Gold has been a notable performer so far in 2023, with prices increasing $100/ounce from their 2022 year-end levels and reaching an eight-month high. Increasing concerns over the potential for a global recession have underpinned prices. The dollar extended its downtrend to a seven-month low this week as Fed rate hike prospects were dialed back, and this has lent support to gold as well.

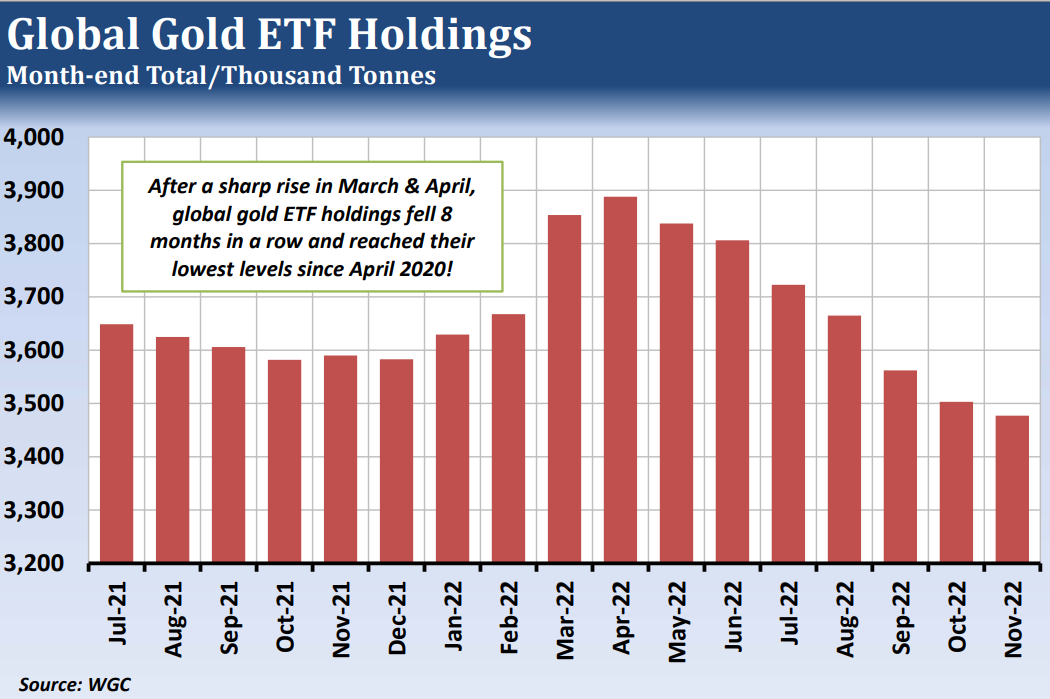

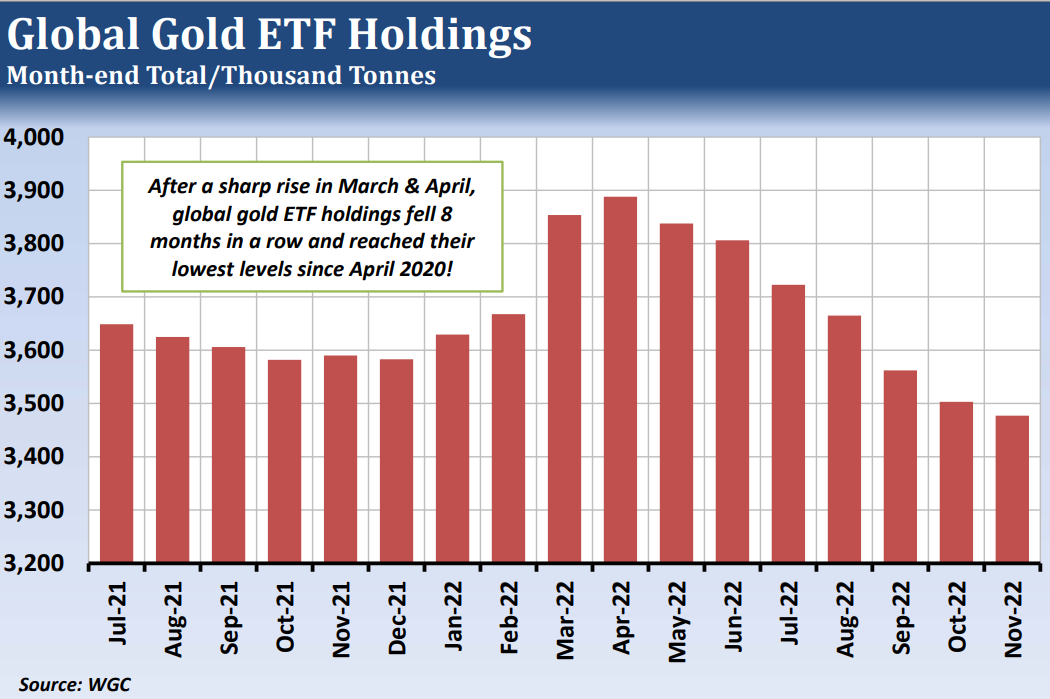

In the wake of Russia’s invasion of Ukraine last February, there was a strong buildup in gold Exchange Traded Fund (ETF) holdings. The World Gold Council (WGC) measured April holdings at 3,888 tonnes, an increase of 220 tonnes from February and close to the all-time high of 3,919 tonnes from October 2020.

Global risk anxiety and inflation concerns have subsided, and that has led to a steady outflow from ETFs. WGC’s data show that holdings declined from May to December, the longest streak of outflows since 2013/14. Holdings fell 415 tonnes (-10.6%) over that timeframe, and the December month-end total of 3,473 tonnes was the lowest since April 2020.

The two smallest outflows were seen in November (-26.1 tonnes) and December (-4.5 tonnes). It was surprising that there were any outflows at all during a period when gold prices rose by more than $170/ounce. Gold prices are up $100 so far in January, and gold ETF holdings remain close to their December month-end level. If investors surge back into gold ETFs, it could provide another boost to gold prices.

—

Originally Published January 20, 2023

Disclosure: The Hightower Report

This report includes information from sources believed to be reliable, but no independent verification has been made, and we do not guarantee its accuracy or completeness. Opinions expressed are subject to change without notice. This report should not be construed as a request to engage in any transaction involving the purchase or sale of a futures contract and/or commodity option thereon. The risk of loss in trading futures contracts or commodity options can be substantial, and investors should carefully consider the inherent risks of such an investment in light of their financial condition. Any reproduction or retransmission of this report without the expressed written consent of The Hightower Report is strictly prohibited. The data contained herein is subject to revision; independent verification is recommended. Any third party opinions regarding this report are not necessarily those of the authors. Due to the volatile nature of futures and options markets, the information contained herein may be outdated upon its release.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from The Hightower Report and is being posted with its permission. The views expressed in this material are solely those of the author and/or The Hightower Report and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: ETFs

Any discussion or mention of an ETF is not to be construed as recommendation, promotion or solicitation. All investors should review and consider associated investment risks, charges and expenses of the investment company or fund prior to investing. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.