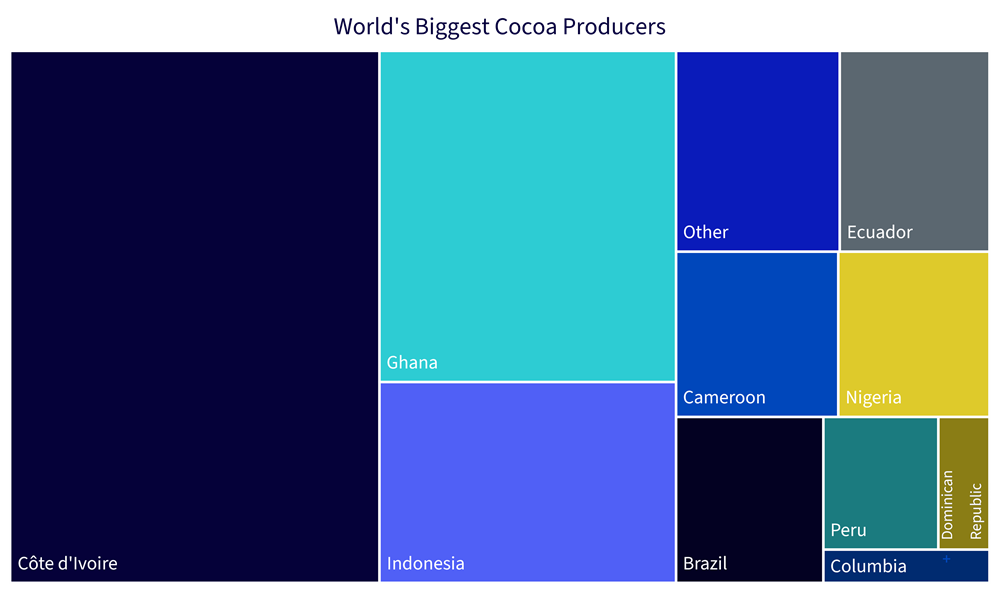

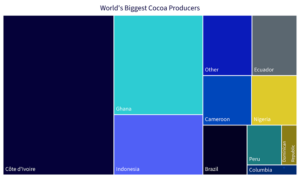

Cocoa’s meteoric price rise +132% has trumped both Nvidia (+90%) and Bitcoin’s (+65%) price performance in Q1 20241. The cocoa market has been struggling with poor crops in major producing regions in West Africa. Two west African countries, Côte d’Ivoire (Ivory Coast) and Ghana represent about 60% of the world’s cocoa production. Dry weather brought by the El Niño followed by unseasonal heavy rains towards the end of 2023, escalated concerns about West African production as discussed here. Additional factors such as extreme heat, ageing cocoa trees and illegal mining have further exacerbated supply shortages.

Source: United Nations (UN) Food and Agriculture Organization (FAO) as of December 2023

News reports and trade publications indicate cocoa bean processing in West Africa is finally being shut-in and running at low utilization throughout March owing to the lack of supply. Cocoa grindings – a good proxy for demand is expected to decline given the fall in supply. We expect to see demand destruction at the user level start to garner momentum over Q2 2024. However, as processing demand only started to meaningfully decline in March 2024 and has held up moderately in both Europe and North America, we do not see increased risk of consumption rolling over.

Farmgate prices for local cocoa farmers set to increase at top producers

Ghana will raise the fixed farmgate price paid to cocoa farmers by up to 50% in an effort to share profits from rising global prices and deter farmers from bean smuggling2. Low pay has hampered farmers’ ability to invest in improvements and fend off disease, limiting the yield of cocoa trees. According to Cocobod, 150 thousand tons of cocoa beans were lost in the 2022/23 crop year due to this and illegal gold mining. This crop year (2023/2024), the loss is likely to be larger owing to higher prices. Ivory Coast has already increased farm-gate prices for cocoa farmers by 50% to the equivalent of US$2470 per ton3.

In the short term, its unlikely to stall cocoa’s price rally as it takes around 5 years for a newly planted cocoa tree to develop pods for the first time. However, over the long term, higher farm-gate prices could incentivise farmers in Ivory coast and Ghana to invest more in the maintenance of their cocoa plantations thereby supporting a price dampening effect.

Mid-crop expectations take centre stage

Cocoa is harvested twice a year. The main crop runs from October to March, while the mid-crop runs from April to August. Investors’ attention is likely to turn towards the upcoming mid-crop harvest in West Africa.

