Making Sense of Mixed Inflation Results

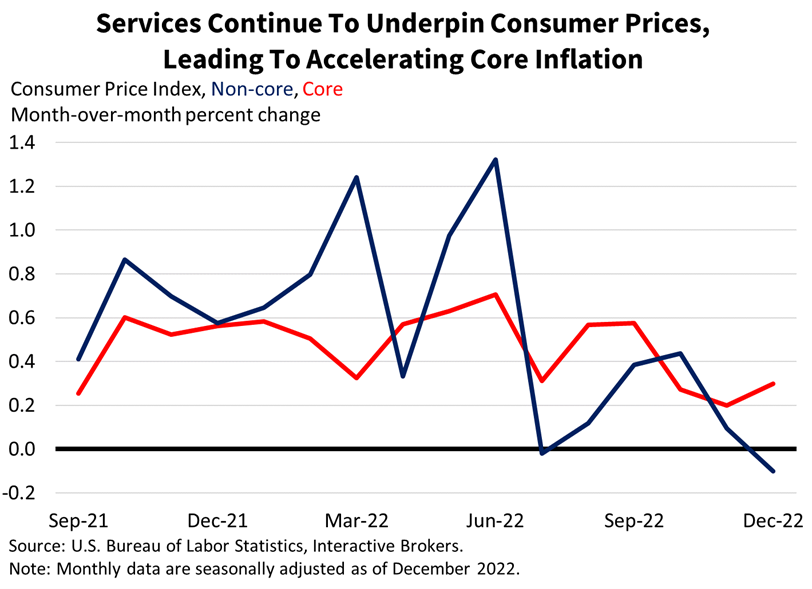

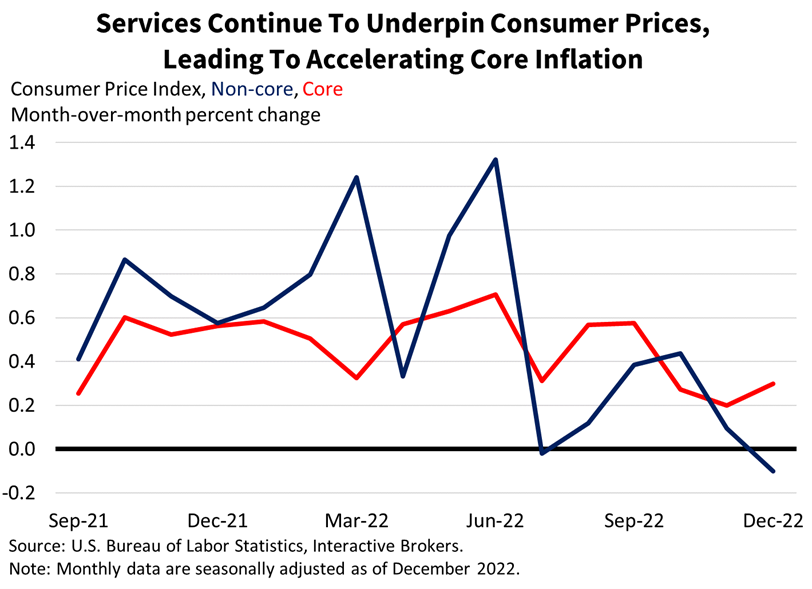

While overall inflation fell due to sharp reductions in gasoline prices, core inflation accelerated in this morning’s CPI release, keeping pressure on the Federal Reserve (the Fed) to maintain its restrictive monetary policy. Markets are confused by the news as investors weigh a -0.1% month-over-month headline inflation reading against a 0.3% core inflation number. In fact, nearly every inflation component registered an increase during December with gasoline and cars being the only exceptions. Markets have moved up and down indecisively this morning with the S&P 500 up 0.1%, yields down across the curve, the dollar index down 0.6% and WTI crude oil up 1.4%.

With the exception of energy, price increases were broad based with the negative headline being driven by falling oil prices against the backdrop of Chinese lockdowns in December, a milder winter in Europe and slowing economic conditions. New and used cars also contributed to price softness due to an increase in inventory, as higher interest rates take their toll on vehicle purchases. Cars are capital intensive, durable goods, where consumers almost always rely on financing to close deals after walking through the red carpet inside dealerships. Tightening lending standards and more expensive financing are creating a significant headwind in this category.

The confusing CPI news comes as corporate earnings this year are likely to be challenged by wage pressures and declining GDP.

The CPI rose 6.5% year over year (y/y), in-line with expectations and the smallest increase since October 2021. It was substantially below November’s 7.1% rate. While overall inflation fell due to sharp reductions in gasoline prices, core inflation, which doesn’t include the more volatile energy and food categories, accelerated, keeping pressure on the Fed to maintain its restrictive monetary policy. For y/y, core inflation was 5.7% for December compared to 6.1% in November. On a month-over-month basis (m/m), overall inflation declined 0.1% but core inflation accelerated to 0.3%, up from 0.2% in November.

For the Fed, this is setback. While Fed leaders have repeatedly mentioned the potential for unchecked inflation to become deeply entrenched in the economy, certain investors and elected officials have urged the central bank to avoid tipping the economy into a recession. In doing so they have reminded the Fed of its dual mandate of maintaining low unemployment and price stability.

While Fed leaders have repeatedly mentioned the potential for unchecked inflation to become deeply entrenched in the economy, certain investors and elected officials have urged the central bank to avoid tipping the economy into a recession.

Markets are confused by the news, as investors weigh the decline in headline inflation and the increase in core inflation. This confusion was illustrated by indecisive market movements. The S&P, furthermore, failed to regain is 200-day moving average and 12 and a half month trend line as the CPI data failed to propel the market above meaningful resistance levels. Fundamentals and valuations remain in question by many investors due to excessive optimism and yields in the fixed-income space.

For many businesses, energy is a significant operating cost and input cost. The considerable December decline in energy appears to have yet to reduce inflationary pressure across industry sectors as its benefits have been offset by other hurdles. While hourly wages increased only 0.3% in December, the moderate gain comes after prior months of substantial wage increases. The supply chain, while easing, has recovered at more expensive rates. China’s lockdown problems continue to linger as the availability of components and other items is limited while labor concerns are causing some importers to move from Los Angeles ports in favor of Gulf Coast and East Coast ports. As longshoreman in the Los Angeles area have high productivity still, some businesses are hedging against the possibility of a potential breakdown in labor negotiations causing disruptions at the ports.

During the past months, investors have become increasingly concerned about inflation while expressing fears that monetary policy tightening can spark a recession. As the markets rang the opening bell this morning, many investors were confused by declining consumer prices and the quickly faded pre-market rally sandwiched in between the CPI release and the markets open. The mission and commentary from the Fed have been clear in explaining the central bank’s goals of low inflation and low unemployment. Central bank members don’t like headline as much as core data when establishing policy because of volatile elements like food and energy in the overall number.

—

Learn More

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.