Last week gave investors an important peek into the state of the US consumer. Despite historically high inflation and rising interest rates, consumers still appear to be relatively strong, although they continue to be choosy with how they allocate their discretionary income.

PPI and Retail Sales Look Bright, But Consumer Debt is Mounting

Last week there were two economic indicators released featuring October statistics that were a positive sign for consumers. Producer Price Index came in at 8%, below the 8.3% expectation, and showing the fourth consecutive month of declines. Retail sales also reported better-than expected at 1.3%, vs. the 1.0% estimate. Strength was led by large ticket items such as motor vehicles which increased 1.3% and furniture which increased 1.1%.

Retail Earnings Parade Begins and It’s Mostly Good News

We also got earnings reports from major retailers including Walmart (WMT), Target (TGT), TJX Companies (TJX), Ross Stores (ROST), Macy’s (M), Kohl’s (KSS), Gap (GPS), Home Depot (HD) and Lowe’s (LOW). Discount and bargain names such as Walmart, TJX and Ross Stores performed well, all beating on the top and bottom-line, with Walmart even raising guidance and buying back $20B in stock. However, fellow discounter Target didn’t fare as well, missing by $0.55 on the bottom-line and warned of a soft holiday shopping season.

Home Improvement names also did well, with Home Depot and Lowe’s beating handily on the top and bottom-line. Lowe’s raised full-year EPS to a range of $13.65 – $13.80, up from $13.10 – $13.60. Mortgage rates that now top 7% have encouraged homeowners to stay put and invest in their own homes rather than purchase a new one.

Department stores Macy’s and Kohl’s reported better than expected sales and profits, but still showed year-over-year declines. And while Macy’s actually raised their full-year earnings guidance based on a positive outlook for the holiday shopping season, Kohl’s pulled full-year guidance because of uncertainty in the retail space. Gap also beat expectations for Q3, but provided a cautious holiday outlook.

With 94% of S&P 500 companies reporting for Q3 at this point, the overall EPS growth rate remains at 2.2%, unchanged for the fourth consecutive week, and the lowest growth seen in two years.

Holiday Shopping Season Preview

The holiday shopping outlook provided by retailers has been mixed thus far as detailed above, with the National Retail Federation forecasting growth between 6 – 8% this year. This would be above the 10-year average of 4.9%, but below the extraordinary growth of 13.5% clocked last year.

Consumers are laser-focused on value this season, with many retailers such as Gap admitting that they’ve had to offer deep discounts to push a glut of inventory. There also seems to be more of a willingness to spend on other things such as travel and experiences in the wake of the COVID pandemic. Many airlines and cruise liners all commented on this pick up in demand on their Q3 calls.

Who is Left to Report for Q3 Earnings Season?

Just ahead of the Thanksgiving holiday we will get a trickle of remaining reports for Q3, mainly from the tech and retail sectors.

Monday, November 21

BMO – J.M. Smucker Company (SJM)

AMC – Dell Technologies (DELL), Zoom Video Communications (ZM), Urban Outfitters (URBN)

Tuesday, November 22

BMO – Baidu (BIDU), Dick’s Sporting Goods (DKS), Medtronic (MDT), Dollar Tree (DLTR), Best Buy (BBY), Abercrombie and Fitch (ANF), American Eagle (AEO), Burlington Stores (BURL)

AMC – Hewlett-Packard (HPQ), VMware (VMW), Guess (GES), Nordstrom (JWN)

Wednesday, November 23

BMO – Deere & Company (DE)

That’s a Wrap

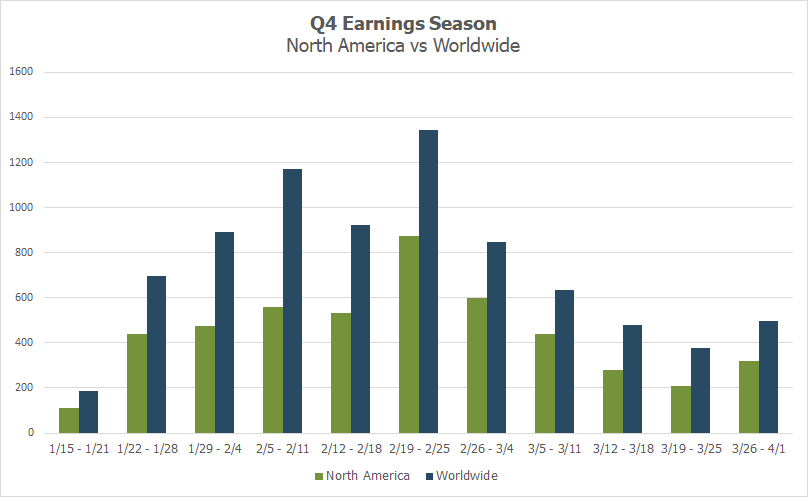

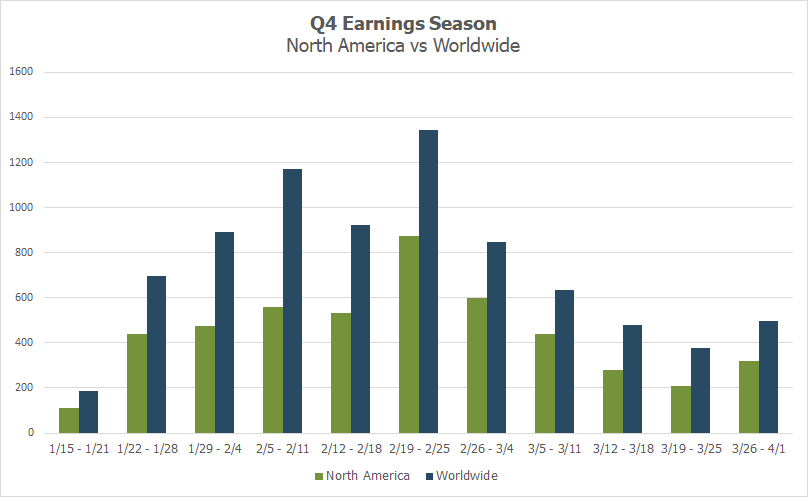

With Q3 now in the rearview, the earnings report trough will take us into the New Year. The fourth quarter earnings season will begin with reports from the big banks the week of January 9.

Source: Wall Street Horizon

—

Originally Posted November 22, 2022 – Third Quarter Earnings Season Wraps Up With a Look at Retail

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Wall Street Horizon and is being posted with its permission. The views expressed in this material are solely those of the author and/or Wall Street Horizon and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.