By: Seth Meyer, CFA ; John Kerschner, CFA and John Lloyd

Portfolio Managers Seth Meyer, John Kerschner, and John Lloyd discuss credit ratings on securitized assets and whether investors can rely on them when constructing fixed income portfolios.

With the Bloomberg U.S. Aggregate Bond Index (Agg) down 15.8% year to date,1 2022 continues to shape up as the worst year on record for U.S. investment-grade bonds. In contrast, between 1976 and 2021, the Agg logged negative calendar year returns only four times, with the worst annual return amounting to -2.9% in 1994. Investors with an allocation to bonds who have come to rely on their steady returns and low volatility have been shocked by the sharp drawdowns. Compounding the challenge is the increased likelihood of a global recession, which has left many investors wondering how to position their portfolios for the future.

In search of quality and yield

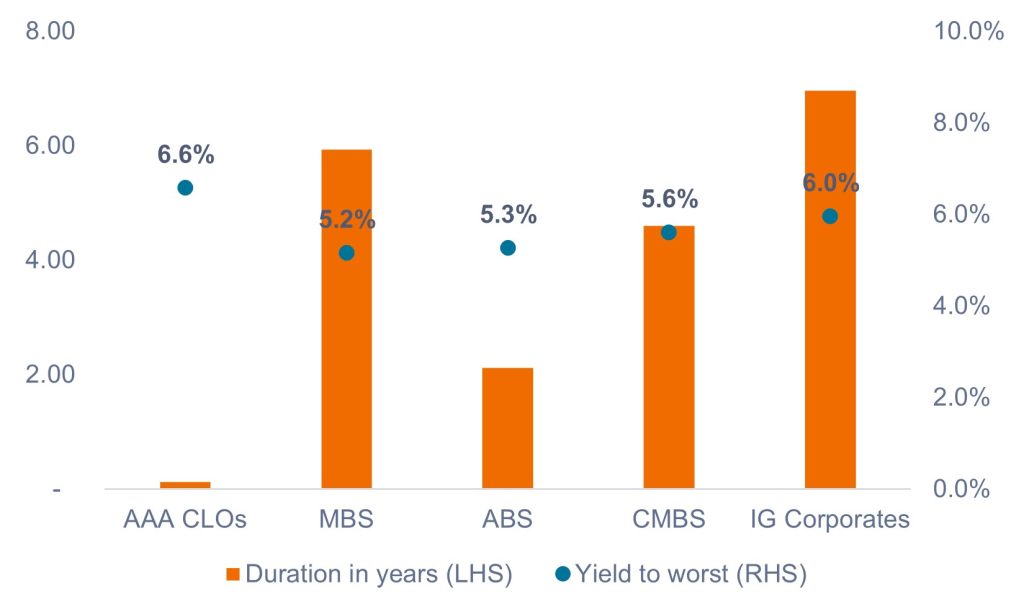

As bond investors search for higher quality and more income, we believe securitized sectors2 may have something to offer on both fronts. Exhibiting low duration, competitive yields, strong credit quality, and diversified risk exposure, securitized assets have come to the fore on a risk-adjusted basis. As shown in Exhibit 1, securitized sectors are offering competitive yields with lower interest rate risk (as measured by duration) relative to investment-grade (IG) corporates.

Exhibit 1: Securitized sectors offer competitive yields with lower interest-rate risk vs. IG corporates

Source: Bloomberg, JP Morgan, as of 14 October 2022. Indices used to represent asset classes: AAA CLOs (JP Morgan AAA CLO Index), MBS (Bloomberg U.S. MBS Index), ABS (Bloomberg U.S. Aggregate ABS Index), CMBS (Bloomberg U.S. CMBS Investment Grade Index), IG Corporates (Bloomberg U.S. Corporate Investment Grade Index). Yield will vary over time.

How risky are securitized assets?

