Bond duration is a basic building block for bond portfolio management and asset-liability management (ALM). This post explains the meaning of duration and calculation of this risk measure by using Excel and R.

In this post, a bond price is calculated by discounting future cash flows using YTM which is the abbreviation of Yield To Maturity.

Bond Price

Bond price with unit notional amount, coupon C, YTM y, annual frequency is as follows.

(Modified) Duration

Duration is a measure of price sensitivity to interest rates. At first, we need to calculate an interest rate sensitivity of a bond price.

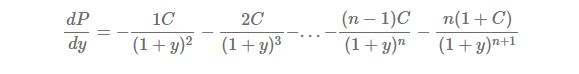

The first derivative of P with respect to y is as follows.

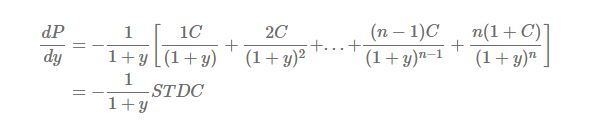

Factoring out  in the above equation yields

in the above equation yields

To avoid lengthy expression, we substitute STDC for the bracketed term. STDC is the abbreviation of the sum of multiplications of time and discounted cash flow (only coupon or coupon + principal amount). Of course, this abbreviation is not official

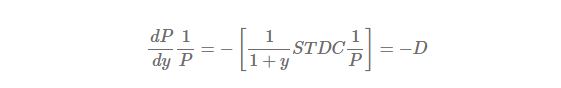

It is noting that the above amount is a kind of a change of bond price. But it is more convenient to use the expression of a percentage change for comparison or analysis. For this reason, let’s modify it by a ratio of its initial bond price.

Through this modification, we can use this measure as a % change of bond price which resulted from a change of interest rate. Dividing  by P gives the following expression.

by P gives the following expression.

This is the modified duration (D). Modified duration is defined without negative sign since this “minus” sign is popped out of discounting, which indicates that an increase in interest rate lowers a bond price.

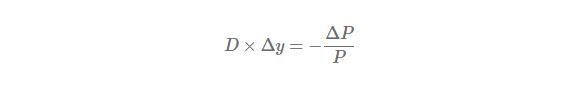

Rearranging this equation, we can find that % change of bond price results from the multiplication of modified duration and interest rate change.

For example,

1) If modified duration is 1 (year) and interest rate change is +25bp (= +0.25%), % change of bond price is equal to -0.25% (= -1*0.25%).

2) If modified duration is 10 (year) and interest rate change is +25bp (= +0.25%), % change of bond price is equal to -2.5% (= -10*0.25%).

In other words, the longer the duration or maturity of a bond, the more sensitive is it’s price to a change in interest rates. For this reason, when the central bank increases the target rate, bond portfolio managers have a tendency to make bond portfolio duration shorter to avoid subsequent capital loss due to interest rate hikes. But it is not always.

Macaulay Duration

In fact, Macaulay originally invented the concept of duration. This is called as Macaulay duration which is the average time until receipt of a bond’s cash flows, weighted according to the present values of these cash flows, measured in years.

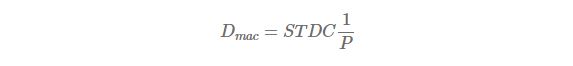

Interestingly, it is already calculated in the previous equation. Macaulay duration  is as follows.

is as follows.

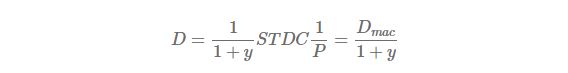

The relationship between modified duration and Macaulay duration is

It is worth while to note that the meaning of “modified” is the modification of Macaulay duration by dividing 1 + y.

As modified duration is widely used than Macaulay duration, when we use the term of duration, it is the modified duration. For this reason, we use D for the modified duration and Dmac for Macaulay duration.

Generalization

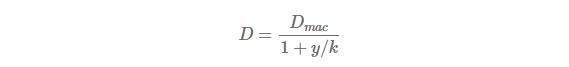

When interest conversion period is less than one year such as one quarter, duration is redefined as follows.

Here, k is the number of compounding periods per year.

