CMT Association’s Market Insights features timely technical analysis of current global markets by veteran CMT charterholders. Each post appears on www.tradingview.com/u/CMT_Association/ in an effort to explain process, tools, and the responsible practice of technical analysis. Shared content and posted charts are intended to be used for informational and educational purposes only. The CMT Association does not offer, and this information shall not be understood or construed as, financial advice or investment recommendations. The information provided is not a substitute for advice from an investment professional. The CMT Association does not accept liability for any financial loss or damage our audience may incur.

In installments 1 – 3 we discussed building a market momentum matrix to help anticipate the business cycle. In this installment we introduce the OECD Composite Leading Indicator and plot the information derived from the momentum matrix onto a stylized business cycle. In the final installment we will make observations and share thoughts around the current cycle.

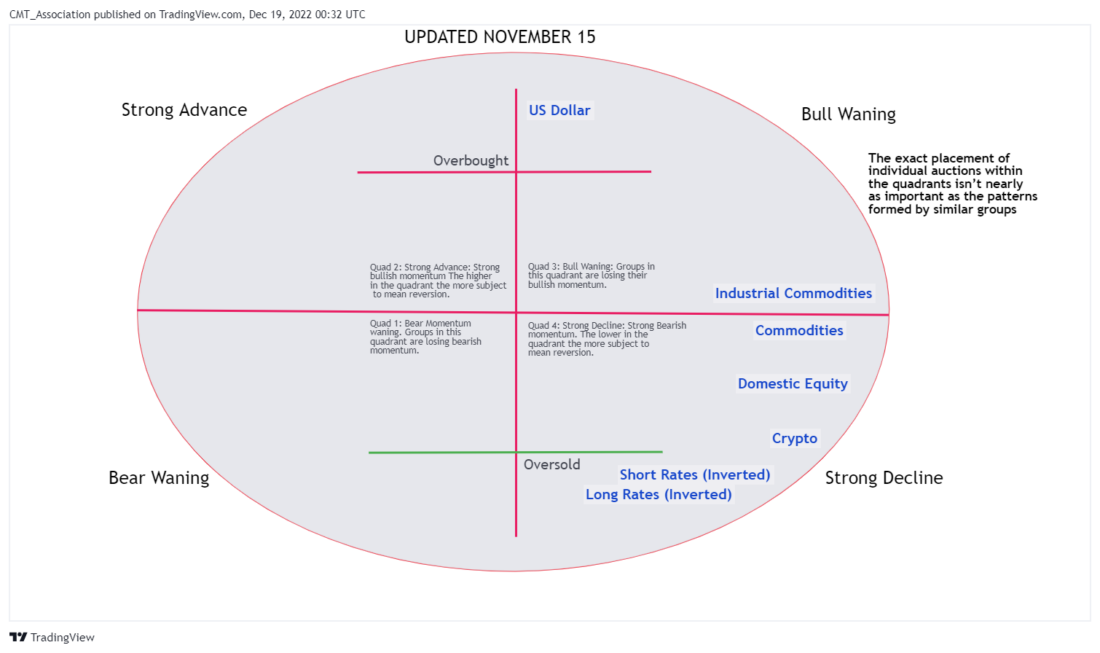

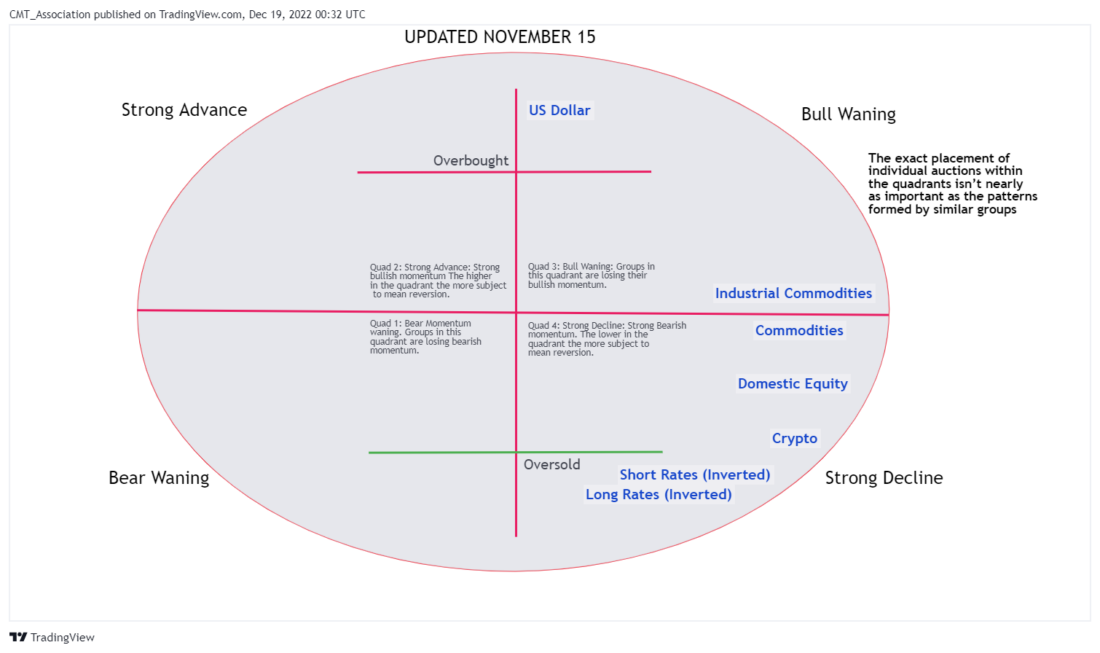

As a reminder, this is the distilled version of the momentum matrix built in the first 3 installments.