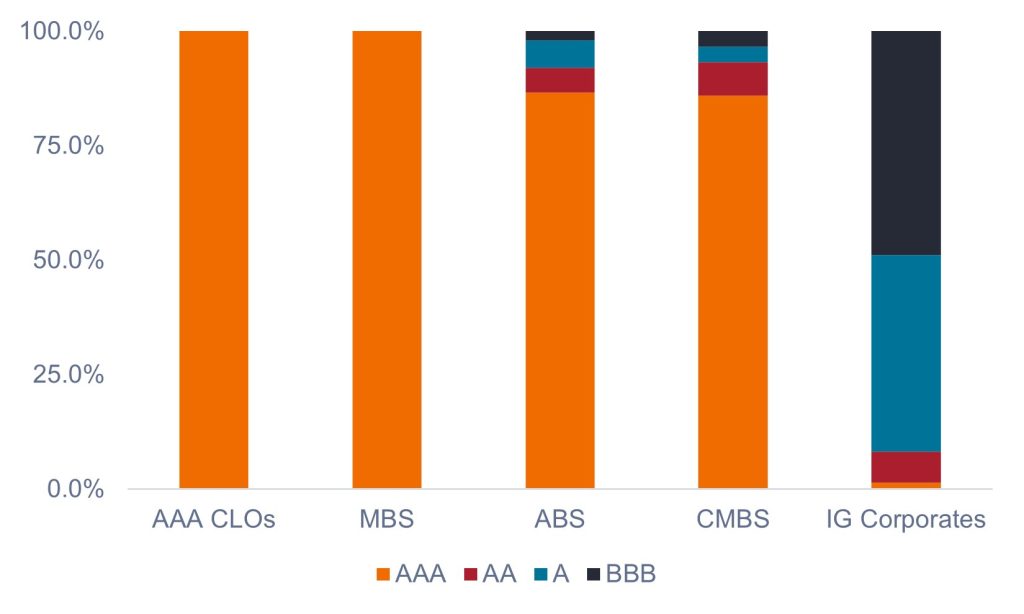

Despite their attractive yield-to-duration offering, many investors may still be concerned about investing in securitized sectors from a credit risk perspective. We think this reticence stems from the Global Financial Crisis (GFC), when securitized assets – specifically those backed by mortgages – were at the epicenter of the financial meltdown. Despite the stigma that they are riskier than corporate bonds, securitized sectors actually exhibit higher average credit ratings than their corporate counterparts, as shown in Exhibit 2.

Exhibit 2: Credit ratings in securitized sectors are mostly AAA

Source: Bloomberg, JP Morgan, as of 17 October 2022. Indices used to represent asset classes, as per Exhibit 1.

The elephant in the room: Can we trust the ratings?

Understandably, scar tissue remains from 2008, when investors incurred losses on what they believed were safe investments – AAA rated mortgage-backed securities. In response, many swore off investing in these “risky” products again. In addition, in the aftermath of 2008, the Financial Crisis Inquiry Commission found that the three largest rating agencies3 had played a key part in the financial meltdown. The agencies were guilty of giving AAA ratings to securities filled with risky subprime mortgages that had a higher risk of default than their ratings suggested. For this reason, many investors no longer trust the credit ratings (especially AAA, ironically) on securitized assets.

While the criticism of the rating agencies is probably justified, it is important to note what was going on in lending markets leading up to the 2008 crisis. Mortgage lenders were, at the time, making large numbers of risky subprime loans to unqualified buyers. Were it not for this extensive, reckless lending, the securitized assets themselves might not have suffered as much. This is an important distinction to make because some investors concluded that securitized assets were inherently the problem, when the real issue was the quality of the underlying loans.

That said, the rating agencies should have flagged the poor quality of the underlying loans and given the securities lower credit ratings. In that respect, they were at fault. However, while the press and regulators blamed the agencies’ conflicts of interest4 for the inflated ratings, the truth is a little more nuanced. For the rating agencies, the real challenge with mortgages during the GFC was twofold. First, subprime loans didn’t exist in securitizations before the year 2000, so they had no track record to work from in calibrating their models. Second, until the GFC, the U.S. housing market had not experienced a year of negative home price appreciation since the Great Depression, so their models were not calibrated to factor in an eventual fall of over 30% in home prices.

As we consider the impact of inflated ratings during the GFC, we do not believe the solution is to write off credit ratings – or rating agencies – entirely. Following 2008, lending standards tightened up significantly and models now incorporate more realistic assumptions regarding price growth and default rates. As such, we would be amiss if we looked at a AAA rating with the same level of skepticism in 2022 as we would have in 2008. In addition, while there were issues with ratings on MBS during the GFC, the rating agencies largely got their ratings right in other securitized sectors. For example, no auto ABS bond has ever defaulted going back to the late 1990s, and there were no impairments to investment-grade CLOs during through the GFC.