The crop in Cote d’Ivoire, by far the most important producer with a market share of around 40% is expected to be only 400-500 thousand tons, versus 600 thousand tons reported last year. These estimates are based on a survey carried out by the national regulator at the end of February. Normally the mid-crop holds less importance in comparison to main crop owing to its smaller size (in the case of Cote d’Ivoire, around 25% of the total crop). However given the already weak main crop, it is likely to dominate investor attention this time around. If estimates are downgraded further, it could provide another catalyst to cocoa’s current price rally.

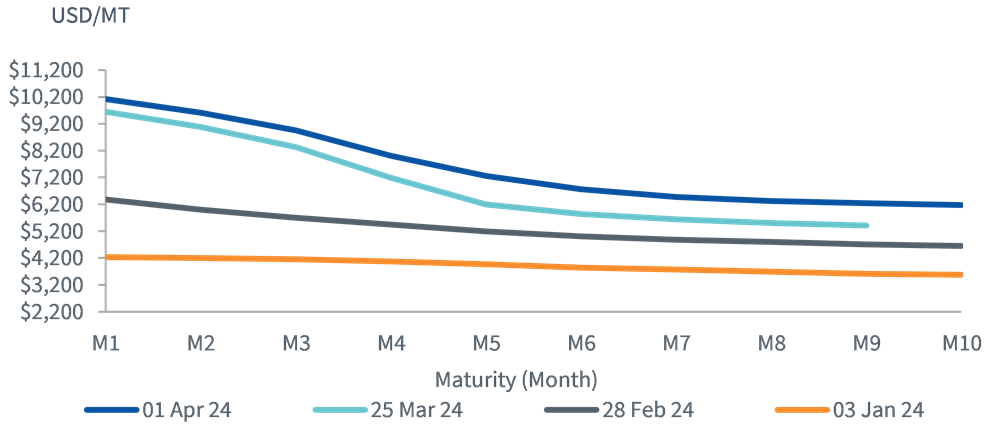

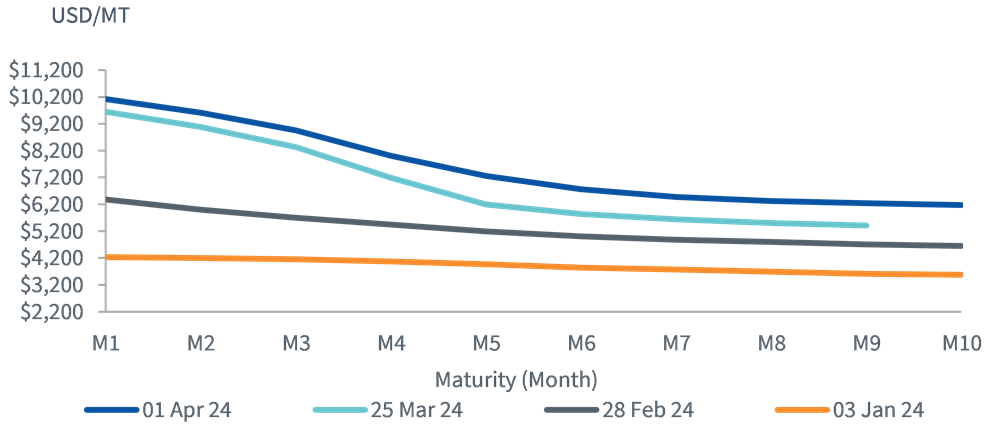

Tight cocoa market driving curve backwardation in 2024

The International Cocoa Organisation (ICCO) also projected the ratio of stockpiles to grindings will fall to the lowest in more than four decades this season. ICCO also expects the existing supply deficit to widen to 374kt this season, versus a deficit of 75kt seen last season.

The front end of the cocoa futures curve remains in backwardation, giving rise to a 5.3% positive roll yields (versus 6.4% last month). The weather is likely to play a crucial role in shaping the market balance for the season.

Figure 2: Front end of the cocoa futures curve remains in backwardation

Source Bloomberg, WisdomTree as of 2 April 2024. Historical performance is not an indication of future performance and any investments may go down in value.