Excel Illustration

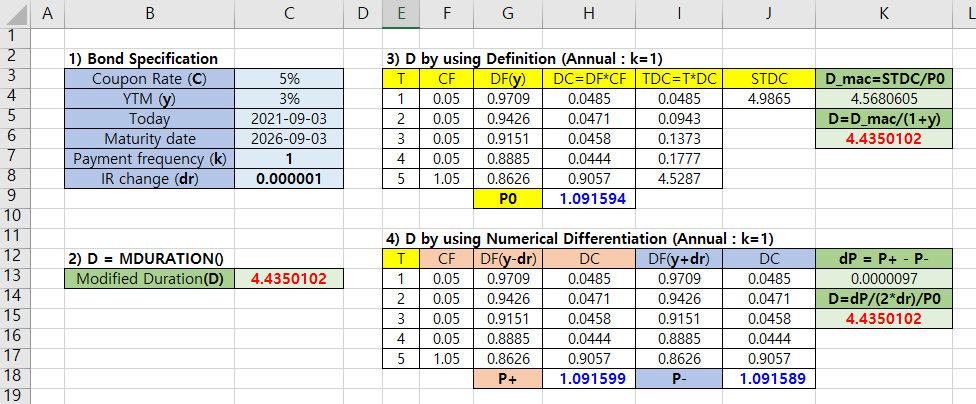

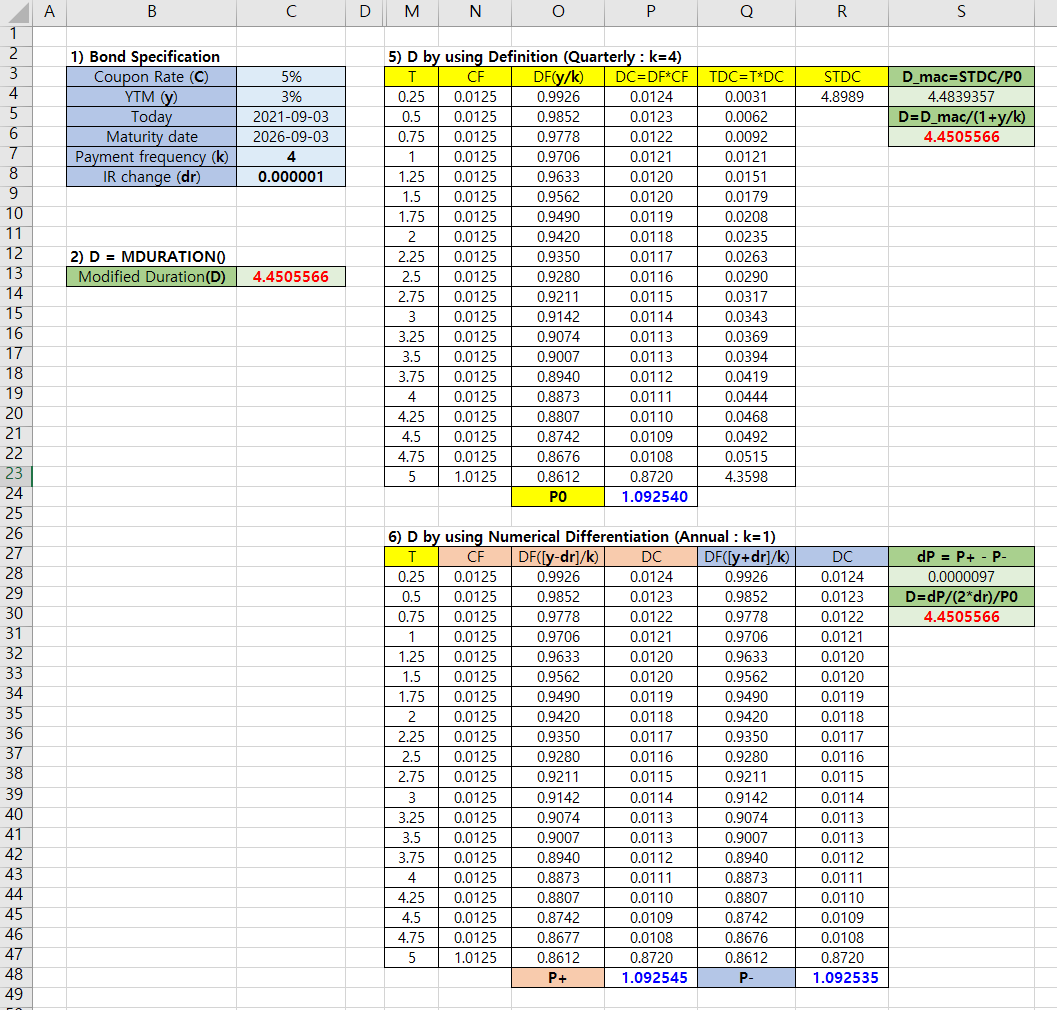

Excel provides MDURATION() function for the calculation of modified duration.

MDURATION (settlement, maturity, coupon, yld, freq)

Arguments of MDURATION() are pricing date, maturity date, coupon rate, YTM, compounding frequency in order.

Besides MDURATION(), we calculate duration by using definition and numerical differentiation for clear understanding.

The following Excel spreadsheet shows the case of k=1.

The following Excel spreadsheet shows the case of k=4.

R code

No sooner had we explained the concept of duration than we made the following R code.