Ratings, independent research, and active management

Rating agencies are tasked with the important responsibility of bridging the information gap between investors and issuers of debt. And while their ratings may be prone to conflicts of interest or error, the ratings are simply too important to do away with entirely. Imagine a world without any credit ratings – where would investors start? And therein lies the point: In our view, credit ratings are simply a place to start. They may be the beginning – but cannot be the end – of credit evaluation. We believe active management is needed to round out the process and that there is no substitute for independent research, where an investment manager conducts rigorous due diligence on debt issues to either corroborate or refute what is implied by the credit rating. While passive investment strategies might be required to take credit ratings at face value, a strong buy-side research team can identify bonds within each rating band that they believe do not justify their rating.

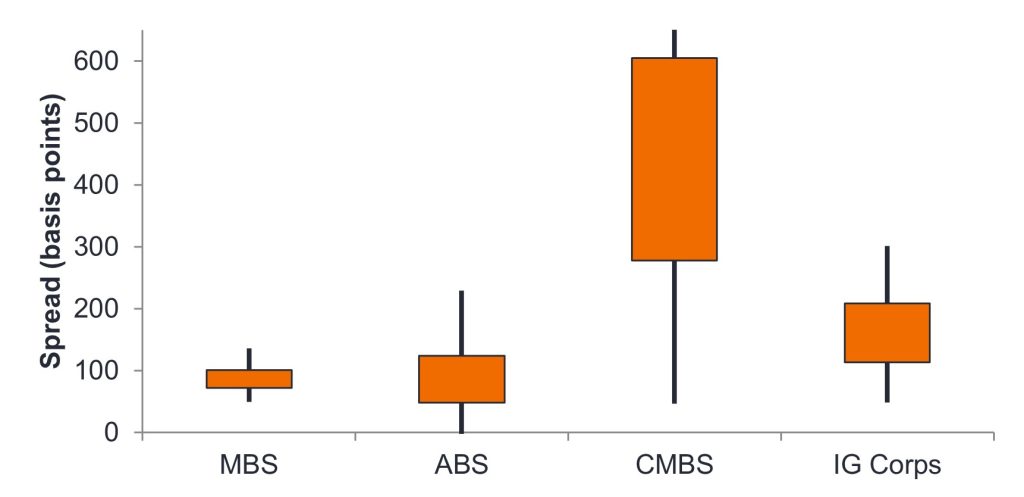

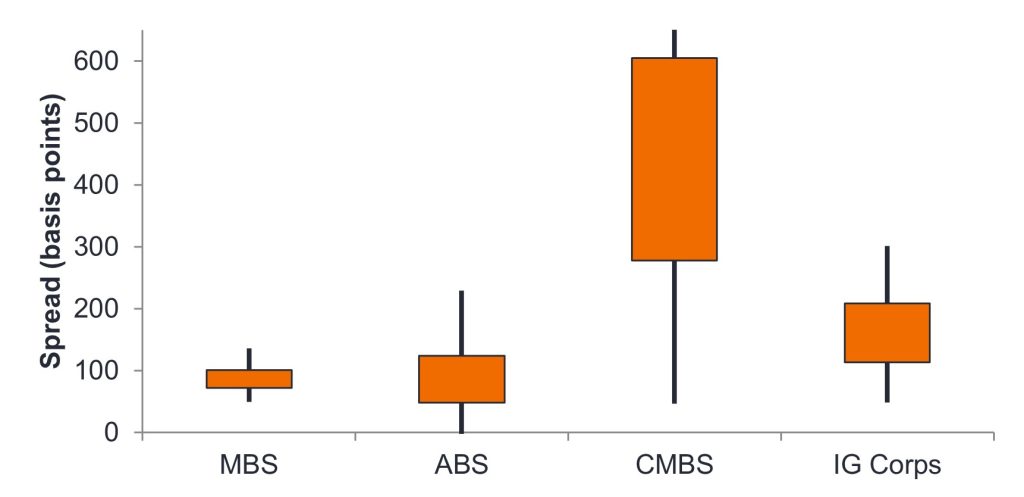

In addition, not all securities of the same credit rating trade at the same yield or spread level. As shown in Exhibit 3, the dispersion of spreads on assets of the same type and of the same or similar rating varies greatly. These variations in credit quality, rating, and spread level can create opportunities for active managers seeking better risk-adjusted returns relative to the index.

Exhibit 3: Range of spreads offers opportunities for active managers

Source: Bloomberg, Janus Henderson Investors, as of 17 October 2022. The chart shows the interquartile range (orange box) and 5th/95th percentiles by rating category (black line). Spreads may vary over time. The orange box represents the75th percentile at the top, 25th percentile at the bottom, the black line represents the 95th percentile at the top and 5th percentile at the bottom. Spreads may vary over time.

