Today’s title might be confusing for those of you who grew up outside North America. Last licks is a playground idiom meaning “final turn” or “last opportunity”, and it comes up in a variety of games. With major retailers like Home Depot (HD), Target (TGT) and Walmart (WMT) reporting over the coming three days, we get a final chance to see whether the stasis that has pervaded much of this earnings season and current quarter overall will persist.

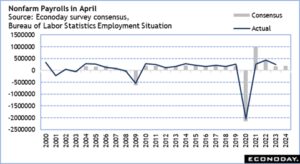

So far, 92% of S&P 500 (SPX) companies have reported earnings for the quarter. In baseball terms, we’re in the bottom of the ninth inning of a tie game. The retailers have a chance to break the tie. Based upon the solid results issued by a wide range of consumer stocks one might think that retailers should be in good shape. We learned that many important companies favored by consumers were able to pass along higher prices to their customers without penalty. The unemployment rate is only 3.4%, meaning that the vast majority of people who want a job have one. People who are employed can afford to buy what they’d like, especially when average hourly earnings rose 0.5% last month. That’s not good for an inflation-fighting Federal Reserve, but good for the companies themselves.

But the University of Michigan survey dealt us a real curveball on Friday. We described the results as “lousy” in a piece published that morning, and that description holds up in hindsight as well. Sentiment was 57.7 vs. a prior 63.0 (and 63.5 consensus), Expectations were 53.4 vs a prior 60.8, 1-Year Inflation was 4.5% vs. 4.4% (though better than the 4.6% consensus), while 5-10 Year Inflation matched a 12-year high of 3.2% (vs. 2.9% prior and 3.0% expected). There is no way to sugarcoat those numbers.

Bearing in mind that the consumer stocks’ quarter ended on March 31st and the retailers ended on April 30th, we will get an important glimpse into whether key retailers felt a decline in sentiment over that timeframe. It is one thing for people to express negative sentiment in a survey, another for them to express it at a store’s cash register.

Has TGT fully fixed its inventory problems? Are consumers downshifting from TGT to WMT? Are higher rates affecting the housing cycle sufficiently to cool spending at HD and Lowes (LOW)? We’ll know soon enough whether retailers’ last licks sink or save the relative tie game of first quarter earnings.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.

Leave a Reply

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.

The part I would add is that Credit debt is at an all time high. To your point that people who want to work are and can buy things… at great cost.

Thank you for sharing, Paul.