Today is a quiet one. Most European and Asian markets are closed for Labor Day or May Day holidays, and US trading is rather directionless after two days of solid gains. The most pressing concern appears to be behind us, with JPMorgan (JPM) assuming the deposits and acquiring most of the assets of troubled First Republic Bank(FRC). That puts the latest chapter of the banking woes behind us and allows us to more clearly focus on the events that await us later this week.

The relative calm is despite higher yields across the Treasury curve. There is a large wave of corporate issuance scheduled for the coming days, led by a $7 billion issue by Meta Platforms (META). They reported solid earnings last week; one can’t blame them for trying to take advantage of the good feelings. But this fits with the theme of the seemingly unflappable market leadership. Little seems to bother equity investors lately.

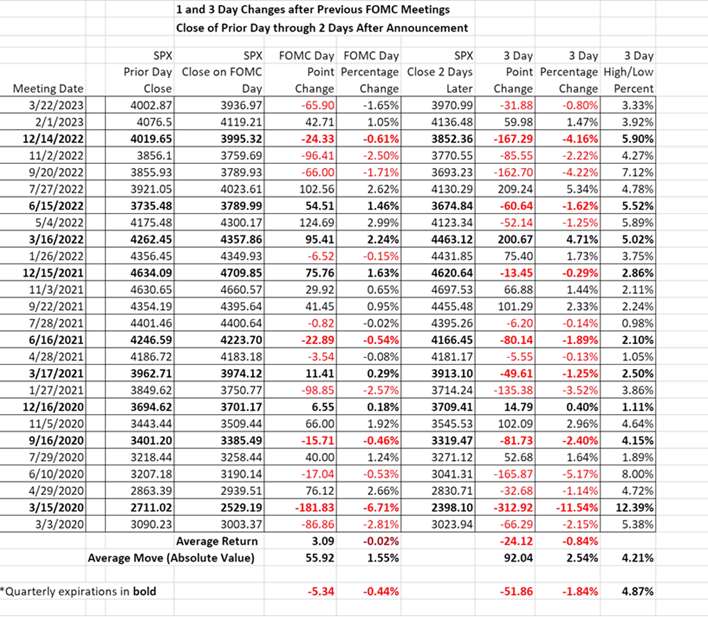

The market’s blasé attitude will be tested this week. On Wednesday, we have an FOMC meeting. We have seen the propensity for FOMC meetings and the subsequent press conferences to bring extra volatility to major indices. That said, the last two meetings have not brought exceptional volatility, as shown in the table below:

Source: Interactive Brokers

The reaction around the February meeting might be a precedent for the events of this week. We had a near-consensus for the FOMC rate announcement on Wednesday and a Nonfarm Payrolls report scheduled for Friday. That is the same scenario we face this week.

On the Monday before the February 1st meeting, Fed Funds futures showed 100% probability for a 25 basis point hike, and a 5% chance for an additional 25bp. Now we show a 95% probability for a 25bp hike, so the setup is relatively similar. If you recall, after an initial dip when the expected hike was announced, stocks rallied sharply each time Chairman Powell uttered the word “disinflation” during the press conference. The rally continued apace during the subsequent session. I view that as the “coming out party” for so-called zero-dated options, as traders discovered that there were now index and ETF options that expired on that Thursday, ahead of Friday’s Payrolls report. We then reversed much of the prior gains on Friday, and February 2nd remains the year-to-date high for the S&P 500 (SPX).

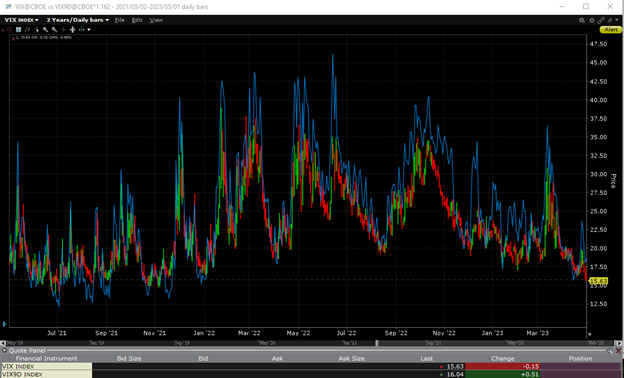

History doesn’t repeat, but it often rhymes, and the Cboe Volatility Index (VIX) is rhyming as well. We came into that week and year-low levels of VIX, which fell even further in the post-FOMC rally. The current levels are now notably even lower, with VIX at a 15 handle and approaching the lows last seen in November 2021, when the NASDAQ 100 (NDX) topped out. One might reasonably assert that VIX, which measures the market’s anticipated volatility over the coming 30 days is reflecting the overall calm that we have seen in recent days, but the 9-Day VIX (VIX9D) shows similar relative calm. Bear in mind that there are significant events scheduled for at least 3 of the next 9 days:

2-Year Chart, VIX (red/green daily bars), VIX9D (blue line)

Source: Interactive Brokers

Yet there is one more highly relevant event that has the potential to move markets this week. Apple (AAPL) reports after the close on Thursday. AAPL is the largest US stock by market capitalization, representing over 7% of SPX and about 12.5% of NDX[i]. We saw last week that solid reports from Microsoft (MSFT) and META were sufficient to catalyze rallies. It is hardly out of the question that AAPL results could exacerbate a market move in either direction.

A classic market adage is “don’t short a dull tape.” Today’s modest rally epitomizes that idea. But things are likely to get far more exciting, whether or not volatility markets agree.

—

[i] Because NDX has a modified market cap weighting, Microsoft (MSFT) actually has a larger weight of 13.3%

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.

Disclosure: ETFs

Any discussion or mention of an ETF is not to be construed as recommendation, promotion or solicitation. All investors should review and consider associated investment risks, charges and expenses of the investment company or fund prior to investing. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Options Trading

Options involve risk and are not suitable for all investors. Multiple leg strategies, including spreads, will incur multiple commission charges. For more information read the "Characteristics and Risks of Standardized Options" also known as the options disclosure document (ODD) or visit ibkr.com/occ

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.