It’s here. We’ve been talking about today’s FOMC meeting for weeks, and we’ll finally know the results this afternoon. With a 50-basis point hike widely telegraphed, investors will pay extra attention to the statement, the “dot plot”, and of course, Chair Powell’s press conference for clues about the path of Federal Reserve policies. Much of the outcome will depend upon whether the recent improvements in stock and bond prices will cause Powell to revert to “Jackson Hole” mode rather than his recent “Goldilocks” mode.

The key will be to see if the Chair or the Committee pushes back upon the interest rate narrative that is priced into fixed income markets. As we showed in greater depth yesterday, Fed Funds futures, which are the purest expression of rate expectations over the near term, are pricing in a higher chance for a 25bp hike at the subsequent FOMC meeting, and a peak rate in May. We have seen that peak rate drop from about 5% a week ago to 4.81% this morning. That implies a split between 25 and 50bp in February, which came into sharper focus lately, and now a previously less-anticipated split between 0 and 25bp in March. Having priced in two 25bp cuts by the end of 2023 for some time, they are now pricing in something more aggressive by the end of the coming year.

Fed Funds futures are more optimistic about the pace of rate policy than the Fed’s dot plot implies. In September’s projections, the median estimate for 2023 rates by FOMC members was 4.625%. Compare that to the futures market’s implied median rate of 4.275% Considering the recent comments by regional Fed Presidents Bullard and Williams, among others, it will be important to see whether the dot plot reflects rate expectations that remain more restrictive than the market currently expects. A 2023 median that is unchanged or higher will push back vigorously against a market that expects a return to accommodative policies.

