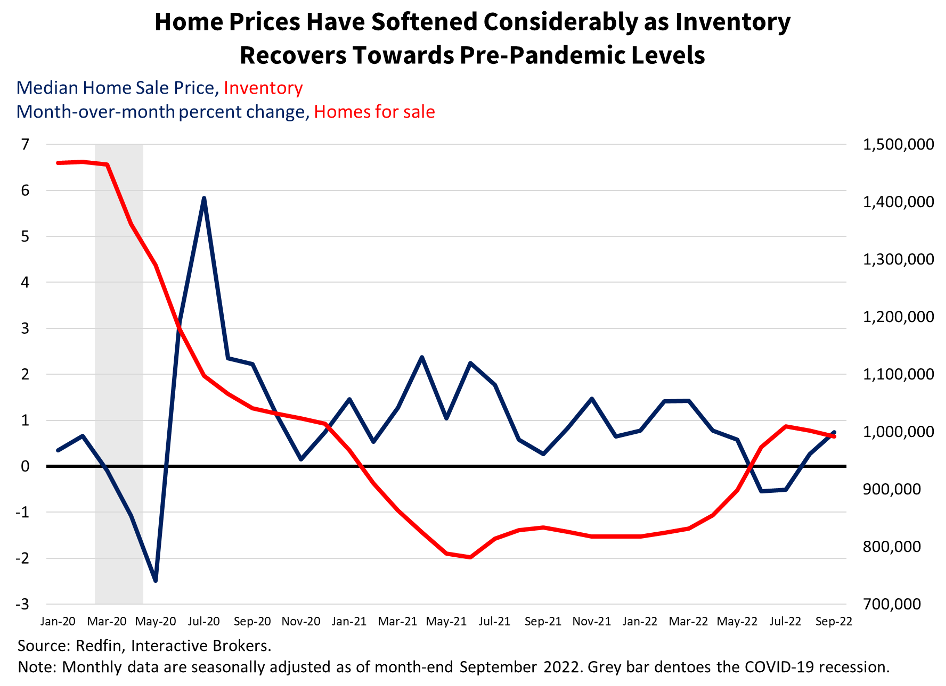

The macroeconomic backdrop for home builders continues to deteriorate and is likely to worsen as the Federal Reserve (the Fed) continues to raise rates and reduce its balance sheet, leading to higher borrowing costs, reduced credit availability and declining liquidity levels. This headwind is already causing home values to fall, with two consecutive months of price declines earlier this year. At the same time, inventory has been growing steadily since this summer, rising from approximately 800,000 homes to 1 million homes. On a non-seasonally adjusted basis, home prices have fallen for four consecutive months: -0.7% in June, -3.6% in July, -1.4% in August and -0.7% in September. Due to the drastic, historic shift in the real estate market, I felt the need to analyze the seasonally and non-seasonally adjusted figures.

The historic rise in home prices after the emergence of COVID-19 can be attributed to tons of liquidity, near zero interest rates, purchases of mortgage-backed securities (MBS) by the Fed totaling $40 billion a month, a decade of low construction levels, high and rising commodity prices, labor shortages, supply chain disruptions, individuals rushing out of cities and the rise in the wealth effect as a result of the high liquidity environment driving up prices for stocks, crypto currency and other assets.

Many of the variables that propelled the housing market in 2020 are aggressively reversing due to recessionary pressures, inflation, the Fed’s monetary policy shift and the return to normal from COVID-19. Consider the following:

- As the Fed hikes interest rates and winds down its balance sheet, housing valuations simply can’t hold up. The shift from the 2.7% mortgage rate in January 2021 to the 7.3% rate in September has created too drastic of an increase in monthly payments for home prices to hold up in a low liquidity, high volatility, recessionary environment.

- In addition to higher interest rates, the Fed’s balance sheet is shifting lower.

- Commodity prices are well off their high levels with lumber prices declining roughly 50% from previous highs.

- Recently, the labor market has been weakening slightly and leading to increased labor availability.

- Supply chains are easing due to softening demand for goods.

- Cities are also returning to more normal conditions as the COVID-19 pandemic is fading.

- Stocks are in and out of a bear market while crypto currency is in a brutal winter.

- The Fed has acknowledged that it has stimulated the economy too much and housing needs a reset. The reset is especially needed for the millennial generation that’s faced with the worst housing affordability in history.

- Strict lending standards and a shortage of homebuilding following the Great Financial Crisis are likely to support home prices somewhat; however, lofty valuations born in a low-rate, high-liquidity environment cannot sustain themselves in a high-interest-rate, low-liquidity one.

These factors, in my view, point to double-digit percentage declines in real estate prices.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.