#========================================================#

# Quantitative ALM, Financial Econometrics & Derivatives

# ML/DL using R, Python, Tensorflow by Sang-Heon Lee

#

# https://shleeai.blogspot.com

#--------------------------------------------------------#

# Bond Modified Duration Calculation

#========================================================#

graphics.off() # clear all graphs

rm(list = ls()) # remove all files from your workspace

#-------------------------------------------------------

# Input

#-------------------------------------------------------

C <- 0.05 # coupon rate

y <- 0.03 # YTM

m <- 5 # maturity

dr <- 0.000001 # interest rate change

#-------------------------------------------------------

# Duration by Definition (k=1)

#-------------------------------------------------------

# data.frame for calculation

df <- data.frame(T = 1:m,

CF = C + c(0,0,0,0,1))

df$DF <- 1/(1+y)^(df$T)

df$DC <- df$DF*df$CF

P0 <- sum(df$DC) # initial bond price

df$TDC <- df$T*df$DC # time * discounted CF

STDC <- sum(df$TDC)

# duration

D_mac_dk1 <- STDC/P0 # Macaulay Dur

D_mod_dk1 <- D_mac_dk1/(1+y) # Modified Dur

#-------------------------------------------------------

# Duration by Numerical Differentiation (k=1)

#-------------------------------------------------------

df <- data.frame(T = 1:m,

CF = C + c(rep(0,m-1),1))

df$DFu <- 1/(1+y-dr)^(df$T)

df$DCu <- df$DFu*df$CF

Pu <- sum(df$DCu) # price up

df$DFd <- 1/(1+y+dr)^(df$T)

df$DCd <- df$DFd*df$CF

Pd <- sum(df$DCd) # price down

# duration

D_mod_nk1 <- (Pu-Pd)/(2*dr)/P0 # Modified Dur

#-------------------------------------------------------

# Duration by Definition (k=4)

#-------------------------------------------------------

k <- 4 # Compouding period = Q

df <- data.frame(T = seq(1/k,m,1/k),

CF = C/k + c(rep(0,k*m-1),1))

df$DF <- 1/(1+y/k)^(df$T*k)

df$DC <- df$DF*df$CF

P0 <- sum(df$DC)

df$TDC <- df$T*df$DC

STDC <- sum(df$TDC)

D_mac_dk4 <- STDC/P0 # Macaulay Dur

D_mod_dk4 <- D_mac_dk4/(1+y/k) # Modified Dur

#-------------------------------------------------------

# Duration by Numerical Differentiation (k=4)

#-------------------------------------------------------

df <- data.frame(T = seq(1/k,m,1/k),

CF = C/k + c(rep(0,k*m-1),1))

df$DFu <- 1/(1+(y-dr)/k)^(df$T*k)

df$DCu <- df$DFu*df$CF

Pu <- sum(df$DCu)

df$DFd <- 1/(1+(y+dr)/k)^(df$T*k)

df$DCd <- df$DFd*df$CF

Pd <- sum(df$DCd)

D_mod_nk4 <- (Pu-Pd)/(2*dr)/P0 # Modified Dur

# Print

cat(paste0("\nDuration Calculation Results \n\n",

"Macaulay Dur (k=1) def = ", D_mac_dk1, "\n",

"Modified Dur (k=1) def = ", D_mod_dk1, "\n",

"Modified Dur (k=1) num = ", D_mod_nk1, "\n",

"\n",

"Macaulay Dur (k=4) def = ", D_mac_dk4, "\n",

"Modified Dur (k=4) def = ", D_mod_dk4, "\n",

"Modified Dur (k=4) num = ", D_mod_nk4))

The above R code produces the same results as those of Excel exercises.

Duration Calculation Results Macaulay Dur (k=1) def = 4.56806046946571 Modified Dur (k=1) def = 4.43501016452982 Modified Dur (k=1) num = 4.43501016417148 Macaulay Dur (k=4) def = 4.48393573818857 Modified Dur (k=4) def = 4.45055656395888 Modified Dur (k=4) num = 4.45055656459531

Concluding Remarks

From this post, we can understand the meaning of duration, in particular modified duration, by using intuitive derivations and Excel illustrations. Finally we can easily implement R code for the calculation of duration. Upon this work, we can build up the advanced risk management or portfolio optimization model.

But care is taken with some limitation of duration so that duration is the first derivative of highly non-linear bond price function, in other words, or the first order or linearly approximation. To make up for this shortcoming, the second order derivative (convexity) can be considered when the first approximation shows poor result. It depends on the product types and specifications.

Originally posted on SHLee AI Financial Model blog.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from SHLee AI Financial Model and is being posted with its permission. The views expressed in this material are solely those of the author and/or SHLee AI Financial Model and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.