In summary, while rating agencies do not have a perfect record of predicting defaults, they continue to perform a key role in the functioning of debt markets, and their ratings remain a useful tool in the hands of investors. That said, rather than rely solely on ratings, investors should, in our view, incorporate the additional safeguards of independent research and active management as they position their fixed income portfolios for the current environment.

Footnotes and definitions

1 As of 14 October 2022.

2 For purposes of this article, securitized sectors are comprised of the following: collateralized loan obligations (CLOs), mortgage-backed securities (MBS), asset-backed securities (ABS), and commercial mortgage-backed securities (CMBS). See end of article for definitions/risk disclosures for each asset class.

3 Moody’s, Standard and Poor’s (S&P), and Fitch.

4 It has been argued that because debt issuers pay for their ratings in the “issuer pays” model, they have a bias toward giving issuers favorable ratings to protect their revenue interests.

Duration measures a bond price’s sensitivity to changes in interest rates. The longer a bond’s duration, the higher its sensitivity to changes in interest rates and vice versa.

Yield to worst (YTW) is the lowest yield a bond can achieve provided the issuer does not default and accounts for any applicable call feature (i.e. the issuer can call the bond back at a date specified in advance). At a portfolio level, this statistic represents the weighted average YTW for all the underlying issues.

Credit quality ratings are measured on a scale that generally ranges from Aaa (highest) to C (lowest).

Credit Spread is the difference in yield between securities with similar maturity but different credit quality. Widening spreads generally indicate deteriorating creditworthiness of corporate borrowers, and narrowing indicate improving.

IMPORTANT INFORMATION

Index performance does not reflect the expenses of managing a portfolio as an index is unmanaged and not available for direct investment.

Diversification neither assures a profit nor eliminates the risk of experiencing investment losses.

Collateralized Loan Obligations (CLOs) are debt securities issued in different tranches, with varying degrees of risk, and backed by an underlying portfolio consisting primarily of below investment grade corporate loans. The return of principal is not guaranteed, and prices may decline if payments are not made timely or credit strength weakens. CLOs are subject to liquidity risk, interest rate risk, credit risk, call risk and the risk of default of the underlying assets.

Mortgage-backed securities (MBS) may be more sensitive to interest rate changes. They are subject to extension risk, where borrowers extend the duration of their mortgages as interest rates rise, and prepayment risk, where borrowers pay off their mortgages earlier as interest rates fall. These risks may reduce returns.

Securitized products, such as mortgage- and asset-backed securities, are more sensitive to interest rate changes, have extension and prepayment risk, and are subject to more credit, valuation and liquidity risk than other fixed-income securities.

—

Originally Posted October 26, 2022 – Credit ratings on securitized assets: Can they be trusted?

The opinions and views expressed are as of the date published and are subject to change. They are for information purposes only and should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation to buy, sell or hold any security, investment strategy or market sector. No forecasts can be guaranteed. Opinions and examples are meant as an illustration of broader themes, are not an indication of trading intent and may not reflect the views of others in the organization. It is not intended to indicate or imply that any illustration/example mentioned is now or was ever held in any portfolio. Janus Henderson Group plc through its subsidiaries may manage investment products with a financial interest in securities mentioned herein and any comments should not be construed as a reflection on the past or future profitability. There is no guarantee that the information supplied is accurate, complete, or timely, nor are there any warranties with regards to the results obtained from its use. Past performance does not predict future returns. Investing involves risk, including the possible loss of principal and fluctuation of value.

Janus Henderson Group plc ©

C-0922-45148 08-30-23 TL

Disclosure: Janus Henderson

The opinions and views expressed are as of the date published and are subject to change without notice. They are for information purposes only and should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation to buy, sell or hold any security, investment strategy or market sector. No forecasts can be guaranteed. Opinions and examples are meant as an illustration of broader themes and are not an indication of trading intent. It is not intended to indicate or imply that any illustration/example mentioned is now or was ever held in any portfolio. Janus Henderson Group plc through its subsidiaries may manage investment products with a financial interest in securities mentioned herein and any comments should not be construed as a reflection on the past or future profitability. There is no guarantee that the information supplied is accurate, complete, or timely, nor are there any warranties with regards to the results obtained from its use. Past performance is no guarantee of future results. Investing involves risk, including the possible loss of principal and fluctuation of value.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Janus Henderson and is being posted with its permission. The views expressed in this material are solely those of the author and/or Janus Henderson and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.