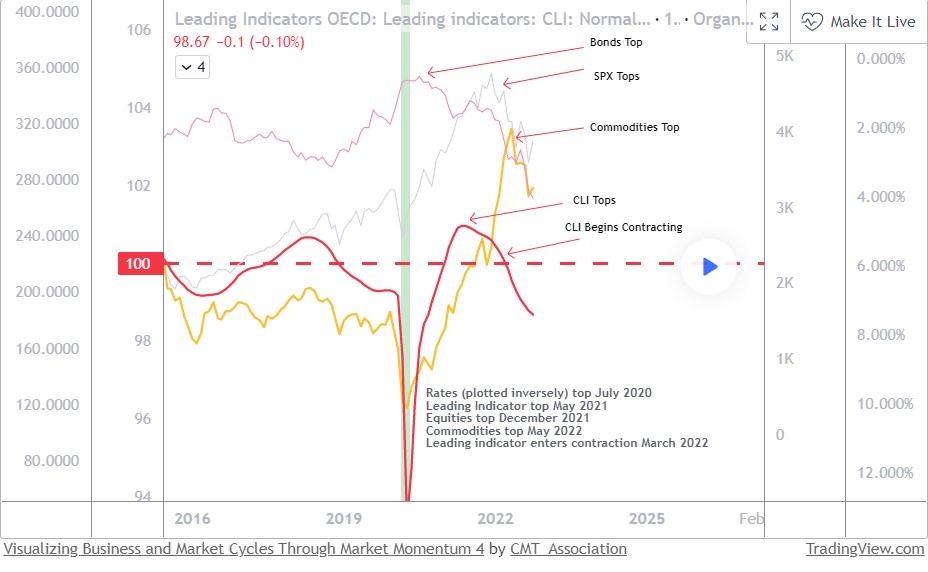

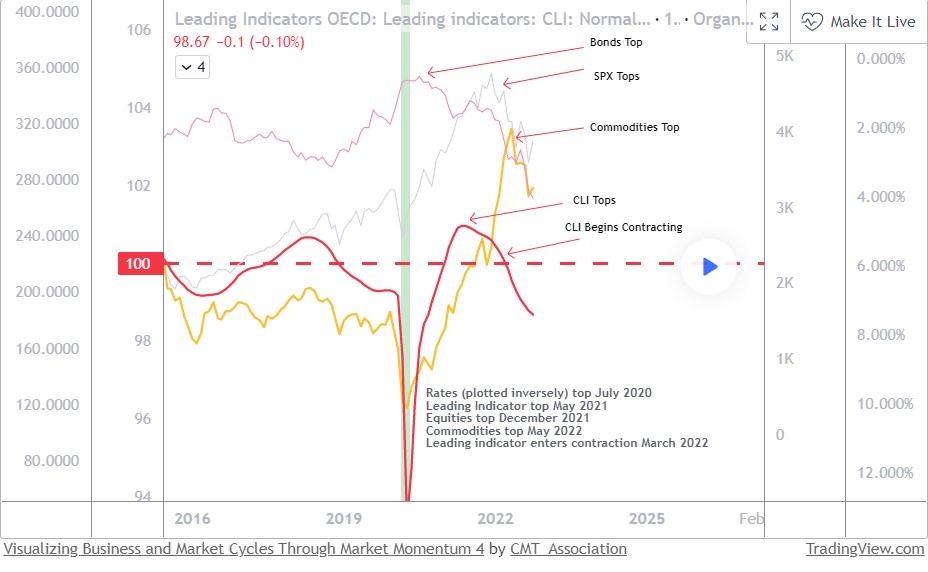

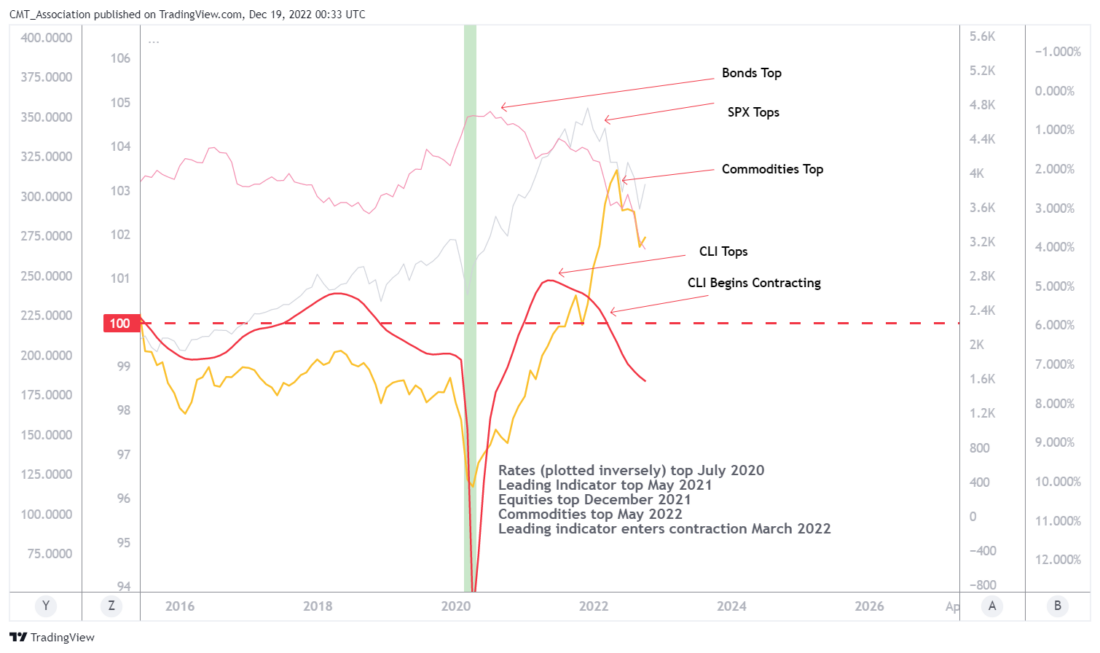

Before I plot the distilled sectors onto a stylized business/market cycle overlay, I plot equities, rates and commodities onto an overlay with the Organization for Economic Co-operation and Development (OECD) Composite Leading Indicator ( CLI ) for the United States. Readings above 100 (dashed red line) suggest economic expansion to come while below the 100 line suggests weakness, and perhaps recession to come. The index is currently below 100 and falling, consistent with future weakness.

To help visualize the cycle, I plot 10 year rates (inverted), SPX and the Thompson Core CRB index along with the CLI. Viewed in the manner the current cycle appears to be consistent with past cycles in terms of sequencing. Rates top, economy ( CLI ) tops, equities top, commodities top and finally CLI enters the contraction phase.