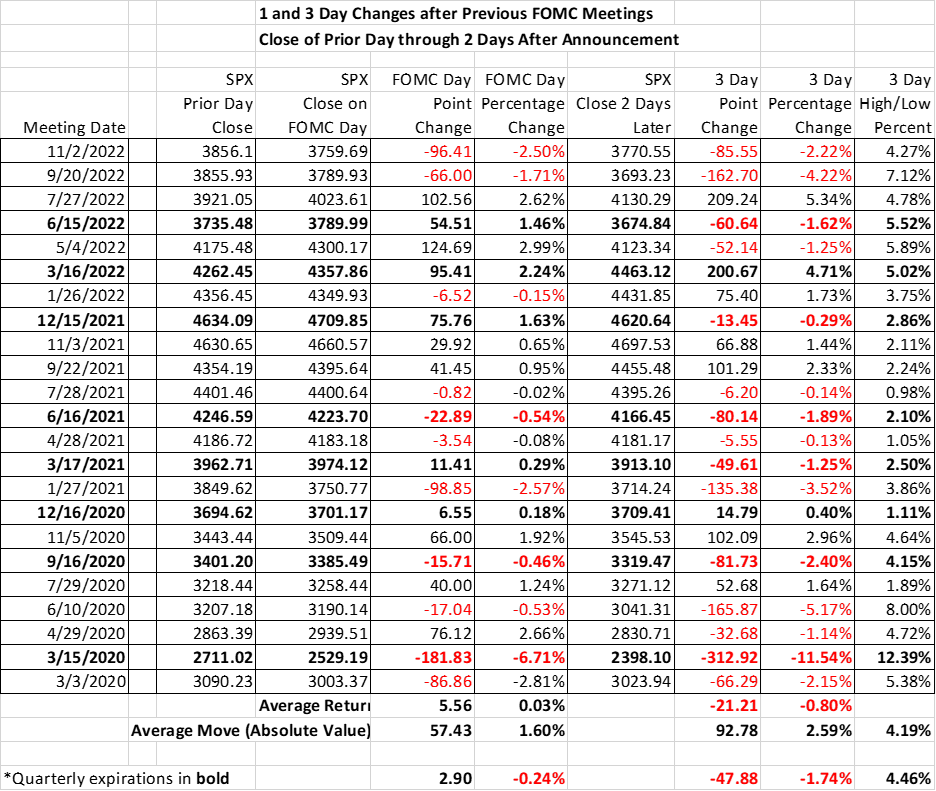

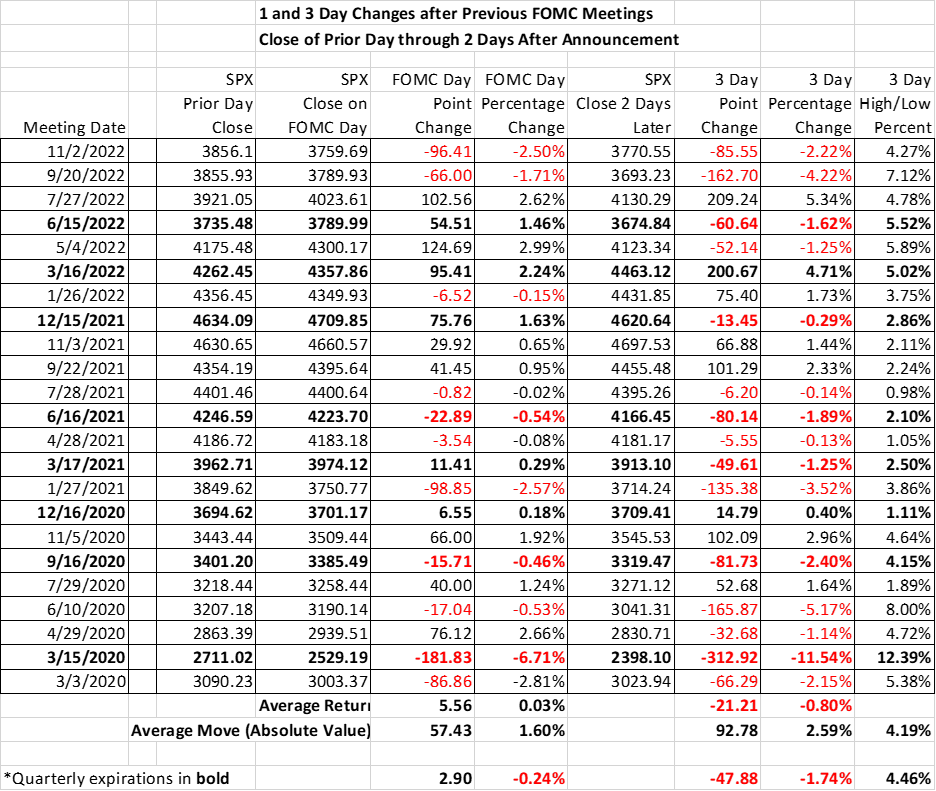

For those of us who focus upon equities, it is important to remember that we have a quarterly expiration on Friday. That increases the likelihood that any moves can be exacerbated by expiring futures and options positions. Yet as the table below shows, there is no clear pattern about the reactions to recent meetings, whether they occur in expiration weeks or not.

The one takeaway is that the equity market tends to reverse after a consensus expectation goes beyond the Fed’s comfort level. During the relentless accommodation of 2020 through mid-2021, the S&P 500 Index (SPX) tended to sell off after the FOMC. Once the rhetoric, and later the actual policies, shifted to a more restrictive stance in mid-2021, SPX tended to rally. Around the past two meetings, when investors began to hope for something accommodative – a pivot, a peak, a pause – equities reacted negatively when none was forthcoming. As noted above, both stocks and bonds have been pricing in a switch to Fed policy over the coming year. Will Powell & Co. affirm or push back against that anticipation?

Source: Interactive Brokers

At some point, probably not today, however, equity investors will need to decide which is more important to them – easy money or a decent economy. Odds are we’re not getting both. Either the economy will weaken substantially, precipitating rate cuts; or it will chug along at a decent clip, allowing the Fed to keep its inflation-fighting policies in place. Equity investors will have to make a choice that has been largely unnecessary during decades of modest inflation– are they concerned about earnings growth or are they simply liquidity-addicted junkies? Lately they seem to be more of the latter, which increases the risk that a strident FOMC could offer a nasty surprise.

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.