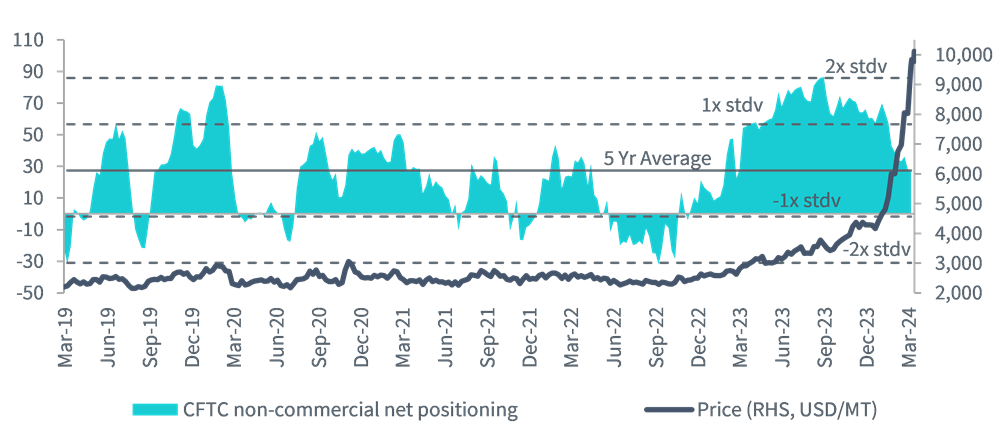

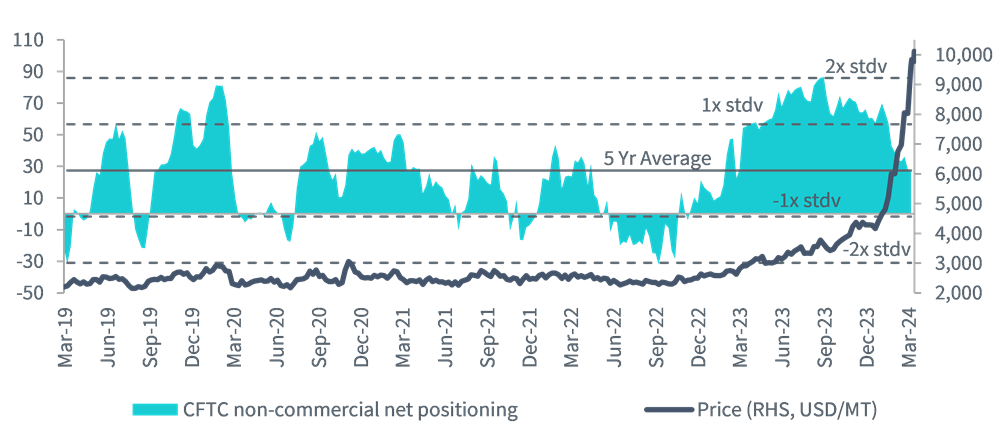

Net speculative positioning has declined 21.9% over the prior month (from 27 February 2024 to 26 March 2024) according to Commodity Futures Trading Commission (CFTC). CFTC data shows that investors remain undecided on extension of cocoa’s rally evident from the 27% decline in short positioning alongside a 24% reduction in long positioning.

Figure 3: Comparison of historical price performance versus net speculative positioning for front- month Cocoa futures

Source: Commodity Futures Trading Commission (CFTC), WisdomTree as of 1 April 2024. Historical performance is not an indication of future performance and any investments may go down in value.

Sources

1 Source: Bloomberg from 2 January 2024 to 28 March 2024

2 State Marketing Authority Cocobod

3 The Business Times as of 31 March 2024

—

Originally Posted April 5, 2024 – What’s Hot: Supply shortages to fuel Cocoa’s sweet surge in 2024

Disclosure: WisdomTree Europe

This material is prepared by WisdomTree and its affiliates and is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of the date of production and may change as subsequent conditions vary. The information and opinions contained in this material are derived from proprietary and non-proprietary sources. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by WisdomTree, nor any affiliate, nor any of their officers, employees or agents. Reliance upon information in this material is at the sole discretion of the reader. Past performance is not a reliable indicator of future performance.

Please click here for our full disclaimer.

Jurisdictions in the European Economic Area (“EEA”): This content has been provided by WisdomTree Ireland Limited, which is authorised and regulated by the Central Bank of Ireland.

Jurisdictions outside of the EEA: This content has been provided by WisdomTree UK Limited, which is authorised and regulated by the United Kingdom Financial Conduct Authority.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from WisdomTree Europe and is being posted with its permission. The views expressed in this material are solely those of the author and/or WisdomTree Europe and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Digital Assets

Trading in digital assets, including cryptocurrencies, is especially risky and is only for individuals with a high risk tolerance and the financial ability to sustain losses. Eligibility to trade in digital asset products may vary based on jurisdiction.

Disclosure: Bitcoin Futures

TRADING IN BITCOIN FUTURES IS ESPECIALLY RISKY AND IS ONLY FOR CLIENTS WITH A HIGH RISK TOLERANCE AND THE FINANCIAL ABILITY TO SUSTAIN LOSSES. More information about the risk of trading Bitcoin products can be found on the IBKR website. If you're new to bitcoin, or futures in general, see Introduction to Bitcoin Futures.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.