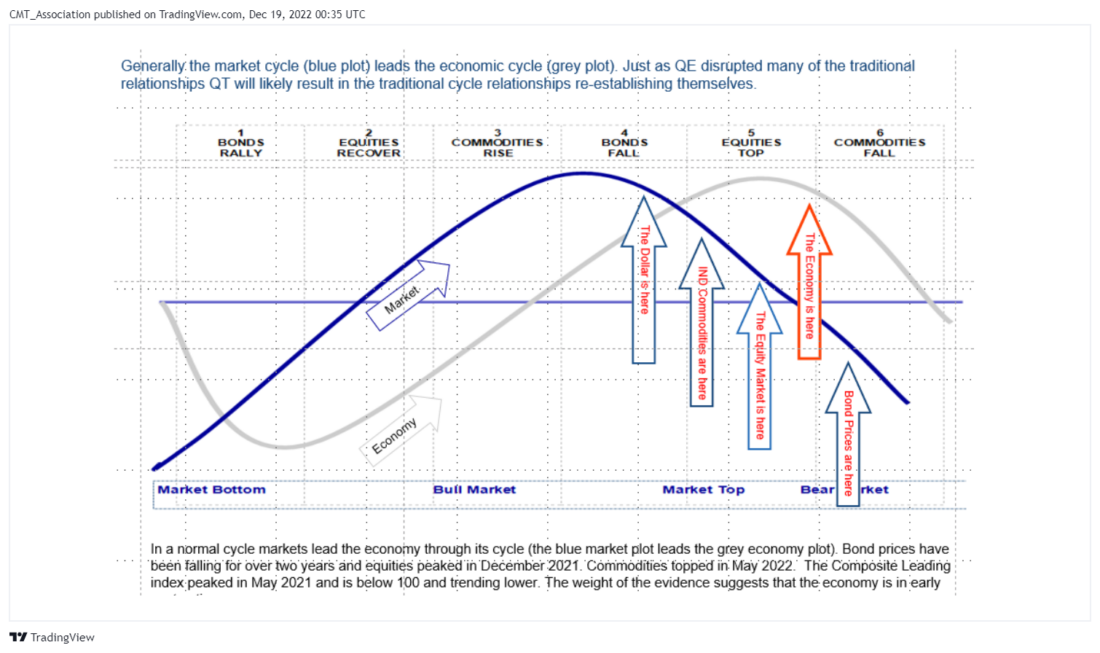

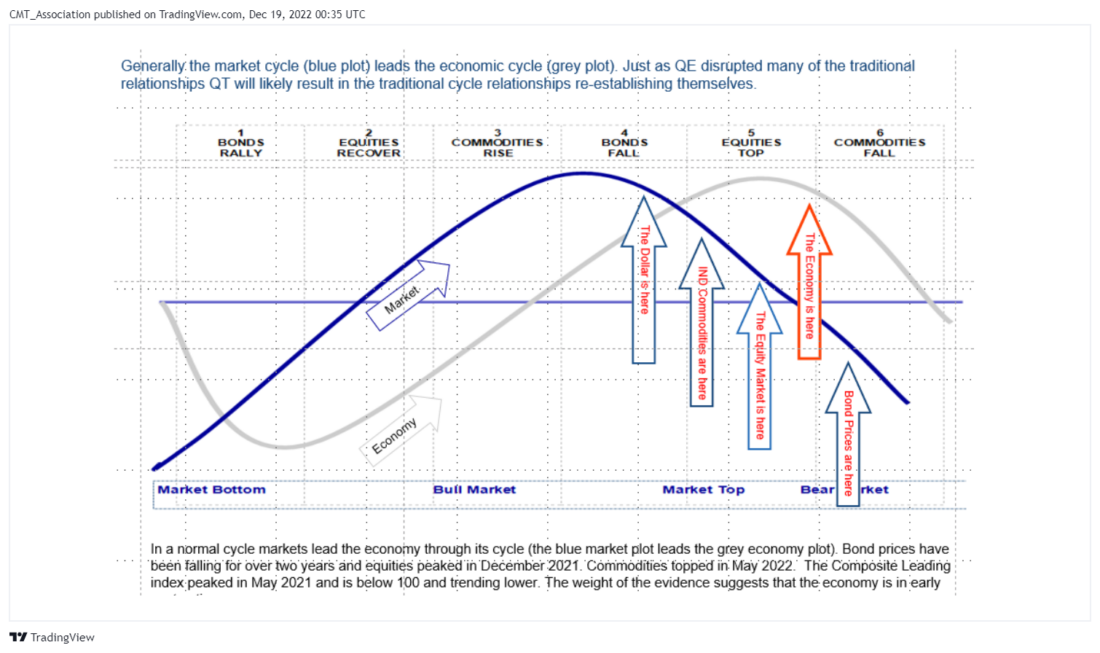

Finally, the distilled sectors are placed onto stylized market and economic cycle sine curves. If markets (dark blue curve) are correctly anticipating the business cycle (grey curve) the business cycle is somewhere past peak, and should be expected to steadily deteriorate over coming quarters.

In part 5 we will draw conclusions.

And finally, many of the topics and techniques discussed in this post are part of the CMT Associations Chartered Market Technician’s curriculum.

—

Originally Posted December 19, 2022 – Visualizing Business and Market Cycles Through Market Momentum 4

Shared content and posted charts are intended to be used for informational and educational purposes only. The CMT Association does not offer, and this information shall not be understood or construed as, financial advice or investment recommendations. The information provided is not a substitute for advice from an investment professional. The CMT Association does not accept liability for any financial loss or damage our audience may incur.

Disclosure: CMT Association

Shared content and posted charts are intended to be used for informational and educational purposes only. The CMT Association does not offer, and this information shall not be understood or construed as, financial advice or investment recommendations. The information provided is not a substitute for advice from an investment professional. The CMT Association does not accept liability for any financial loss or damage our audience may incur.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from CMT Association and is being posted with its permission. The views expressed in this material are solely those of the author and/or CMT Association and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.